- Finland

- /

- Life Sciences

- /

- HLSE:NANOFH

Nanoform Finland Oyj (HEL:NANOFH shareholders incur further losses as stock declines 10% this week, taking three-year losses to 53%

While it may not be enough for some shareholders, we think it is good to see the Nanoform Finland Oyj (HEL:NANOFH) share price up 19% in a single quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 53% in that time. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Nanoform Finland Oyj

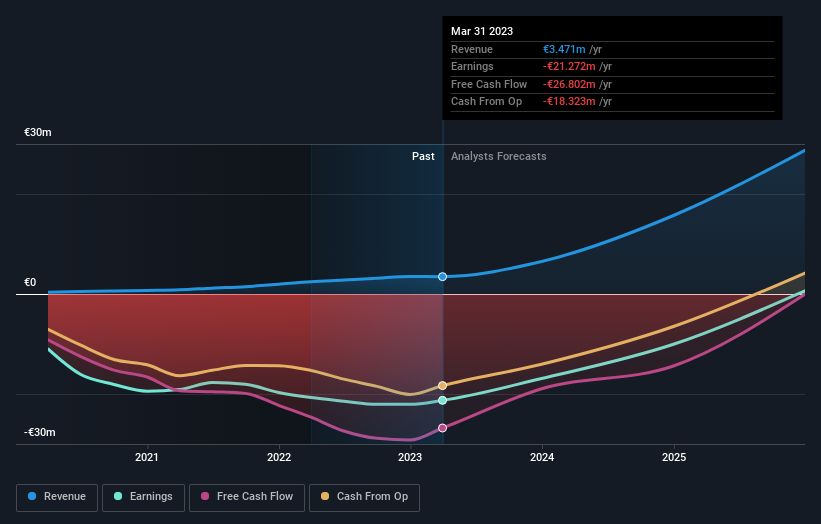

Because Nanoform Finland Oyj made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Nanoform Finland Oyj grew revenue at 68% per year. That's well above most other pre-profit companies. In contrast, the share price is down 15% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Nanoform Finland Oyj's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Nanoform Finland Oyj shares, which performed worse than the market, costing holders 44%. Meanwhile, the broader market slid about 5.8%, likely weighing on the stock. Shareholders have lost 15% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Nanoform Finland Oyj better, we need to consider many other factors. Take risks, for example - Nanoform Finland Oyj has 3 warning signs (and 1 which is concerning) we think you should know about.

Of course Nanoform Finland Oyj may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nanoform Finland Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:NANOFH

Nanoform Finland Oyj

Engages in the provision of nanotechnology and drug particle engineering services for the pharma and biotech industries in Europe and the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives