The European stock market has recently seen mixed performances, with the pan-European STOXX Europe 600 Index edging higher amid dovish signals from the U.S. Federal Reserve and easing trade tensions between major global economies. For investors exploring opportunities beyond established giants, penny stocks—typically smaller or newer companies—can offer intriguing possibilities despite their somewhat vintage label. In this article, we explore three European penny stocks that stand out for their financial strength and potential value in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.09 | €16.19M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.94 | €26.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €225.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.58 | DKK115.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.69 | €38.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.966 | €77.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.08 | €8.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.926 | €31.01M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

NX Filtration (ENXTAM:NXFIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NX Filtration N.V. develops, produces, and sells hollow fiber membrane modules across various regions including the Netherlands, Europe, North America, and Asia with a market cap of €161.97 million.

Operations: The company generates its revenue from two primary segments: Clean Municipal Water (€3.85 million) and Sustainable Industrial Water (€6.71 million).

Market Cap: €161.97M

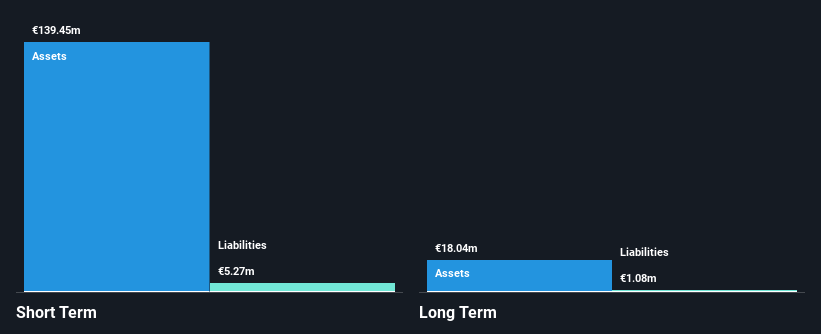

NX Filtration N.V. has a market cap of €161.97 million and generates revenue from Clean Municipal Water (€3.85 million) and Sustainable Industrial Water (€6.71 million). Recently, the company was dropped from the S&P Global BMI Index, reflecting potential challenges in market perception. Despite being unprofitable with a net loss of €12.75 million for H1 2025, NX Filtration's short-term assets exceed both its short-term and long-term liabilities, suggesting financial stability in the near term. With no significant shareholder dilution over the past year and sufficient cash runway for over a year based on current cash flow trends, NX Filtration remains positioned for potential growth amidst volatility concerns.

- Click to explore a detailed breakdown of our findings in NX Filtration's financial health report.

- Gain insights into NX Filtration's outlook and expected performance with our report on the company's earnings estimates.

Anora Group Oyj (HLSE:ANORA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anora Group Oyj is involved in the production, importation, marketing, distribution, and sale of alcoholic beverages across Finland, Europe, and internationally with a market cap of €203.34 million.

Operations: Anora Group Oyj generates its revenue through three main segments: Wine (€314.1 million), Spirits (€220 million), and Industrial (€226.3 million).

Market Cap: €203.34M

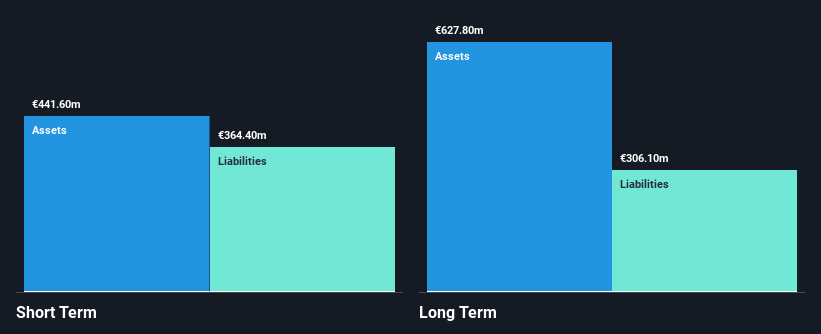

Anora Group Oyj, with a market cap of €203.34 million, recently initiated restructuring efforts to enhance profitability and efficiency by downsizing operations across its Wine, Spirits, and Industrial segments. Despite past earnings declines averaging 39.2% annually over five years, the company turned profitable last year with high-quality earnings and forecasts indicating a 22.57% annual growth in profits. While Anora's short-term assets cover both its short- and long-term liabilities, its debt is not well covered by operating cash flow or EBIT for interest payments. The dividend yield of 7.31% remains unsustainable under current earnings coverage.

- Click here to discover the nuances of Anora Group Oyj with our detailed analytical financial health report.

- Evaluate Anora Group Oyj's prospects by accessing our earnings growth report.

Siili Solutions Oyj (HLSE:SIILI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Siili Solutions Oyj offers information system development services both in Finland and internationally, with a market cap of €38.03 million.

Operations: The company generates revenue of €110.26 million from its information systems development services segment.

Market Cap: €38.03M

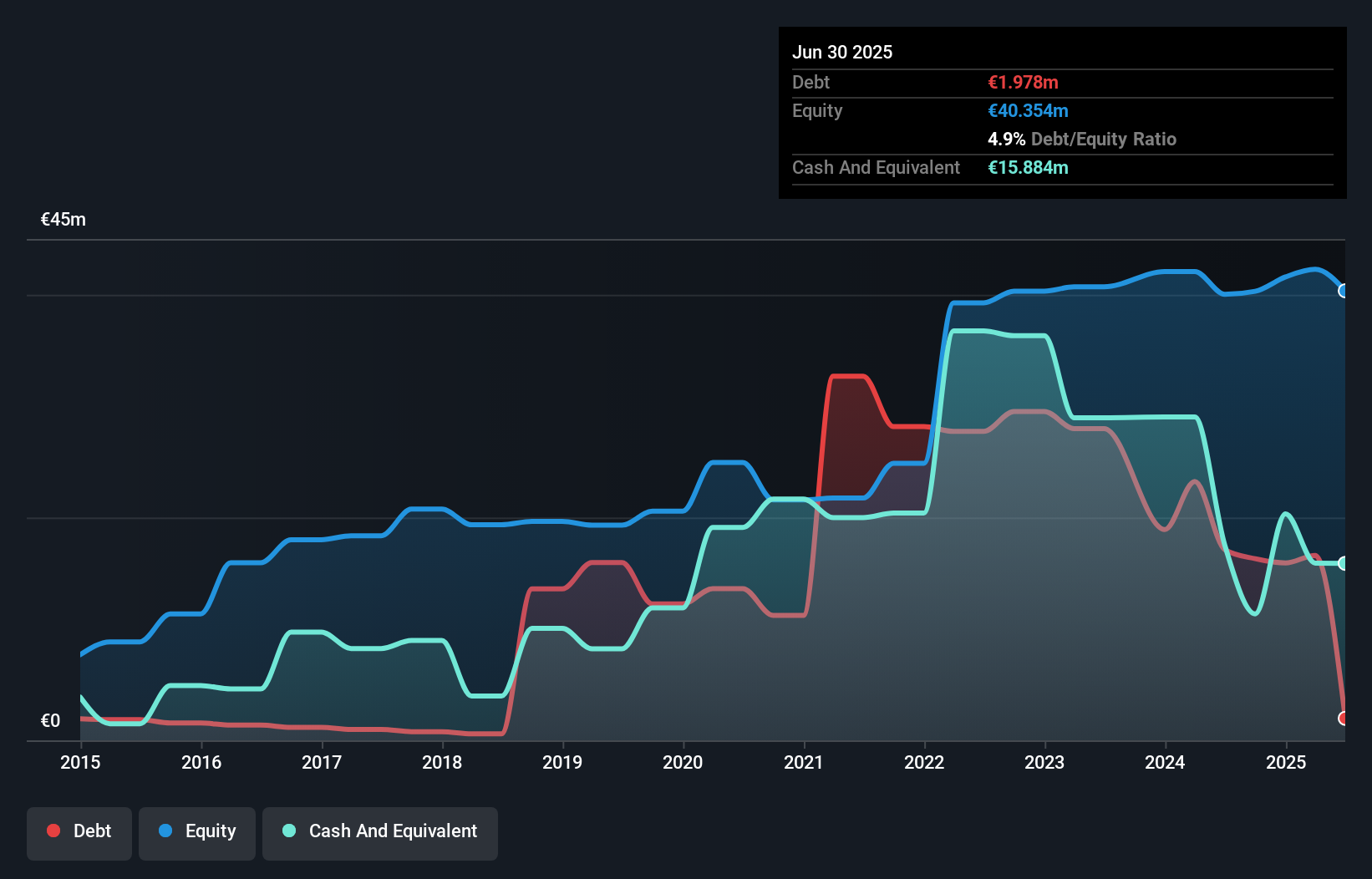

Siili Solutions Oyj, with a market cap of €38.03 million, is undergoing significant organizational changes to align with AI-driven strategies. Despite recent revenue guidance of €108-120 million for 2025 and stable weekly volatility, the company faces challenges such as declining earnings and lower profit margins compared to last year. The management team and board are relatively new, averaging less than two years in tenure. However, Siili's financial health is supported by more cash than total debt and operating cash flow covering debt well. The stock trades at a substantial discount to its estimated fair value despite an unstable dividend history.

- Navigate through the intricacies of Siili Solutions Oyj with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Siili Solutions Oyj's future.

Seize The Opportunity

- Unlock our comprehensive list of 278 European Penny Stocks by clicking here.

- Curious About Other Options? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ANORA

Anora Group Oyj

Produces, imports, markets, distributes, and sells alcoholic beverages in the Finland, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives