Anora Group Oyj And 2 Other European Penny Stocks With Promising Prospects

Reviewed by Simply Wall St

The European markets have shown resilience, with the pan-European STOXX Europe 600 Index climbing 1.18% amid easing trade tensions and optimism over potential U.S. interest rate cuts. For investors seeking opportunities beyond well-known stocks, penny stocks—typically smaller or newer companies—remain an intriguing option despite their somewhat outdated label. These stocks can offer surprising value when they are underpinned by solid financials, presenting potential for significant returns while maintaining a degree of stability.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.40 | €45.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €247.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.12 | €65.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.81 | €17.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN5.00 | PLN13.47M | ✅ 2 ⚠️ 4 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.725 | €417.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.942 | €31.77M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 344 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Anora Group Oyj (HLSE:ANORA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anora Group Oyj operates in the production, importation, marketing, distribution, and sale of alcoholic beverages across Finland, Europe, and internationally with a market cap of €210.77 million.

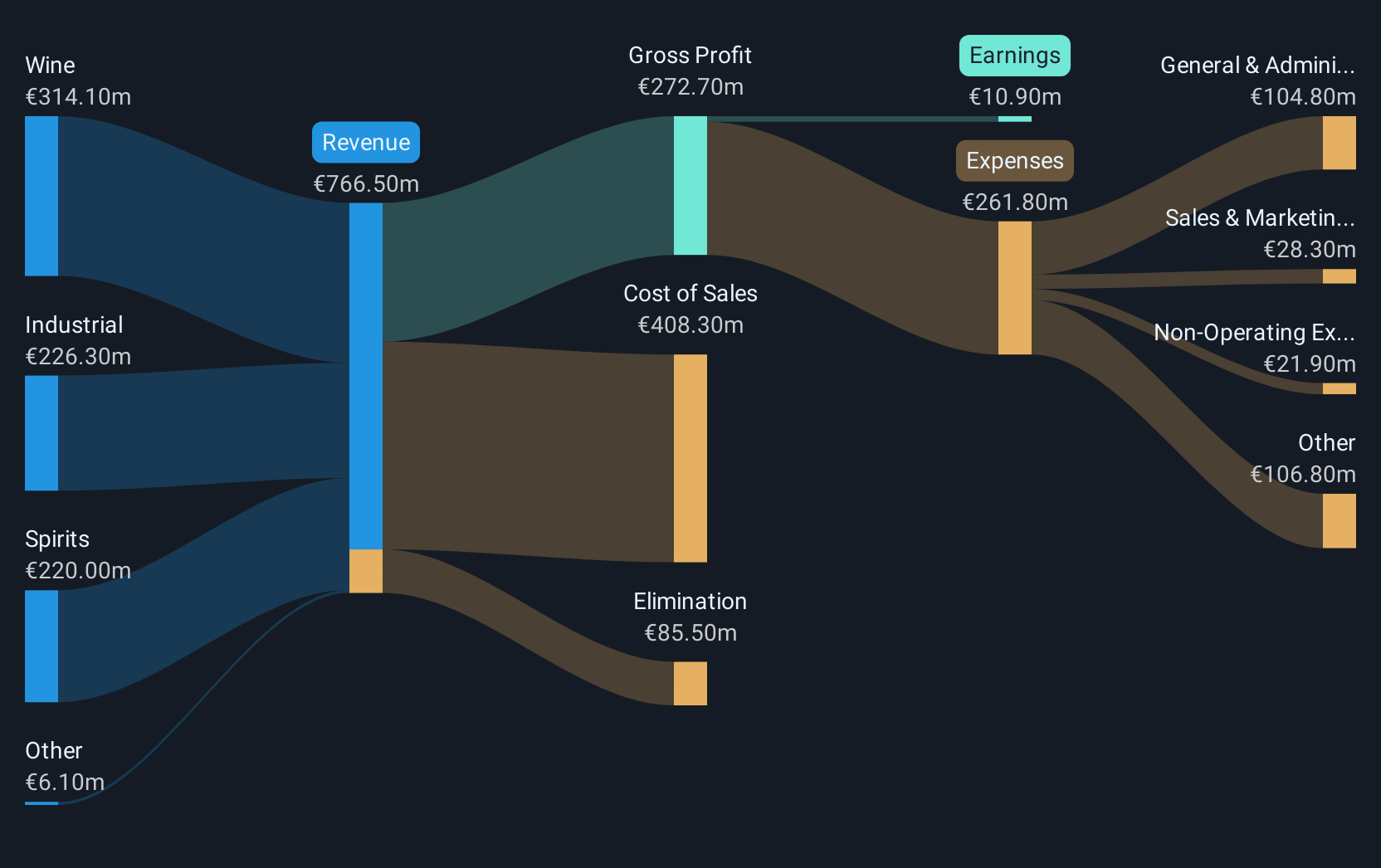

Operations: Anora Group Oyj generates its revenue from three main segments: Wine (€314.10 million), Spirits (€220 million), and Industrial (€226.30 million).

Market Cap: €210.77M

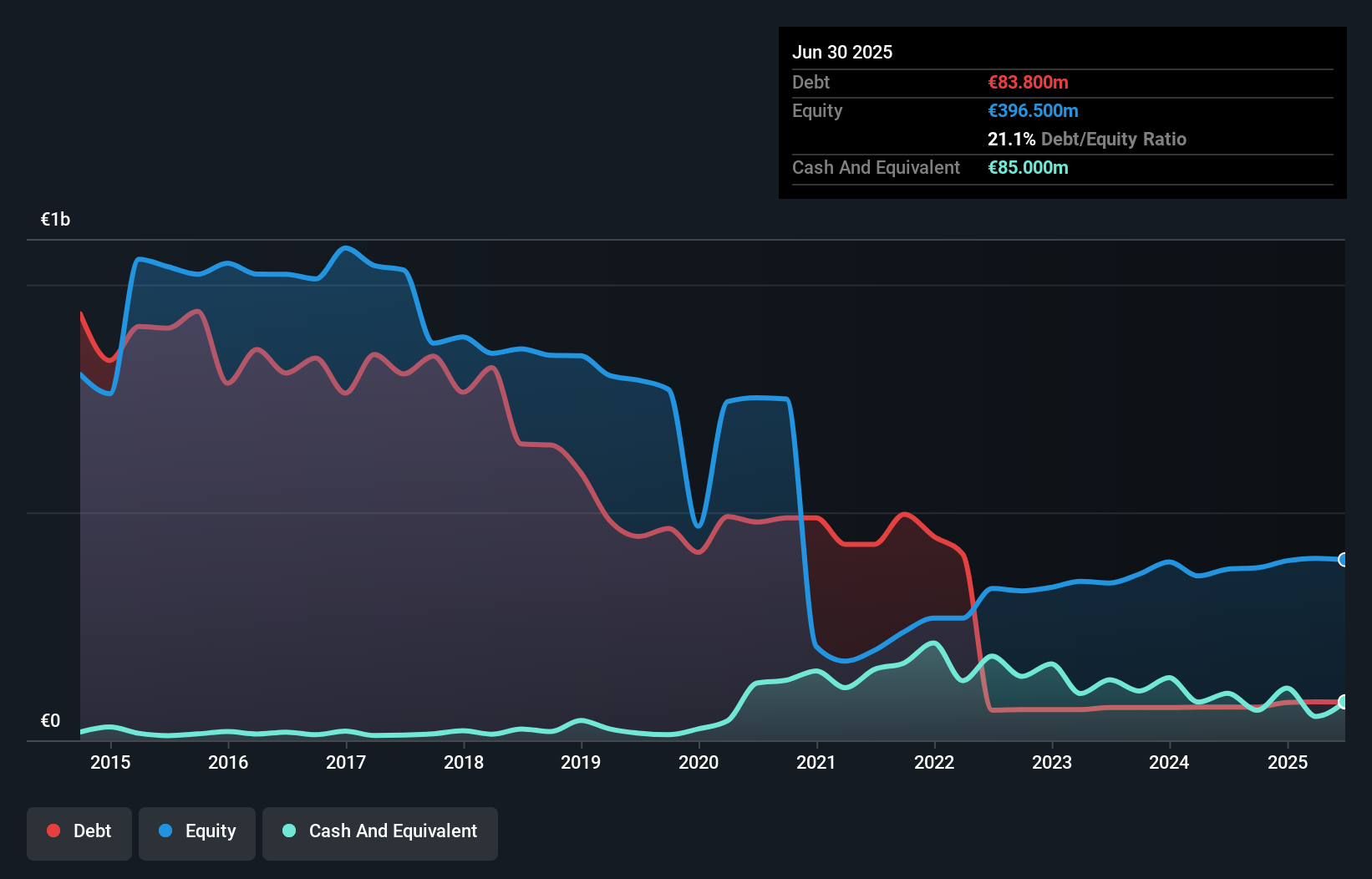

Anora Group Oyj, with a market cap of €210.77 million, operates in the alcoholic beverage sector and has shown resilience despite past challenges. The company reported a slight improvement in net income for Q2 2025 at €2.2 million, up from €1.8 million the previous year, though sales declined to €165.5 million from €177.1 million in the same period last year. Anora's financial position is bolstered by satisfactory debt levels and high-quality earnings; however, its interest coverage remains below optimal levels at 2.8 times EBIT, and dividend sustainability is questionable with a low return on equity of 2.7%.

- Take a closer look at Anora Group Oyj's potential here in our financial health report.

- Evaluate Anora Group Oyj's prospects by accessing our earnings growth report.

Lindex Group Oyj (HLSE:LINDEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindex Group Oyj operates in the retail sector both in Finland and internationally, with a market capitalization of €475.72 million.

Operations: The company's revenue is derived from its Lindex segment, contributing €627 million, and the Stockmann segment, which adds €309 million.

Market Cap: €475.72M

Lindex Group Oyj, with a market cap of €475.72 million, navigates the retail sector with a focus on strategic restructuring and financial stability. Recent earnings for H1 2025 show sales at €439.9 million, slightly down from last year, while net loss narrowed to €7.1 million from €8.4 million. The company’s operating cash flow comfortably covers its debt obligations, yet long-term liabilities exceed short-term assets by a significant margin. Despite low return on equity at 3.7%, Lindex has reduced its debt-to-equity ratio over five years and forecasts robust earnings growth of 26% annually moving forward.

- Get an in-depth perspective on Lindex Group Oyj's performance by reading our balance sheet health report here.

- Learn about Lindex Group Oyj's future growth trajectory here.

Binero Group (OM:BINERO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Binero Group AB (publ) provides cloud and platform services across Sweden, Norway, Denmark, and Finland with a market cap of SEK338.58 million.

Operations: The company's revenue from Internet Software & Services amounts to SEK416.38 million.

Market Cap: SEK338.58M

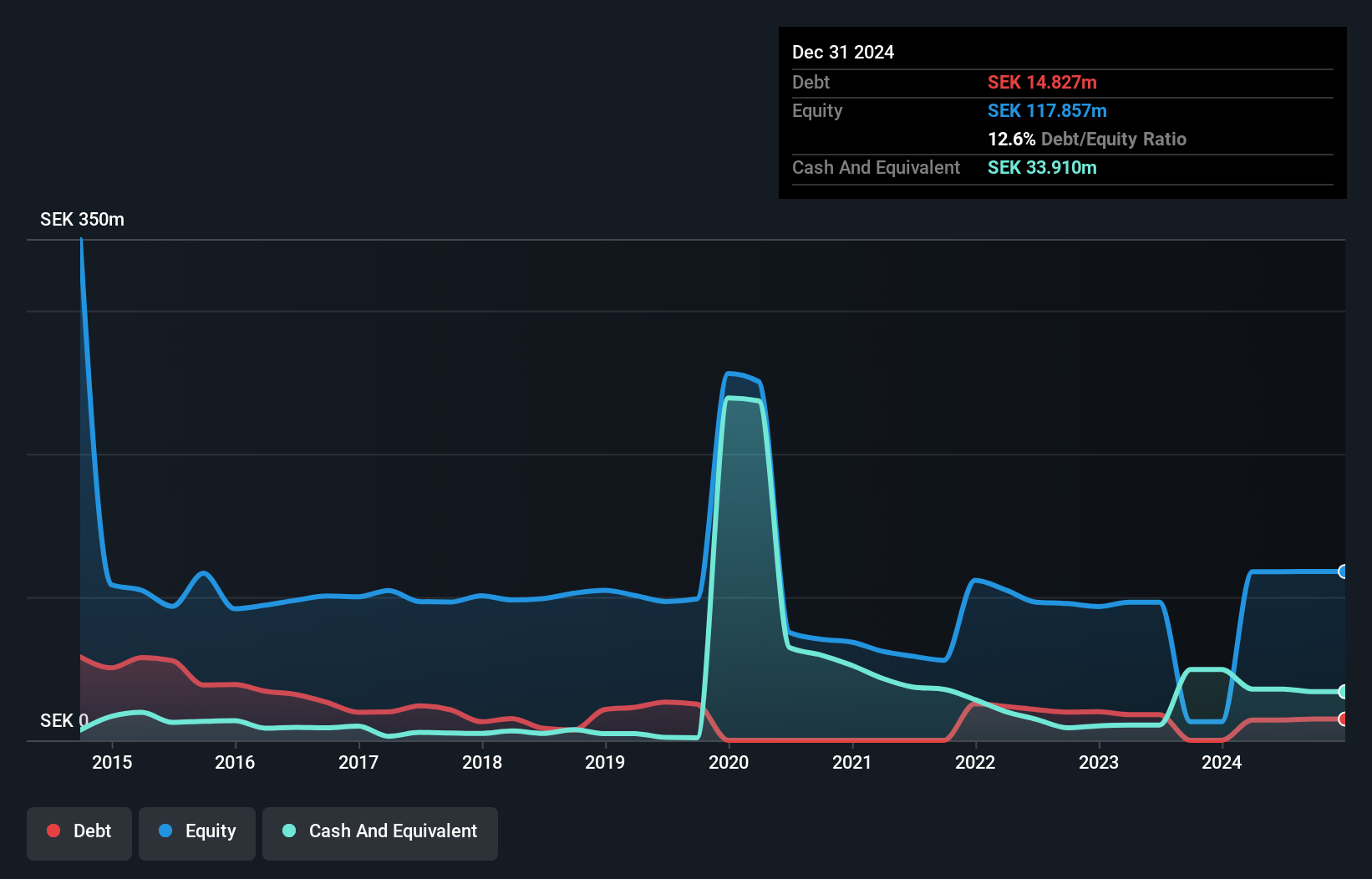

Binero Group AB, with a market cap of SEK338.58 million, has recently achieved profitability after several years of growth, with earnings increasing by 37.3% annually over the past five years. Despite this progress, its return on equity remains low at 10.9%, and the company faces high weekly volatility compared to most Swedish stocks. Binero's management and board are relatively new, suggesting ongoing organizational changes. The company's financial health is supported by more cash than total debt and sufficient coverage of interest payments; however, short-term liabilities exceed short-term assets by SEK46 million, indicating potential liquidity challenges.

- Dive into the specifics of Binero Group here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Binero Group's future.

Make It Happen

- Reveal the 344 hidden gems among our European Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Binero Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BINERO

Binero Group

Develops and delivers cloud and platform services in Sweden, Norway, Denmark, and Finland.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives