CapMan Oyj (HEL:CAPMAN) is reducing its dividend from last year's comparable payment to €0.06 on the 9th of April. This means that the annual payment is 5.1% of the current stock price, which is lower than what the rest of the industry is paying.

Check out our latest analysis for CapMan Oyj

CapMan Oyj's Dividend Is Well Covered By Earnings

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Prior to this announcement, the company was paying out 1,178% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Looking forward, earnings per share is forecast to rise exponentially over the next year. Assuming the dividend continues along recent trends, we estimate that the payout ratio could reach 72%, which is in a comfortable range for us.

Dividend Volatility

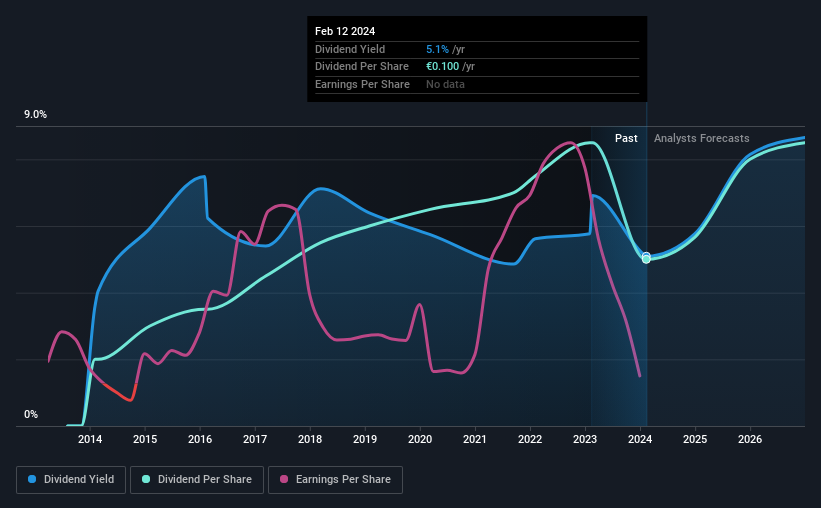

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has gone from €0.04 total annually to €0.10. This works out to be a compound annual growth rate (CAGR) of approximately 9.6% a year over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. CapMan Oyj's earnings per share has shrunk at 31% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We're Not Big Fans Of CapMan Oyj's Dividend

To sum up, we don't like when dividends are cut, but in this case the dividend may have been too high to begin with. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 4 warning signs for CapMan Oyj (of which 2 are concerning!) you should know about. Is CapMan Oyj not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:CAPMAN

CapMan Oyj

A leading Nordic private assets management and investment firm with an active approach to value creation and private equity and venture capital firm specializing in growth capital investments, industry consolidation, special situations, turnaround, recapitalization, middle market buyouts, credit and mezzanine financing in unquoted companies, investments in value-add and income focused real estate, transportation, telecommunications infrastructure and investments in small and mid-cap companies.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success