Assessing Sampo (HLSE:SAMPO) Valuation as Shares Show Steady Momentum Without Major News

Reviewed by Simply Wall St

Sampo Oyj (HLSE:SAMPO) might not be making headlines with a dramatic announcement this week, but the stock’s recent moves have caught some attention. Without a specific event serving as the spark, investors may be left wondering whether the current momentum is part of a larger valuation story or just market noise. In moments like these, quiet periods can be almost as revealing as big news, especially for those considering their next step with Sampo’s shares.

Looking at the bigger picture, Sampo’s stock has shown steady momentum over the past year, posting a 24% total return and nearly 23% since the start of this year. While there have been small dips in the past month, the longer-term trend remains positive. Revenue and net income have continued to grow at a moderate pace, suggesting underlying strength even in quieter times.

Some investors may wonder whether this lull represents a genuine opportunity or if the market has already factored in potential future gains.

Most Popular Narrative: 4% Undervalued

According to the most widely followed narrative, Sampo Oyj is considered undervalued, with its current share price trading slightly below the estimated fair value based on analyst consensus. This view incorporates forward-looking expectations around earnings growth, profit margins, and discounting for risk.

Ongoing investments in digital distribution, automation, and analytics are driving margin expansion through improved underwriting quality, lower cost ratios, and enhanced claims management. These factors support higher net margins and bottom-line earnings.

Curious about what’s fueling this valuation? Discover the powerful mix of digital transformation, cost control, and new sector trends that shape these bold expectations. Wonder which key growth assumptions support such a robust case for Sampo’s future? Get ready to see how changing investor sentiment could play a big role in this surprisingly optimistic forecast.

Result: Fair Value of €10.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Sampo’s heavy focus on Nordic markets, along with rising competition from digital-first rivals, could disrupt the outlook if conditions shift unexpectedly.

Find out about the key risks to this Sampo Oyj narrative.Another View: What Does Our DCF Say?

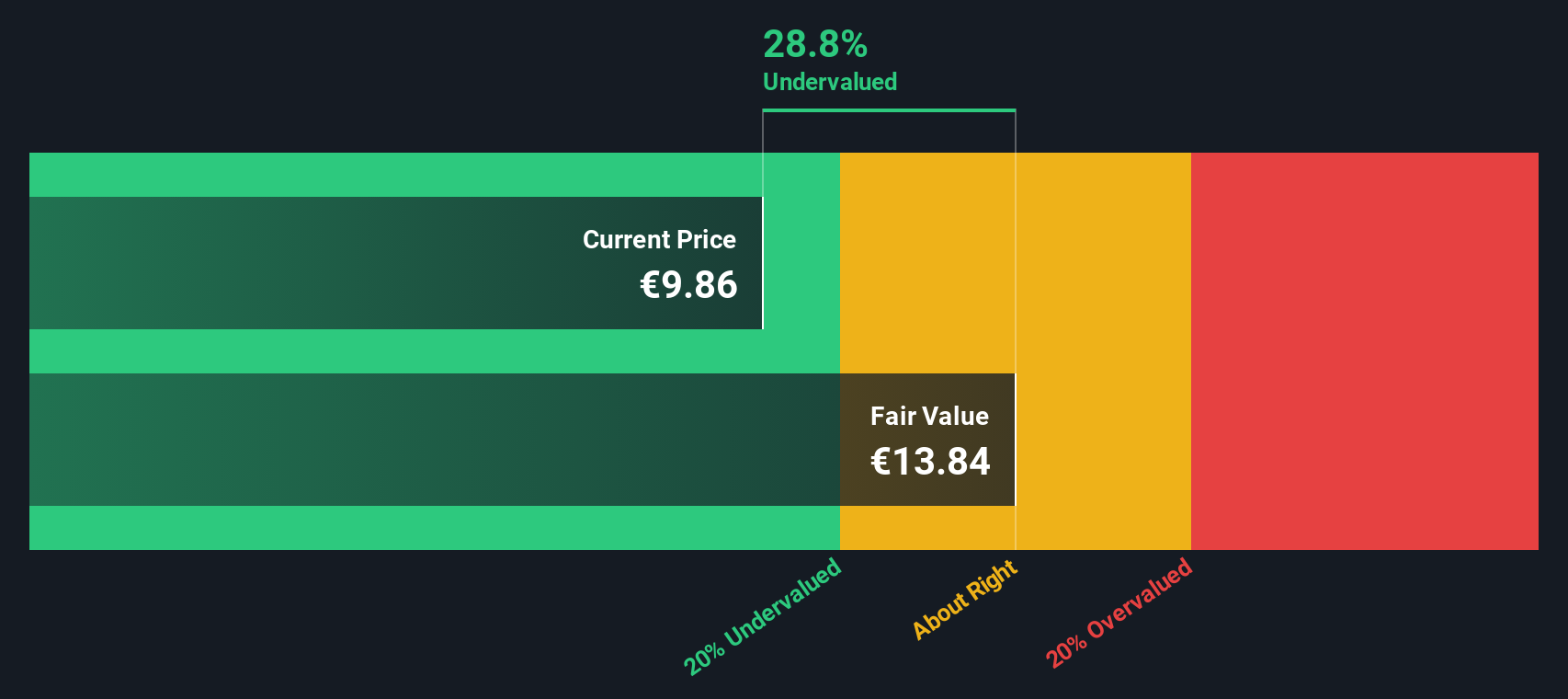

While the analyst consensus points to Sampo trading just below fair value, our DCF model takes a different approach and suggests the shares are trading well beneath their long-term intrinsic worth. Which perspective will ultimately prove more accurate as the market unfolds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sampo Oyj Narrative

If you have a different perspective or want to dive into the numbers yourself, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Sampo Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart investment ideas?

Don’t wait on the sidelines and let opportunities pass by. Tap into powerful market trends and keep your portfolio ahead of the curve with these handpicked ideas:

- Uncover stocks that offer high income potential by searching for strong yields in dividend stocks with yields > 3%.

- Spot companies unlocking breakthroughs in artificial intelligence healthcare with the targeted insights of healthcare AI stocks.

- Chase undervalued opportunities and reveal shares the market may be overlooking through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About HLSE:SAMPO

Sampo Oyj

Provides non-life insurance products and services in Finland, Sweden, Norway, Denmark, Estonia, Lithuania, Latvia, Spain, Gibraltar, Germany, the Netherlands, France, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives