- Finland

- /

- Food and Staples Retail

- /

- HLSE:KESKOB

Kesko Oyj (HLSE:KESKOB) Is Up 5.2% After Beating Sales Trends in a Down Market Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Kesko Oyj recently announced its group sales results for the month, quarter, and nine months ended September 30, 2025, reporting monthly sales of €1,143.5 million with growth across all reported periods.

- This strong sales momentum stands out especially as it came during a period when most stocks on the Helsinki Stock Exchange saw declines.

- We'll explore how Kesko Oyj's robust sales figures strengthen its investment narrative amid challenging broader market conditions.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Kesko Oyj's Investment Narrative?

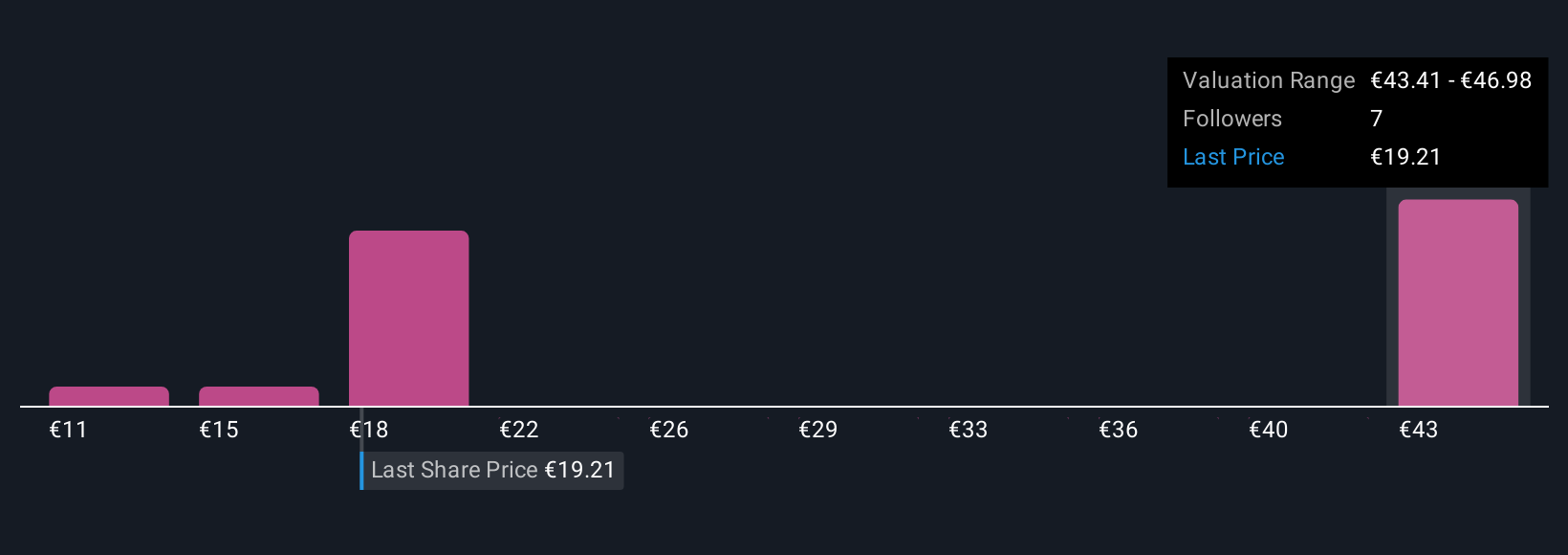

To believe in Kesko Oyj as a shareholder, you have to buy into its ability to consistently grow sales and maintain solid market positioning, even as the broader Finnish market faces turbulence. The company's latest sales announcement, reporting 9.6% monthly, 6.8% quarterly, and 4.3% nine-month growth to €1.14 billion, €3.30 billion, and €9.45 billion respectively, arrived as most Helsinki stocks declined, drawing positive attention. This recent outperformance may help temper near-term concerns over slow profit growth, narrowing margins, and cautious management earnings guidance. While previously, the biggest catalysts centered on new store expansions and sustainability initiatives, these robust sales numbers could rekindle optimism for operating momentum in the short term. Key risks remain, such as elevated debt and dividend coverage, but the latest figures appear to mitigate immediate fears that demand weakness might persist. On the other hand, dividend coverage and debt levels still present headline risks investors should track closely.

Kesko Oyj's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Kesko Oyj - why the stock might be worth over 2x more than the current price!

Build Your Own Kesko Oyj Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kesko Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kesko Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kesko Oyj's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kesko Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KESKOB

Kesko Oyj

Engages in the chain operations in Finland, Sweden, Norway, Estonia, Latvia, Lithuania, Denmark, and Poland.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives