Metsä Board (HLSE:METSB): Losses Deepen as Volatility Challenges Optimistic Earnings Growth Narrative

Reviewed by Simply Wall St

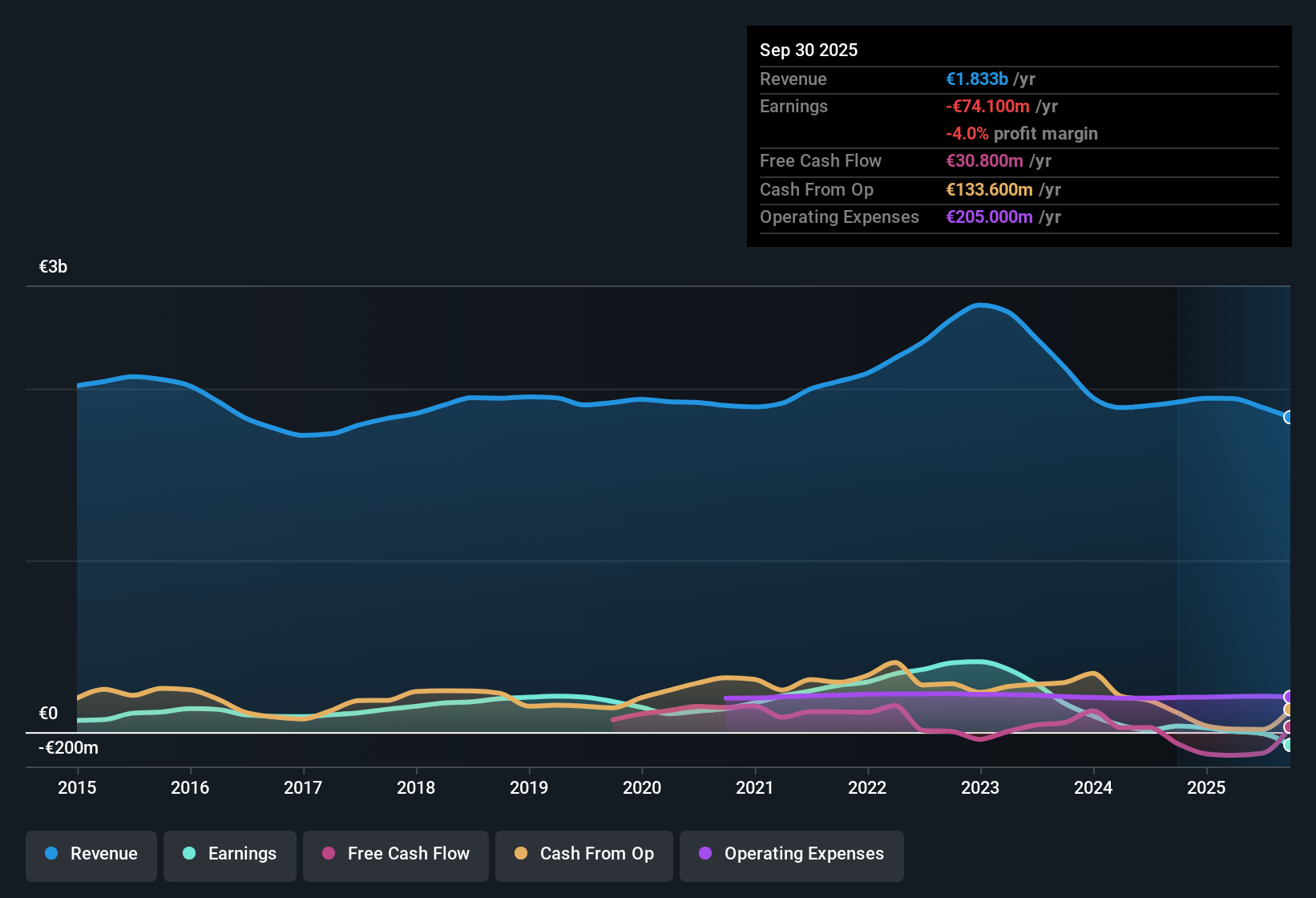

Metsä Board Oyj (HLSE:METSB) is currently unprofitable, with losses widening at a rate of 34% per year over the past five years. Looking ahead, revenue is forecast to grow 5.3% annually while earnings are expected to surge by 85.57% per year. This puts the company on track for profitability within the next three years. Investors will likely weigh the promise of rapid earnings growth and a path back to profit against the recent track record of mounting losses and ongoing share price volatility.

See our full analysis for Metsä Board Oyj.The next section dives into how these figures stack up against the broader community narratives for Metsä Board, exploring where the consensus aligns and where the numbers prompt a rethink.

See what the community is saying about Metsä Board Oyj

Ambitious €200 Million Cost Program Underway

- Metsä Board's management has set a goal of achieving a €200 million annual EBITDA uplift by 2027. The company is targeting cost savings and efficiency gains through operating upgrades and supply chain optimization.

- According to the analysts' consensus view, the company’s success in executing this program is considered pivotal for boosting net margins and future earnings.

- If executed as planned, a successful rollout could help transition from current negative profit margins (-0.4%) to positive margins of 5.8% within three years. This would represent a significant turnaround.

- Consensus narrative highlights that capacity expansions at sites such as Simpele, combined with inventory management aimed at releasing €150 million in near-term cash, could accelerate profitability as demand for sustainable packaging increases.

- See how capacity growth and efficiency efforts are shaping the consensus outlook for Metsä Board’s turnaround story in the detailed analyst narrative. 📊 Read the full Metsä Board Oyj Consensus Narrative.

Share Price Volatility Flags Execution Risks

- Despite optimistic earnings forecasts, Metsä Board's share price has fluctuated markedly over the past three months. This signals ongoing investor doubts about the timing and certainty of a recovery.

- Consensus narrative cautions that ambitious targets bring execution risk, particularly given industry headwinds.

- Bears highlight that excess market supply and subdued demand trends in Europe could keep deliveries below capacity. This directly challenges revenue growth goals and could result in lower operating rates for longer than planned.

- Critics point out that fixed costs, high logistics expenses, and market disruptions make meeting the €200 million profit uplift target challenging if economic stagnation or high input prices continue.

Valuation Remains Attractive Versus Peers, But Not The Industry

- Metsä Board trades below both its analyst price target (€2.98 vs. €3.25 target) and its DCF fair value (€6.81), while also showing a Price-To-Sales ratio of 0.6x compared to its peer average of 1x and the European packaging industry average of 0.5x.

- The analysts' consensus view suggests the current share price leaves some room for upside if earnings growth occurs, but returns may be limited as peers and the broader industry continue to experience pricing pressure.

- Notably, the analyst price target is only 2.8% higher than the latest share price, suggesting expectations for solid but not spectacular returns, unless upside risk from cost savings and top-line growth materializes sooner than anticipated.

- Consensus narrative indicates the overall valuation appeal relies heavily on new volume from sustainable packaging and disciplined cost management, rather than simply on market recovery.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Metsä Board Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Use your insights to build your own narrative in just a few minutes: Do it your way.

A great starting point for your Metsä Board Oyj research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Metsä Board faces uncertainty around consistent profitability and execution, as volatile earnings and shifting market demand put steady returns at risk.

If reliable growth matters to you, use stable growth stocks screener (2099 results) to spot companies proven to deliver strong, consistent results through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:METSB

Metsä Board Oyj

Engages in the folding boxboard, fresh fibre linerboard, and market pulp businesses in Finland and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)