Health Check: How Prudently Does PunaMusta Media Oyj (HEL:PUMU) Use Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies PunaMusta Media Oyj (HEL:PUMU) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for PunaMusta Media Oyj

What Is PunaMusta Media Oyj's Net Debt?

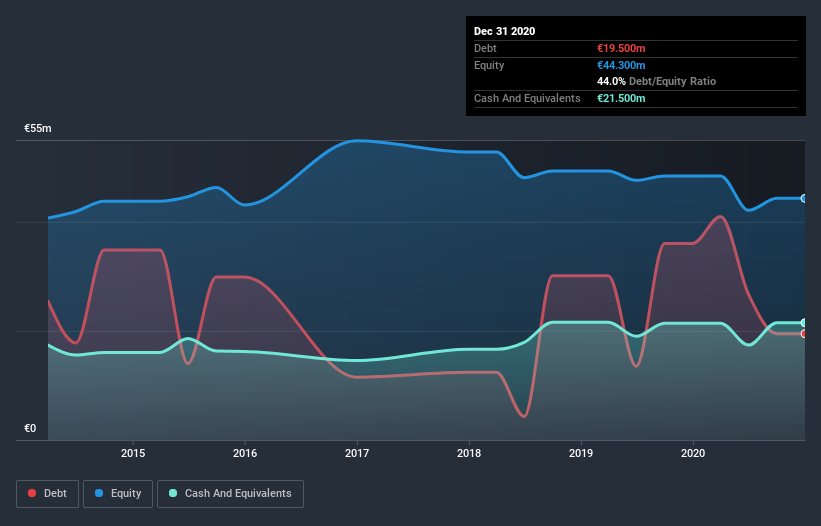

As you can see below, PunaMusta Media Oyj had €14.5m of debt at December 2020, down from €36.0m a year prior. However, its balance sheet shows it holds €21.5m in cash, so it actually has €6.98m net cash.

A Look At PunaMusta Media Oyj's Liabilities

According to the last reported balance sheet, PunaMusta Media Oyj had liabilities of €35.2m due within 12 months, and liabilities of €23.9m due beyond 12 months. Offsetting this, it had €21.5m in cash and €12.4m in receivables that were due within 12 months. So it has liabilities totalling €25.2m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since PunaMusta Media Oyj has a market capitalization of €78.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. Despite its noteworthy liabilities, PunaMusta Media Oyj boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine PunaMusta Media Oyj's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, PunaMusta Media Oyj made a loss at the EBIT level, and saw its revenue drop to €106m, which is a fall of 2.2%. We would much prefer see growth.

So How Risky Is PunaMusta Media Oyj?

While PunaMusta Media Oyj lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow €9.0m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. With revenue growth uninspiring, we'd really need to see some positive EBIT before mustering much enthusiasm for this business. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for PunaMusta Media Oyj (1 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading PunaMusta Media Oyj or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:REBL

Rebl Group Oyj

Primarily engages in printing and designing of magazines and newspapers business in Finland.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success