- Finland

- /

- Metals and Mining

- /

- HLSE:OUT1V

Investors Appear Satisfied With Outokumpu Oyj's (HEL:OUT1V) Prospects

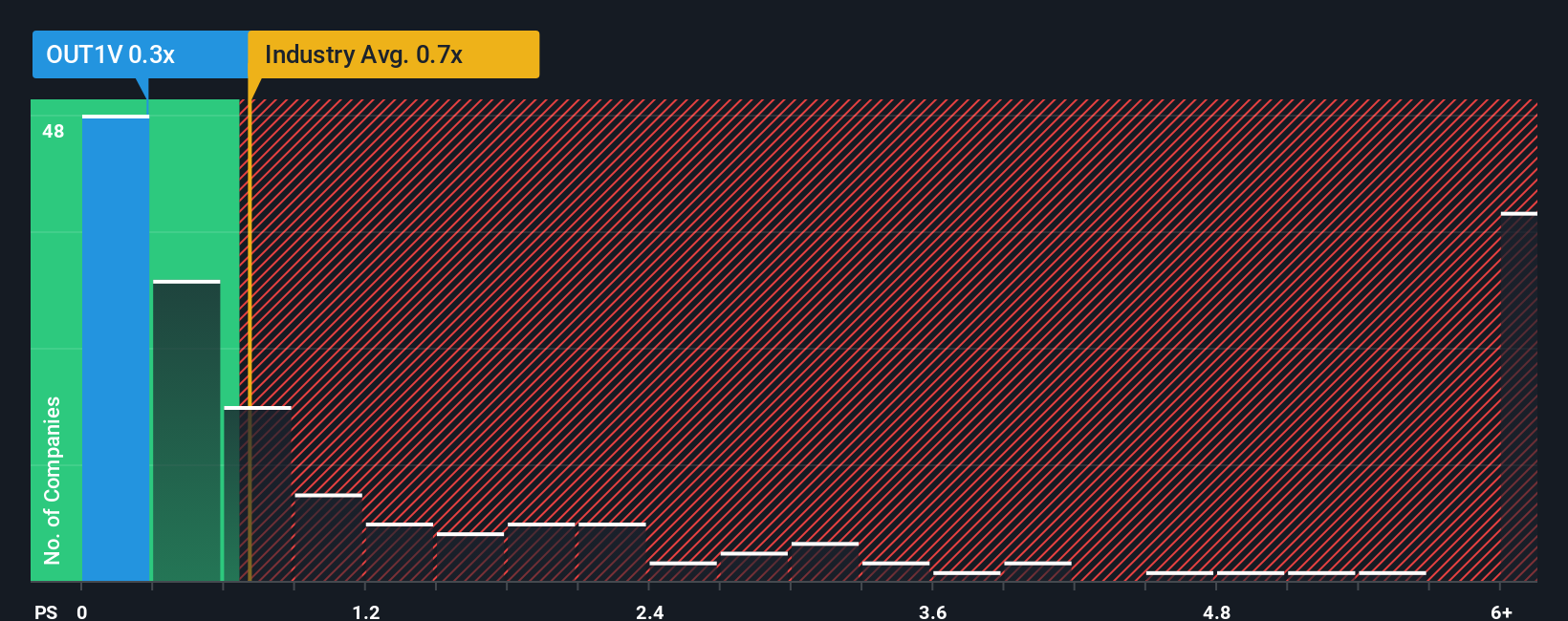

There wouldn't be many who think Outokumpu Oyj's (HEL:OUT1V) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Metals and Mining industry in Finland is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Outokumpu Oyj

What Does Outokumpu Oyj's P/S Mean For Shareholders?

Outokumpu Oyj could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Outokumpu Oyj's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Outokumpu Oyj's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 2.2% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 35% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 4.2% per annum as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.8% each year, which is not materially different.

In light of this, it's understandable that Outokumpu Oyj's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Outokumpu Oyj's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Outokumpu Oyj that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:OUT1V

Outokumpu Oyj

Produces and sells various stainless steel products in Finland, Germany, Italy, the United Kingdom, other European countries, North America, the Asia-Pacific, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives