- Finland

- /

- Healthcare Services

- /

- HLSE:TTALO

Terveystalo Oyj Beat Analyst Estimates: See What The Consensus Is Forecasting For Next Year

The third-quarter results for Terveystalo Oyj (HEL:TTALO) were released last week, making it a good time to revisit its performance. It looks like a credible result overall - although revenues of €296m were what the analysts expected, Terveystalo Oyj surprised by delivering a (statutory) profit of €0.12 per share, an impressive 38% above what was forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Terveystalo Oyj

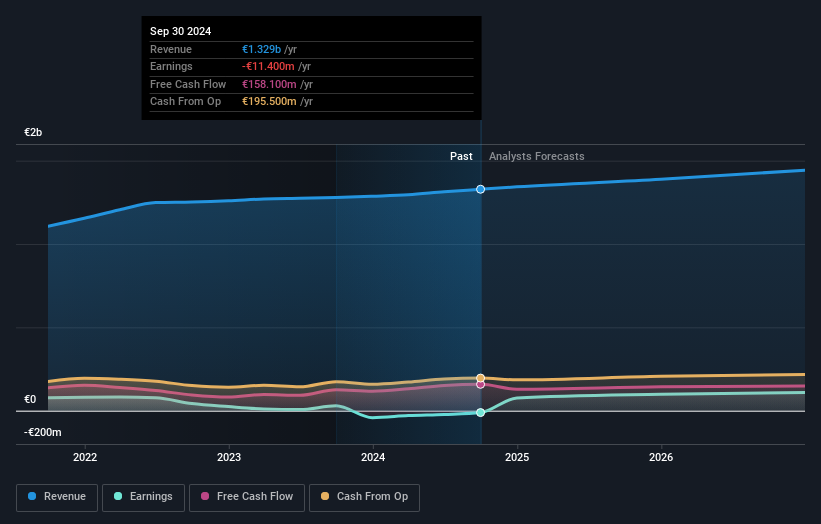

Taking into account the latest results, the most recent consensus for Terveystalo Oyj from four analysts is for revenues of €1.39b in 2025. If met, it would imply a satisfactory 4.6% increase on its revenue over the past 12 months. Terveystalo Oyj is also expected to turn profitable, with statutory earnings of €0.77 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of €1.39b and earnings per share (EPS) of €0.75 in 2025. So the consensus seems to have become somewhat more optimistic on Terveystalo Oyj's earnings potential following these results.

The consensus price target rose 5.5% to €11.55, suggesting that higher earnings estimates flow through to the stock's valuation as well. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Terveystalo Oyj at €12.00 per share, while the most bearish prices it at €10.80. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Terveystalo Oyj is an easy business to forecast or the the analysts are all using similar assumptions.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Terveystalo Oyj's revenue growth is expected to slow, with the forecast 3.6% annualised growth rate until the end of 2025 being well below the historical 7.1% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 5.0% per year. Factoring in the forecast slowdown in growth, it seems obvious that Terveystalo Oyj is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Terveystalo Oyj following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Terveystalo Oyj's revenue is expected to perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Terveystalo Oyj analysts - going out to 2026, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Terveystalo Oyj you should be aware of.

If you're looking to trade Terveystalo Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Terveystalo Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TTALO

Terveystalo Oyj

Provides occupational healthcare services in Finland, Sweden, and Estonia.

Undervalued with moderate growth potential.

Market Insights

Community Narratives