PunaMusta Media Oyj's (HEL:PUMU) Prospects Need A Boost To Lift Shares

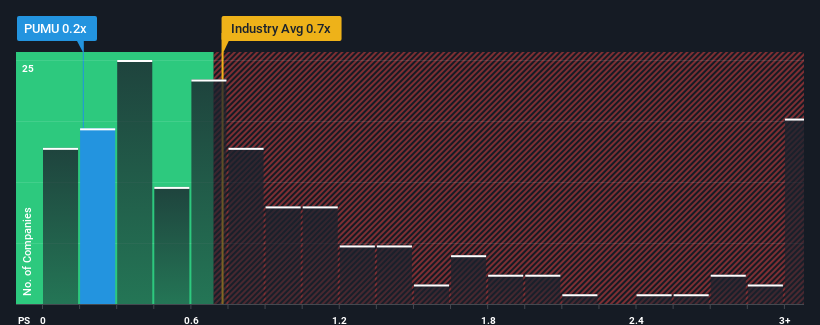

PunaMusta Media Oyj's (HEL:PUMU) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Media industry in Finland have P/S ratios greater than 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for PunaMusta Media Oyj

What Does PunaMusta Media Oyj's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, PunaMusta Media Oyj has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on PunaMusta Media Oyj will help you uncover what's on the horizon.How Is PunaMusta Media Oyj's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as PunaMusta Media Oyj's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to slump, contracting by 5.0% per year during the coming three years according to the one analyst following the company. Meanwhile, the broader industry is forecast to expand by 2.7% per year, which paints a poor picture.

In light of this, it's understandable that PunaMusta Media Oyj's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On PunaMusta Media Oyj's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that PunaMusta Media Oyj's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, PunaMusta Media Oyj's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with PunaMusta Media Oyj (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on PunaMusta Media Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:REBL

Rebl Group Oyj

Primarily engages in printing and designing of magazines and newspapers business in Finland.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026