- Finland

- /

- Medical Equipment

- /

- HLSE:BIOBV

Biohit Oyj (HEL:BIOBV) Is In A Strong Position To Grow Its Business

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Biohit Oyj (HEL:BIOBV) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Biohit Oyj

How Long Is Biohit Oyj's Cash Runway?

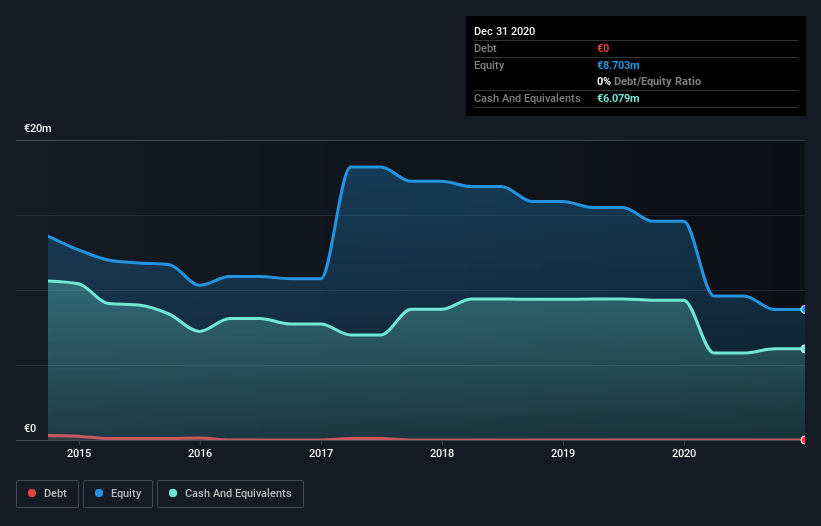

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at December 2020, Biohit Oyj had cash of €6.1m and no debt. Importantly, its cash burn was €40k over the trailing twelve months. So it had a very long cash runway of many years from December 2020. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. The image below shows how its cash balance has been changing over the last few years.

Is Biohit Oyj's Revenue Growing?

Given that Biohit Oyj actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 29%. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Biohit Oyj has developed its business over time by checking this visualization of its revenue and earnings history.

How Easily Can Biohit Oyj Raise Cash?

Since its revenue growth is moving in the wrong direction, Biohit Oyj shareholders may wish to think ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Biohit Oyj has a market capitalisation of €37m and burnt through €40k last year, which is 0.1% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Biohit Oyj's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Biohit Oyj is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Separately, we looked at different risks affecting the company and spotted 2 warning signs for Biohit Oyj (of which 1 is potentially serious!) you should know about.

Of course Biohit Oyj may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Biohit Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:BIOBV

Biohit Oyj

A biotechnology company, manufactures and sells bind acetaldehyde, diagnostic products, and systems for diagnostic analysis for the use of research institutions, healthcare, and industry worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives