As global markets navigate a mixed landscape of rising stock indices and declining consumer confidence, investors are keenly watching for opportunities that align with current economic conditions. Penny stocks, often associated with smaller or newer companies, remain an intriguing investment area due to their affordability and potential for growth. Despite being considered a somewhat outdated term, these stocks can still offer significant opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £149.54M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,826 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Oriola Oyj (HLSE:OKDBV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oriola Oyj is a company that offers healthcare and wellbeing products mainly in Sweden and Finland, with a market cap of €161.88 million.

Operations: The company generates its revenue primarily from Sweden (€1.01 billion) and Finland (€550.3 million), with additional income from other countries (€69.7 million).

Market Cap: €161.88M

Oriola Oyj, with a market cap of €161.88 million, primarily generates revenue from Sweden and Finland. Despite being unprofitable with a negative return on equity of -3.36%, the company has reduced its debt-to-equity ratio over five years and has more cash than total debt, indicating financial prudence. Recent management changes could bring fresh strategic direction as Satu Nylén and Katja Lundell join the team in executive roles. Although trading at significant value below estimated fair value, Oriola's short-term liabilities exceed its assets, posing liquidity challenges amidst ongoing efforts to stabilize earnings growth forecasted at 77.63% annually.

- Take a closer look at Oriola Oyj's potential here in our financial health report.

- Gain insights into Oriola Oyj's outlook and expected performance with our report on the company's earnings estimates.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Financial Health Rating: ★★★★★☆

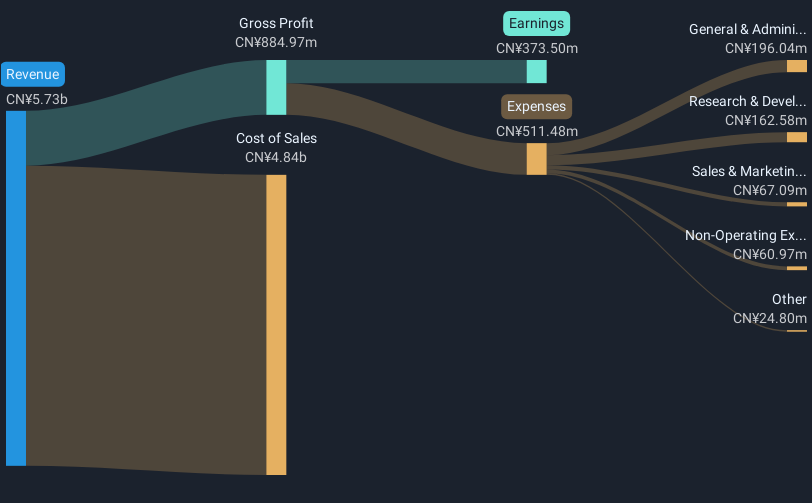

Overview: Zhejiang Hailide New Material Co., Ltd specializes in the research, development, production, and marketing of industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors both in China and internationally with a market cap of CN¥5.14 billion.

Operations: Zhejiang Hailide New Material Co., Ltd does not report specific revenue segments.

Market Cap: CN¥5.14B

Zhejiang Hailide New Material Co., Ltd, with a market cap of CN¥5.14 billion, shows promising financial health in the penny stock realm. The company's operating cash flow adequately covers its debt, and it maintains a satisfactory net debt to equity ratio of 25%. Earnings have grown by 15.5% over the past year, surpassing both its industry peers and its own five-year average growth rate. Despite shareholder dilution over the past year and an unstable dividend track record, Zhejiang Hailide’s price-to-earnings ratio suggests good value relative to the Chinese market. Recent earnings reports highlight steady revenue growth and improved net profit margins.

- Unlock comprehensive insights into our analysis of Zhejiang Hailide New MaterialLtd stock in this financial health report.

- Evaluate Zhejiang Hailide New MaterialLtd's prospects by accessing our earnings growth report.

Bonus BioGroup (TASE:BONS)

Simply Wall St Financial Health Rating: ★★★★☆☆

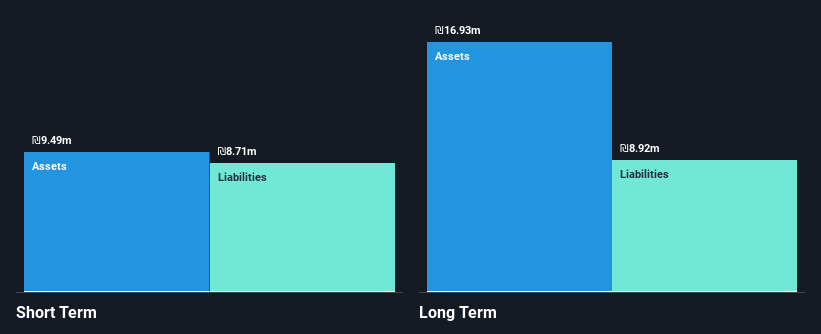

Overview: Bonus BioGroup Ltd. is a clinical-stage biotechnology company focused on developing tissue engineering and cell therapy products, with a market cap of ₪165.85 million.

Operations: Bonus BioGroup Ltd. currently does not have any reported revenue segments.

Market Cap: ₪165.85M

Bonus BioGroup Ltd., with a market cap of ₪165.85 million, remains pre-revenue, highlighting its early-stage status in the biotechnology sector. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges with a net loss of ILS 21.97 million for the first nine months of 2024 and less than a year of cash runway at current burn rates. Its share price has been highly volatile recently, yet shareholders have not faced significant dilution over the past year. The management team and board are experienced, which may provide stability as they navigate these hurdles.

- Dive into the specifics of Bonus BioGroup here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Bonus BioGroup's track record.

Taking Advantage

- Click here to access our complete index of 5,826 Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonus BioGroup might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BONS

Bonus BioGroup

A clinical-stage biotechnology company, develops products based on tissue engineering and cell therapy.

Moderate with adequate balance sheet.