- Finland

- /

- Entertainment

- /

- HLSE:REMEDY

Remedy Entertainment Oyj's (HEL:REMEDY) 28% Jump Shows Its Popularity With Investors

Remedy Entertainment Oyj (HEL:REMEDY) shareholders have had their patience rewarded with a 28% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

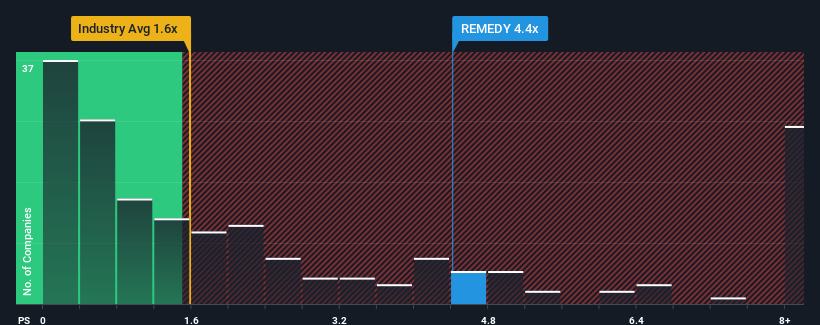

Following the firm bounce in price, given around half the companies in Finland's Entertainment industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Remedy Entertainment Oyj as a stock to avoid entirely with its 4.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

We check all companies for important risks. See what we found for Remedy Entertainment Oyj in our free report.View our latest analysis for Remedy Entertainment Oyj

What Does Remedy Entertainment Oyj's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Remedy Entertainment Oyj has been doing quite well of late. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Remedy Entertainment Oyj will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Remedy Entertainment Oyj's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. As a result, it also grew revenue by 13% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 28% per annum as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 10% per year, which is noticeably less attractive.

With this information, we can see why Remedy Entertainment Oyj is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Remedy Entertainment Oyj have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Remedy Entertainment Oyj shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Remedy Entertainment Oyj with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:REMEDY

Remedy Entertainment Oyj

A video game company, engages in the development and sale of PC and console games in Finland.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026