- Finland

- /

- Oil and Gas

- /

- HLSE:NESTE

Neste (HLSE:NESTE): Assessing Valuation After Q3 Net Income Surge and Upbeat 2025 Outlook

Reviewed by Simply Wall St

Investors watching Neste Oyj (HLSE:NESTE) had a busy day as the company reported third quarter results. Net income jumped sharply from last year, even as overall sales slipped during the same period.

See our latest analysis for Neste Oyj.

Neste Oyj’s upbeat third quarter saw net income surge, and investors have taken notice. The 90-day share price return stands at a robust 36.75%, capping off a remarkable 51.91% year-to-date share price climb. While momentum has been building in recent months, the one-year total shareholder return sits at 31.80%, providing some balance to a more sobering three- and five-year return picture. Recent gains seem fueled by renewed optimism following management’s steady outlook and growth expectations for next year.

If this turnaround has you wondering what else is gaining traction, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares up sharply and results defying expectations, the big question now is whether Neste Oyj’s current price leaves room for upside, or if markets are already anticipating all the growth that lies ahead.

Price-to-Sales Ratio of 0.7x: Is it justified?

Neste Oyj currently trades at a price-to-sales ratio of 0.7x, noticeably higher than the peer group average of 0.4x. At yesterday's close of €18.92, this premium assessment suggests the market is assigning additional value to Neste's sales compared to its listed competitors.

The price-to-sales (P/S) ratio is a common valuation tool for companies with fluctuating or negative earnings, such as those in the oil and gas sector. It compares a company’s market capitalization to its total annual revenue, providing insight into how much investors are willing to pay for each euro of sales.

Neste Oyj’s P/S ratio sits above that of its Finnish and European peers. This indicates the market may be pricing in stronger growth, resilience, or future profitability. Interestingly, even though Neste is unprofitable and past profit growth has lagged, its revenue outlook is positive and expected to outpace the domestic market average, which helps justify some of this valuation gap. By industry standards, however, Neste is still good value compared to the average P/S of 1.2x for European oil and gas companies. This highlights a potential disconnect between local and regional market expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.7x (ABOUT RIGHT)

However, risks remain, including the company’s negative net income as well as potential overvaluation if next year’s revenue growth falls short of expectations.

Find out about the key risks to this Neste Oyj narrative.

Another View: DCF Perspective

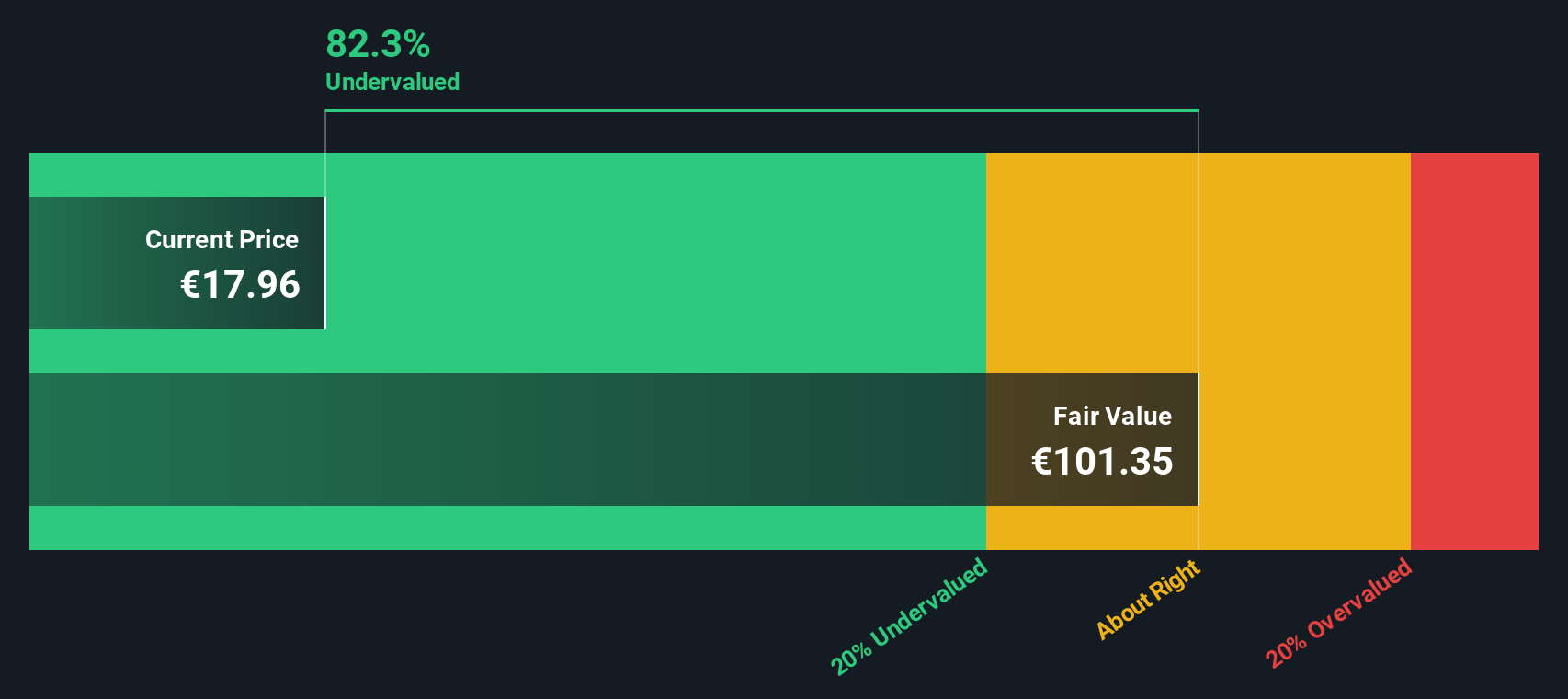

Looking at Neste Oyj from another angle, our DCF model estimates its fair value at €20.40 per share. With the market price at €18.92, this suggests the shares are undervalued by around 7%. Does this signal more upside ahead, or is something keeping the current price in check?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Neste Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Neste Oyj Narrative

If you have your own perspective or want to dive deeper into the numbers, you can easily craft a personal take with just a few minutes of effort, so why not Do it your way

A great starting point for your Neste Oyj research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put yourself ahead of the crowd and make smarter moves by tapping into opportunities other investors might miss. The right ideas can reshape your portfolio.

- Tap into tomorrow’s tech by reviewing these 26 AI penny stocks that are pushing the boundaries of artificial intelligence and transforming entire industries.

- Maximize your returns with these 21 dividend stocks with yields > 3%, a resource designed for those who want income and stability from investments yielding over 3%.

- Get in early on breakthrough innovations by evaluating these 28 quantum computing stocks, which showcases companies leading the charge in quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neste Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NESTE

Neste Oyj

Provides renewable diesel and sustainable aviation fuel in Finland, other Nordic countries, Baltic Rim, other European countries, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives