- Finland

- /

- Paper and Forestry Products

- /

- HLSE:STERV

Why Investors Shouldn't Be Surprised By Stora Enso Oyj's (HEL:STERV) P/S

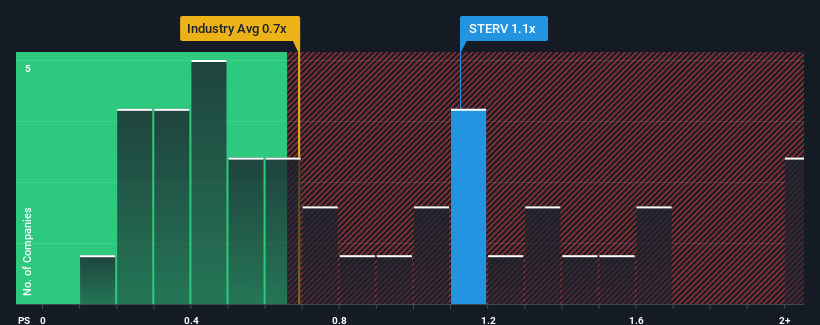

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Forestry industry in Finland, you could be forgiven for feeling indifferent about Stora Enso Oyj's (HEL:STERV) P/S ratio of 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Stora Enso Oyj

What Does Stora Enso Oyj's Recent Performance Look Like?

Stora Enso Oyj has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Stora Enso Oyj's future stacks up against the industry? In that case, our free report is a great place to start.How Is Stora Enso Oyj's Revenue Growth Trending?

Stora Enso Oyj's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 6.3% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 4.9% growth each year, the company is positioned for a comparable revenue result.

With this information, we can see why Stora Enso Oyj is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Stora Enso Oyj's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Stora Enso Oyj with six simple checks on some of these key factors.

If you're unsure about the strength of Stora Enso Oyj's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:STERV

Stora Enso Oyj

Provides renewable solutions for the packaging, biomaterials, wooden constructions, and paper industries in Finland and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives