- Finland

- /

- Capital Markets

- /

- HLSE:CAPMAN

CapMan Oyj's (HEL:CAPMAN) Upcoming Dividend Will Be Larger Than Last Year's

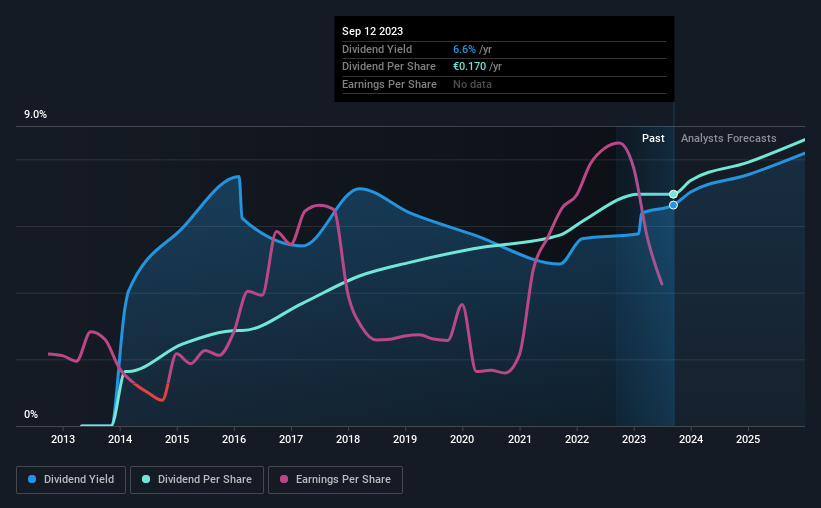

CapMan Oyj (HEL:CAPMAN) will increase its dividend from last year's comparable payment on the 22nd of September to €0.08. This takes the annual payment to 6.6% of the current stock price, which is about average for the industry.

View our latest analysis for CapMan Oyj

CapMan Oyj's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

Over the next year, EPS is forecast to expand by 97.1%. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 84% - on the higher side, but we wouldn't necessarily say this is unsustainable.

CapMan Oyj Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was €0.04 in 2013, and the most recent fiscal year payment was €0.17. This means that it has been growing its distributions at 16% per annum over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

Dividend Growth Could Be Constrained

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. CapMan Oyj has impressed us by growing EPS at 18% per year over the past five years. Although per-share earnings are growing at a credible rate, the massive payout ratio may limit growth in the company's future dividend payments.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. Although they have been consistent in the past, we think the payments are a little high to be sustained. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 4 warning signs for CapMan Oyj you should be aware of, and 2 of them are a bit concerning. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:CAPMAN

CapMan Oyj

A leading Nordic private assets management and investment firm with an active approach to value creation and private equity and venture capital firm specializing in growth capital investments, industry consolidation, special situations, turnaround, recapitalization, middle market buyouts, credit and mezzanine financing in unquoted companies, investments in value-add and income focused real estate, transportation, telecommunications infrastructure and investments in small and mid-cap companies.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success