Does Sampo’s Q3 Profit Surge and Reaffirmed Outlook Reinforce Its Growth Narrative (HLSE:SAMPO)?

Reviewed by Sasha Jovanovic

- Sampo Oyj recently reported third quarter and nine-month earnings, with net income for the third quarter increasing to €757 million from €320 million a year earlier, and basic earnings per share rising to €0.28 from €0.13 year-on-year.

- Alongside the results, the company reaffirmed its 2025 group insurance revenue guidance of €8.9 billion to €9.1 billion, highlighting management's confidence in achieving significant year-on-year growth.

- We’ll explore how Sampo’s strong earnings growth and maintained revenue outlook shape the overall investment narrative for the company.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sampo Oyj Investment Narrative Recap

To be a Sampo Oyj shareholder, you need to believe in the company’s ability to convert its strong presence in Nordic and Baltic markets into consistent insurance revenue growth while managing the evolving risks of economic slowdowns, competition, and interest rate movements. The recent surge in third quarter earnings and the reaffirmed 2025 revenue guidance support near-term optimism but do not materially shift the biggest near-term catalyst, continued premium and digital growth, or the key risk of regional macroeconomic weakness.

Among recent announcements, Sampo’s completed share buyback in late September stands out as directly relevant to shareholder value. This initiative reduced share count by 0.76%, reinforcing management’s capital return focus, but does not offset broader risks linked to economic or regulatory changes in its core markets. Investors may want to weigh such capital management actions in the context of Sampo’s ongoing exposure to regional cycles and evolving insurance product demands...

Read the full narrative on Sampo Oyj (it's free!)

Sampo Oyj's narrative projects €10.6 billion revenue and €1.6 billion earnings by 2028. This requires 2.7% yearly revenue growth and a €0.4 billion earnings increase from €1.2 billion currently.

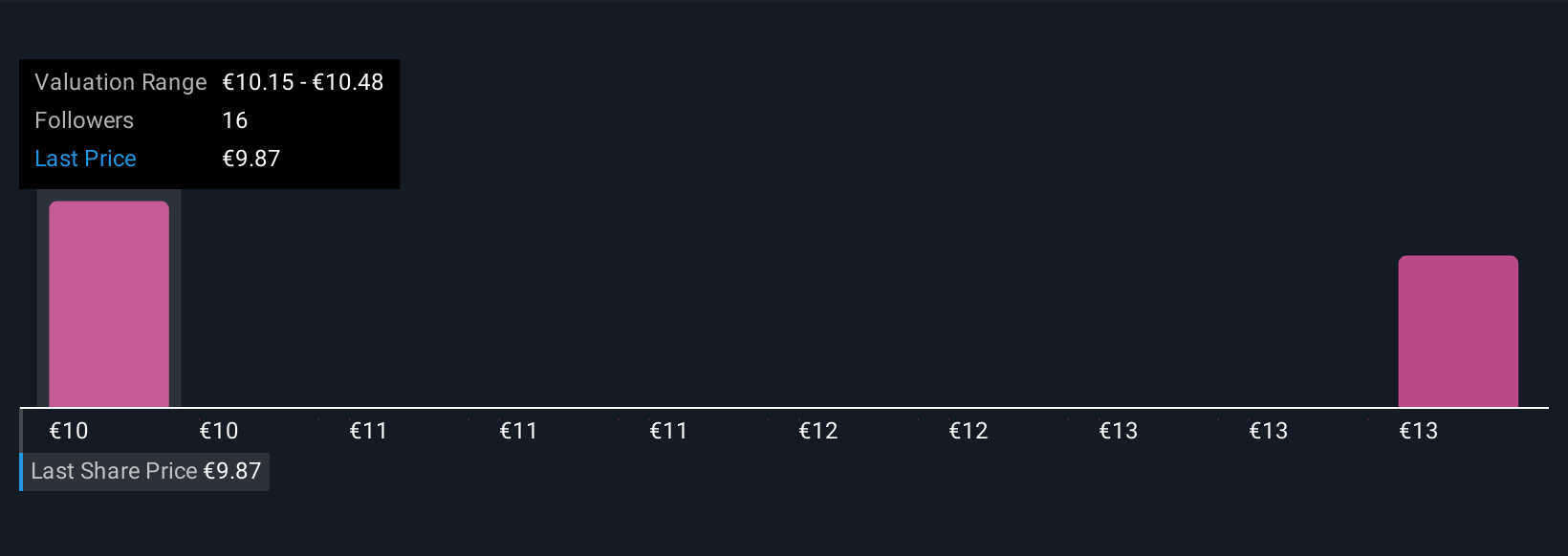

Uncover how Sampo Oyj's forecasts yield a €10.28 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently estimate Sampo’s fair value anywhere from €10.28 to €14.32 per share, drawing on two separate forecasts. While expectations for sustained premium growth are a catalyst for many, diverging outlooks highlight how differently individual investors view Sampo’s potential and its challenges in Nordic-focused insurance.

Explore 2 other fair value estimates on Sampo Oyj - why the stock might be worth just €10.28!

Build Your Own Sampo Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sampo Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sampo Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sampo Oyj's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:SAMPO

Sampo Oyj

Provides non-life insurance products and services in Finland, Sweden, Norway, Denmark, Estonia, Lithuania, Latvia, Spain, Gibraltar, Germany, the Netherlands, France, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives