- France

- /

- Oil and Gas

- /

- ENXTPA:LHYFE

Lhyfe And 2 Other European Penny Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed stock index performances and cautious monetary policy decisions, investors are increasingly looking for opportunities that align with current economic conditions. Penny stocks, though a term from earlier market days, continue to offer potential growth opportunities by focusing on smaller or emerging companies. By identifying those with strong financial health and clear growth trajectories, investors can uncover promising prospects within this niche investment area.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.258 | €1.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €238.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.95 | €40.14M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.49 | RON16.57M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.53 | €400.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.908 | €30.62M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 327 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lhyfe (ENXTPA:LHYFE)

Simply Wall St Financial Health Rating: ★★★★★☆

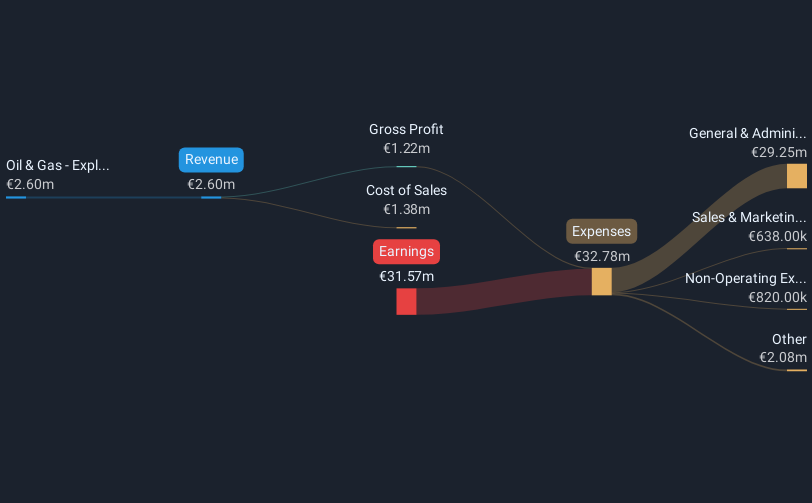

Overview: Lhyfe SA produces and supplies renewable green hydrogen for mobility and industry markets, with a market cap of €152.52 million.

Operations: The company generates revenue from its Oil & Gas - Exploration & Production segment, amounting to €5.10 million.

Market Cap: €152.52M

Lhyfe SA, with a market cap of €152.52 million, has shown potential in the renewable green hydrogen sector despite current unprofitability. The company raised €2.5 million through crowdfunding, indicating investor interest. Lhyfe's short-term assets (€95.8M) exceed its short-term liabilities (€51.4M), providing some financial stability, although long-term liabilities remain uncovered by these assets (€99.4M). The board is experienced with an average tenure of 3.7 years, and shareholders haven't faced significant dilution recently. While earnings are forecast to grow significantly at 44% annually, the company still faces challenges such as a negative return on equity (-40.72%).

- Unlock comprehensive insights into our analysis of Lhyfe stock in this financial health report.

- Explore Lhyfe's analyst forecasts in our growth report.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★★

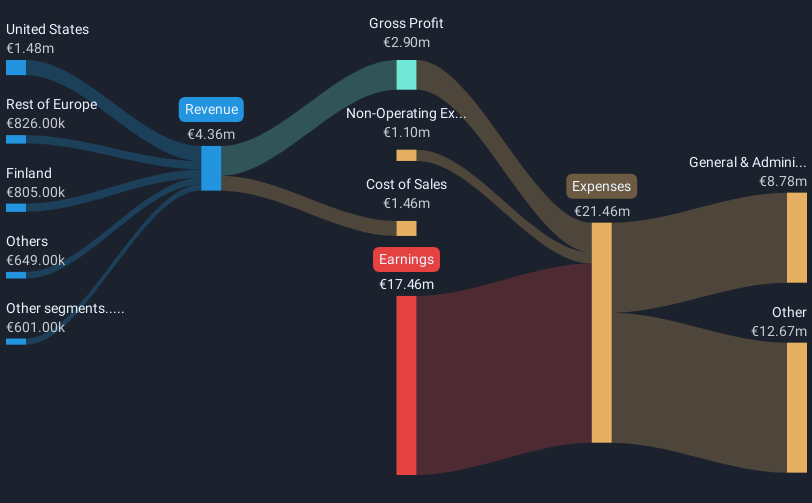

Overview: Nightingale Health Oyj is a health technology company providing a health data platform to detect disease risks across Finland, the United Kingdom, Europe, the United States, and internationally, with a market cap of €146.18 million.

Operations: Nightingale Health Oyj has not reported any specific revenue segments.

Market Cap: €146.18M

Nightingale Health Oyj, with a market cap of €146.18 million, is navigating the health technology space despite being unprofitable and experiencing increasing losses over the past five years. The company recently reported sales of €4.69 million for the full year ending June 2025, with a net loss of €18.46 million. It has secured significant contracts, including a €2.4 million deal with Aalborg University and another for Italy's Moli-sani study, indicating strong demand for its services in metabolomics and proteomics analysis. Nightingale Health's U.S expansion via its new laboratory underscores its strategic growth ambitions in international markets.

- Get an in-depth perspective on Nightingale Health Oyj's performance by reading our balance sheet health report here.

- Gain insights into Nightingale Health Oyj's outlook and expected performance with our report on the company's earnings estimates.

Atende (WSE:ATD)

Simply Wall St Financial Health Rating: ★★★★☆☆

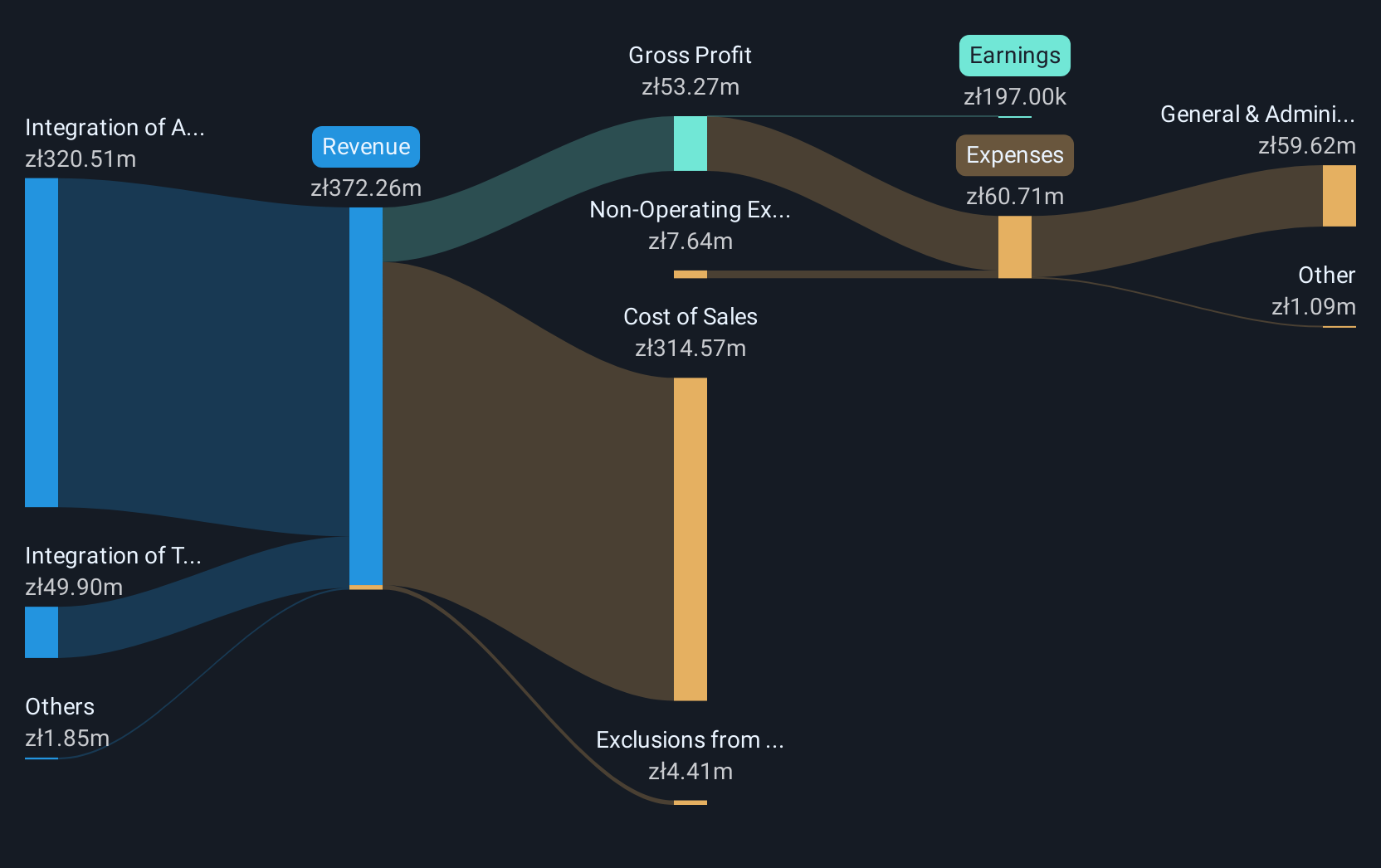

Overview: Atende S.A. specializes in IT systems integration in Poland and has a market capitalization of PLN149.01 million.

Operations: Atende S.A. has not reported any specific revenue segments.

Market Cap: PLN149.01M

Atende S.A., with a market cap of PLN149.01 million, operates in the IT systems integration sector in Poland. Despite experiencing a 48% annual decline in earnings over five years, recent results show improvement with net income rising to PLN0.79 million for Q2 2025 from PLN0.54 million the previous year and sales reaching PLN141.33 million for the first half of 2025, up from PLN126.99 million year-on-year. The company maintains stable debt levels with satisfactory coverage by operating cash flow and has an experienced management team averaging 8.2 years tenure, contributing to operational stability amidst industry challenges.

- Take a closer look at Atende's potential here in our financial health report.

- Gain insights into Atende's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Click here to access our complete index of 327 European Penny Stocks.

- Ready For A Different Approach? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LHYFE

Lhyfe

Produces and supplies renewable green hydrogen for mobility and industry markets.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives