Attractive stocks have exceptional fundamentals. In the case of Sanoma Oyj (HEL:SAA1V), there's is a company with great financial health as well as a a strong history of performance. Below, I've touched on some key aspects you should know on a high level. For those interested in understanding where the figures come from and want to see the analysis, take a look at the report on Sanoma Oyj here.

Proven track record with adequate balance sheet

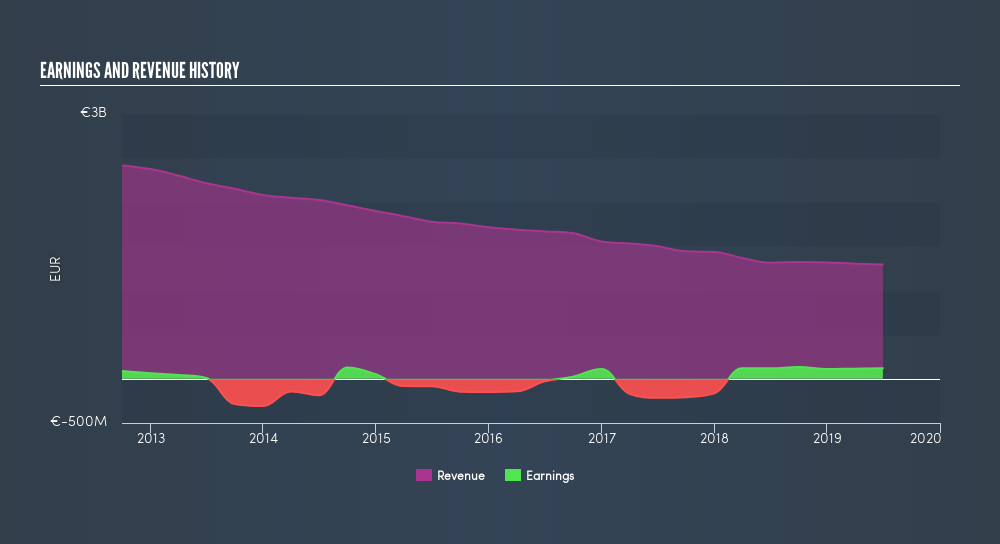

Over the past few years, SAA1V has demonstrated a proven ability to generate robust returns of 20%. Unsurprisingly, SAA1V surpassed the Media industry return of 5.5%, which gives us more confidence of the company's capacity to drive earnings going forward. SAA1V seems to have put its debt to good use, generating operating cash levels of 0.33x total debt in the most recent year. This is also a good indication as to whether debt is properly covered by the company’s cash flows. Also, SAA1V’s earnings amply cover its interest expense. Paying interest on time and in full can help the company get favourable debt terms in the future, leading to lower cost of debt and helps SAA1V expand.

Next Steps:

For Sanoma Oyj, I've put together three relevant factors you should look at:

- Future Outlook: What are well-informed industry analysts predicting for SAA1V’s future growth? Take a look at our free research report of analyst consensus for SAA1V’s outlook.

- Valuation: What is SAA1V worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether SAA1V is currently mispriced by the market.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of SAA1V? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:SANOMA

Sanoma Oyj

Operates as a media and learning company in Finland, the Netherlands, Poland, Spain, Belgium, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion