As Europe grapples with the impact of proposed U.S. tariffs, major stock indexes have seen declines, reflecting broader economic uncertainties and revised growth forecasts. Amidst these challenges, investors often turn to smaller or newer companies for potential opportunities. Penny stocks, despite their somewhat outdated moniker, remain a relevant investment area where companies with solid financial foundations can offer surprising value and potential for significant returns.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.28 | SEK2.18B | ✅ 4 ⚠️ 1 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.678 | SEK455M | ✅ 3 ⚠️ 4 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.24 | SEK215.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.69 | SEK276.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.44 | SEK209.29M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN4.05 | PLN137.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.74 | €57.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €31.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.75 | €17.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.145 | €296.15M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 452 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Cellectis (ENXTPA:ALCLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cellectis S.A. is a clinical-stage biotechnological company focused on developing gene-editing products, particularly allogeneic chimeric antigen receptor T-cells, with a market cap of €102.36 million.

Operations: Cellectis generates revenue primarily from its Therapeutics segment, amounting to $54.75 million.

Market Cap: €102.36M

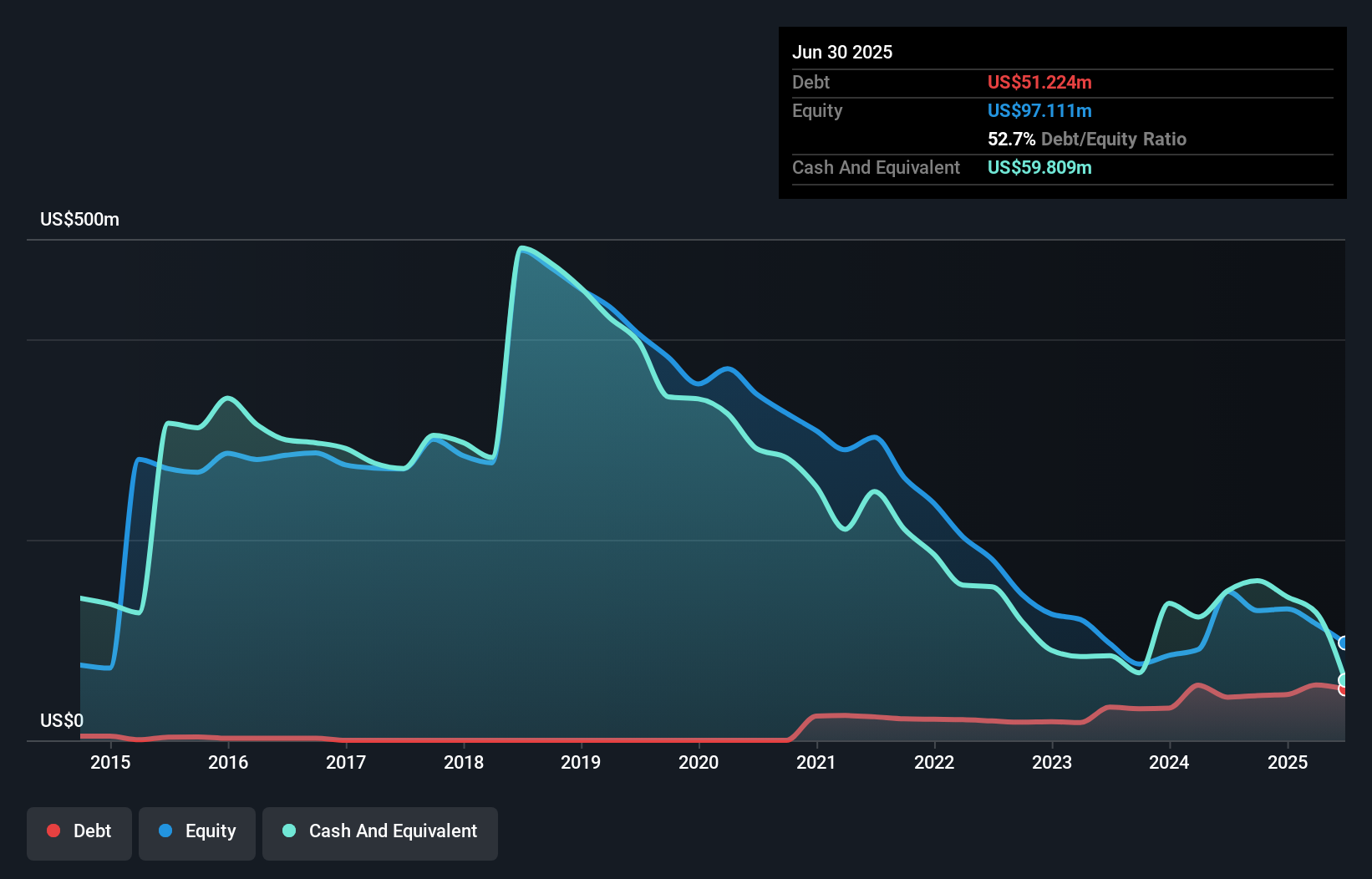

Cellectis, a clinical-stage biotech company with a market cap of €102.36 million, has shown significant revenue growth, reporting US$12.03 million for Q1 2025 compared to US$6.5 million the previous year. Despite being unprofitable with a net loss of US$18.13 million for the quarter, it maintains financial stability with more cash than total debt and sufficient cash runway exceeding three years due to positive free cash flow growth. Recent advancements in gene-editing technologies presented at major conferences highlight its potential in developing next-generation therapies, although high share price volatility remains a concern for investors considering penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Cellectis.

- Gain insights into Cellectis' outlook and expected performance with our report on the company's earnings estimates.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nightingale Health Oyj is a health technology company providing a health data platform for disease risk detection across Finland, the United Kingdom, Europe, the United States, and internationally with a market cap of €168.98 million.

Operations: The company's revenue is primarily generated from its Medical Labs & Research segment, amounting to €4.95 million.

Market Cap: €168.98M

Nightingale Health Oyj, with a market cap of €168.98 million, has shown revenue growth in its Medical Labs & Research segment, generating €4.95 million despite remaining unprofitable with a net loss of €8.2 million for the recent half-year period. The company benefits from an experienced management team and board, and its short-term assets significantly exceed liabilities. Recent strategic appointments aim to strengthen its commercial focus in Asia while inclusion in the OMX Nordic indices enhances visibility among investors. However, high share price volatility persists alongside challenges in achieving profitability within the next three years amidst ongoing innovation efforts like their new LLM-based health tool.

- Take a closer look at Nightingale Health Oyj's potential here in our financial health report.

- Gain insights into Nightingale Health Oyj's future direction by reviewing our growth report.

Tulikivi (HLSE:TULAV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tulikivi Corporation manufactures and sells fireplaces, sauna heaters, and interior stone products across Finland, the United States, and Europe with a market cap of €28.68 million.

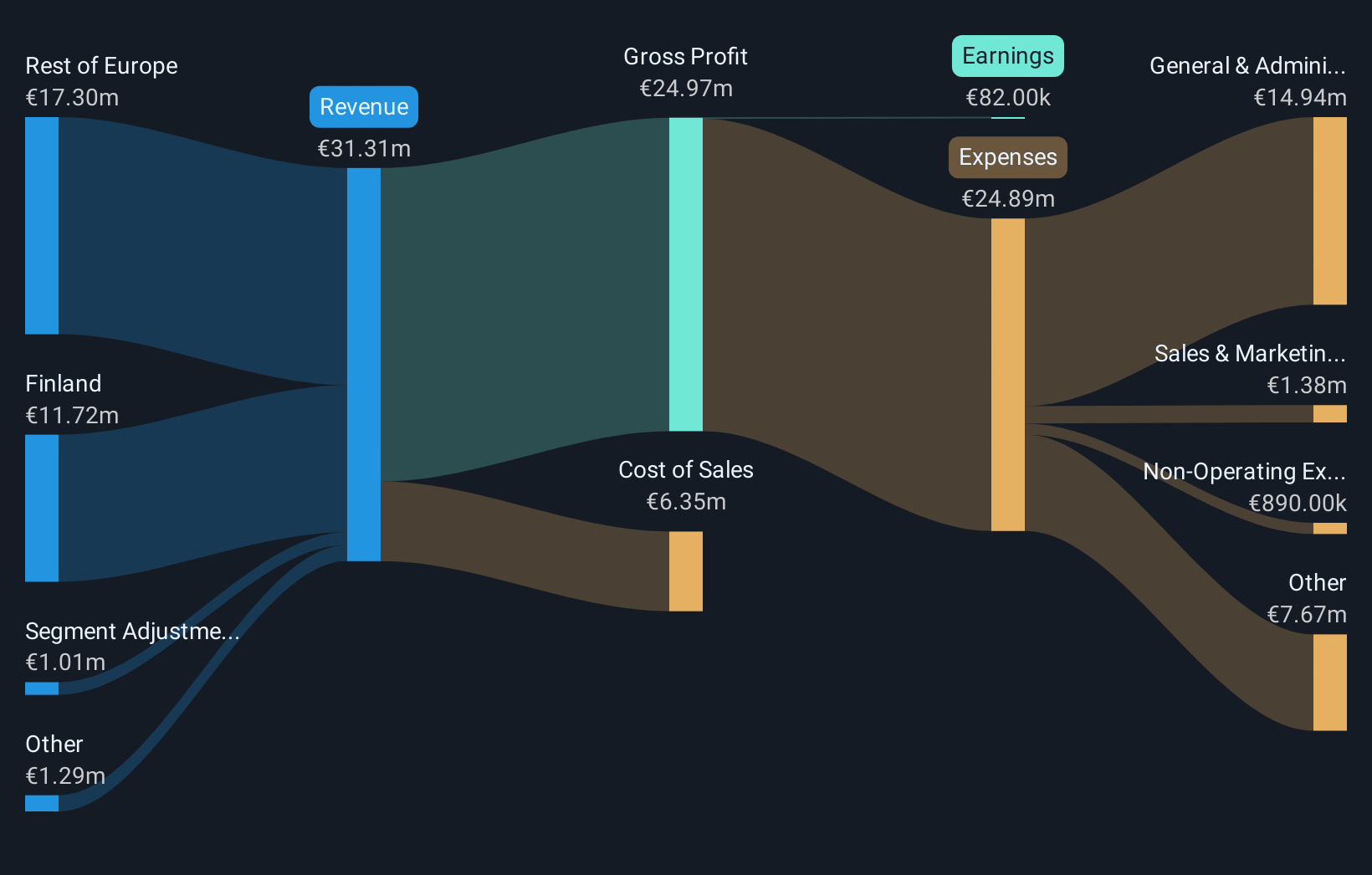

Operations: The company's revenue is primarily derived from its Building Products segment, which generated €32.01 million.

Market Cap: €28.68M

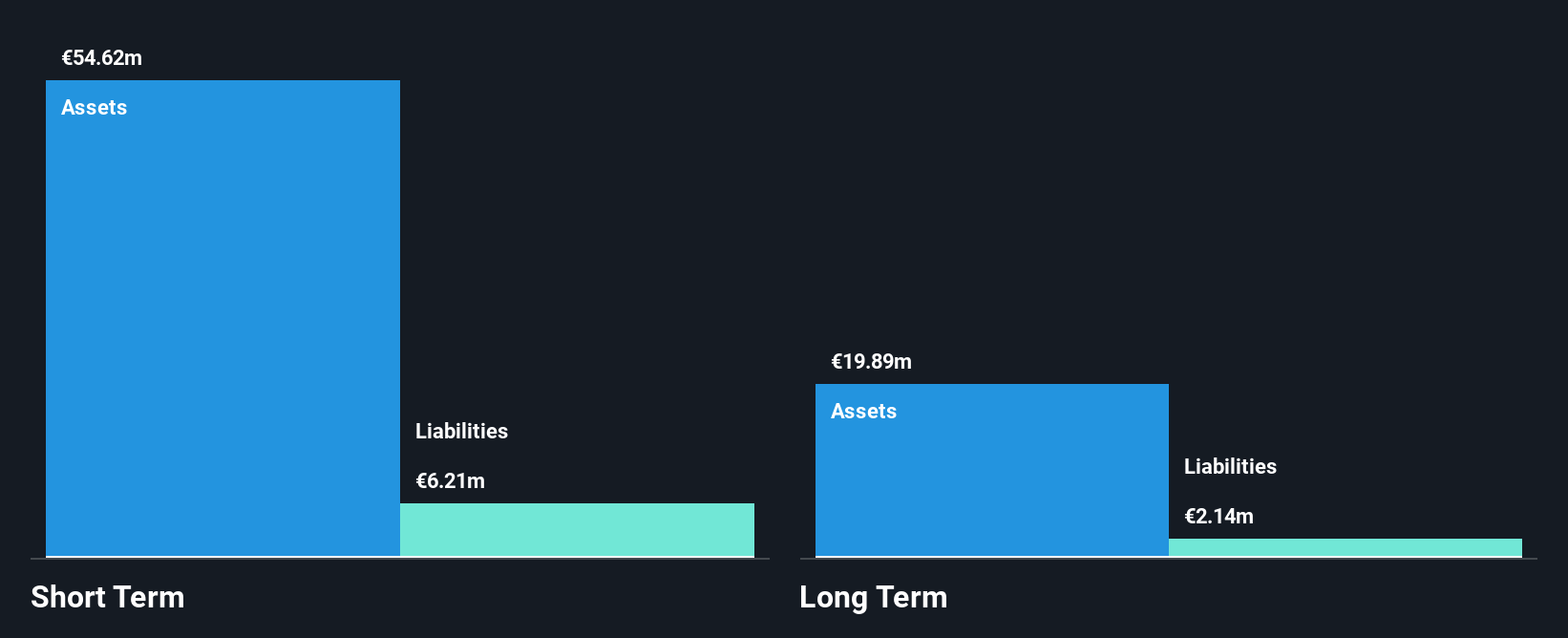

Tulikivi Corporation, with a market cap of €28.68 million, faces challenges as recent earnings show a decline in sales to €6.2 million for Q1 2025, down from €8.6 million the previous year, resulting in a net loss of €0.9 million. Despite this setback, the company has maintained stable weekly volatility and reduced its debt-to-equity ratio significantly over five years from 214.3% to 57.3%. Tulikivi's short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management; however, interest coverage remains weak at 1.4x EBIT due to low profit margins and return on equity at just 1%.

- Unlock comprehensive insights into our analysis of Tulikivi stock in this financial health report.

- Assess Tulikivi's future earnings estimates with our detailed growth reports.

Taking Advantage

- Discover the full array of 452 European Penny Stocks right here.

- Searching for a Fresh Perspective? Outshine the giants: these 29 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALCLS

Cellectis

A clinical stage biotechnological company, develops products based on gene-editing with a portfolio of allogeneic chimeric antigen receptor T-cells product candidates in the field of immuno-oncology and gene therapy product candidates in other therapeutic indications.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives