Assessing Alma Media (HLSE:ALMA) Valuation Following Steady Share Gains and Growing Investor Confidence

Reviewed by Simply Wall St

Most Popular Narrative: 1.8% Undervalued

According to the most widely followed narrative, Alma Media Oyj is currently trading slightly below its estimated fair value, pointing to a modest undervaluation based on growth and profitability forecasts.

"Alma Media's accelerating integration of AI and automation across digital marketplaces, news, and insights services is expected to drive sustained operating margin expansion through enhanced personalization, internal productivity, and product innovation. This is anticipated to directly boost net margins and earnings in the medium to long term."

Curious what’s really powering this price target? The popular narrative is built around an ambitious transformation plan, emphasizing margin expansion and revamped revenue sources. Discover the projections and underlying financial moves that analysts believe could redefine Alma Media’s valuation story.

Result: Fair Value of €14.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing macroeconomic headwinds and rising competition from international tech players could challenge Alma Media Oyj’s margin expansion and revenue growth story.

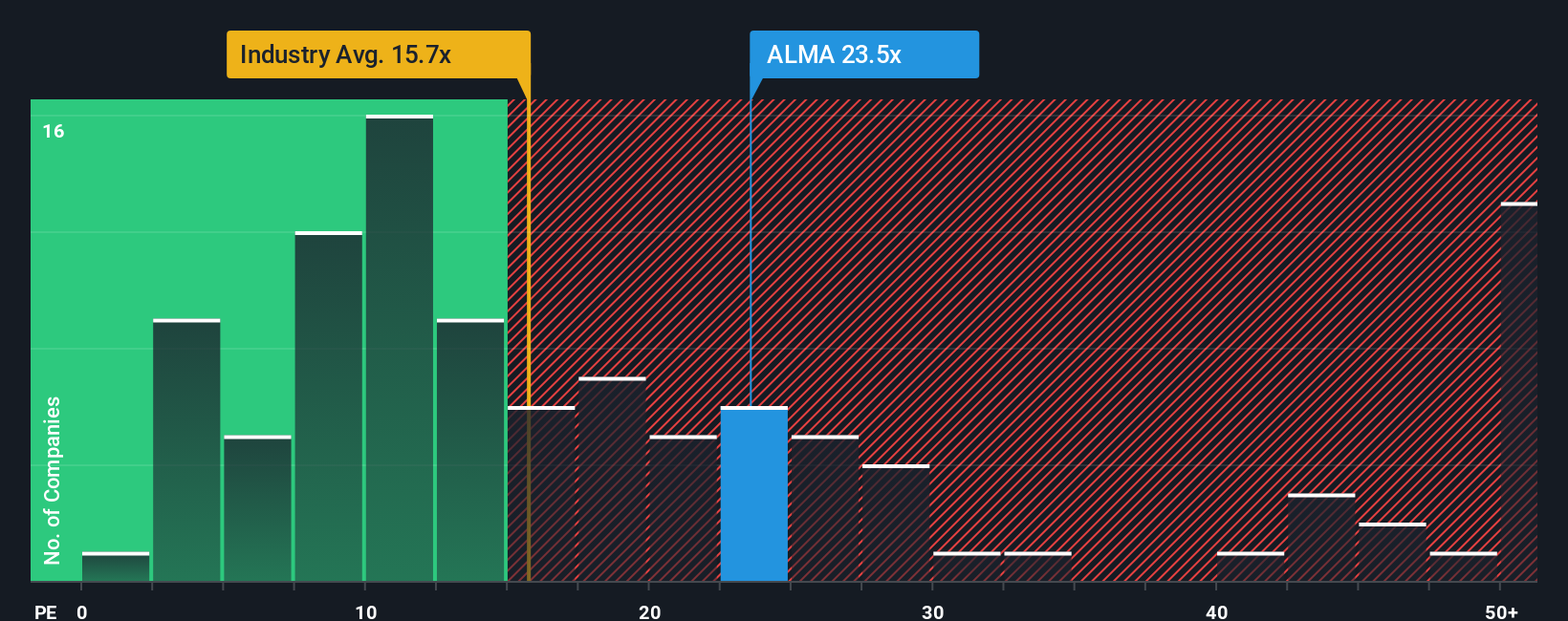

Find out about the key risks to this Alma Media Oyj narrative.Another View: Market Ratios Tell a Different Story

Looking at Alma Media Oyj through industry-standard valuation ratios paints a less optimistic picture. In this context, the company appears expensive compared to its media sector peers. Could growth ambitions justify this pricing?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Alma Media Oyj to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Alma Media Oyj Narrative

If you see things differently or want to dig into the numbers yourself, why not build your own assessment and put the story together in your own way? Do it your way

A great starting point for your Alma Media Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

You do not have to settle for what everyone else is watching. Put yourself ahead by searching for stocks that truly match your strategy and financial goals.

- Tap into steady income by checking out companies offering dividend stocks with yields > 3% and see which firms deliver strong, reliable yields above 3%.

- Spot forward-thinking companies at the intersection of medicine and machine intelligence with our handpicked healthcare AI stocks selection.

- Catch tomorrow's leaders before they become household names by finding penny stocks with strong financials showing impressive financial muscle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About HLSE:ALMA

Alma Media Oyj

A media company, engages in digital services and journalistic media content in Finland and the rest of Europe.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives