- Finland

- /

- Capital Markets

- /

- HLSE:CAPMAN

CapMan Oyj (HEL:CAPMAN) Will Pay A Larger Dividend Than Last Year At €0.07

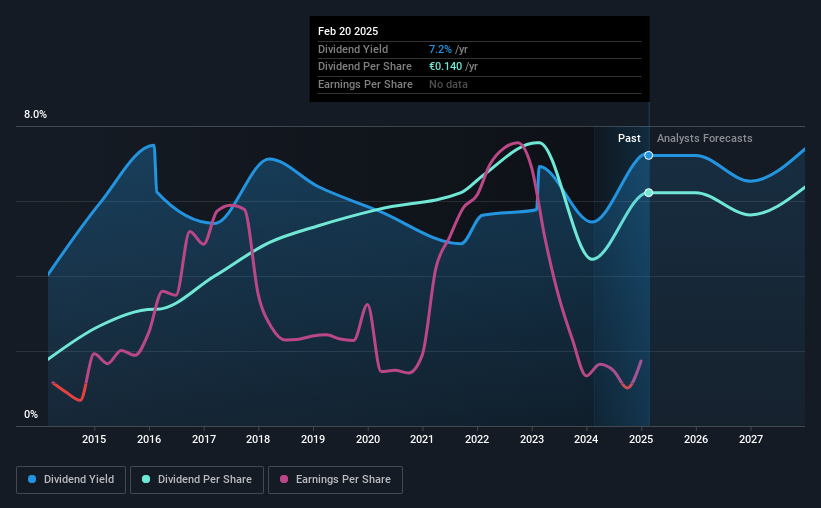

CapMan Oyj's (HEL:CAPMAN) dividend will be increasing from last year's payment of the same period to €0.07 on 3rd of April. This takes the annual payment to 7.2% of the current stock price, which is about average for the industry.

Check out our latest analysis for CapMan Oyj

CapMan Oyj's Payment Could Potentially Have Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, the company was paying out 541% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Earnings per share is forecast to rise exponentially over the next year. If the dividend continues along recent trends, we believe we could see the payout ratio reaching 81%, which is definitely on the higher side, but still sustainable.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2015, the dividend has gone from €0.04 total annually to €0.14. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though CapMan Oyj's EPS has declined at around 23% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We should note that CapMan Oyj has issued stock equal to 11% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

CapMan Oyj's Dividend Doesn't Look Great

Overall, while the dividend being raised can be good, there are some concerns about its long term sustainability. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, CapMan Oyj has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:CAPMAN

CapMan Oyj

A leading Nordic private assets management and investment firm with an active approach to value creation and private equity and venture capital firm specializing in growth capital investments, industry consolidation, turnaround, recapitalization, middle market buyouts, credit and mezzanine financing in unquoted companies, investments in value-add and income focused real estate, and investments in energy, transportation, and telecommunications infrastructure.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives