Despite an already strong run, YIT Oyj (HEL:YIT) shares have been powering on, with a gain of 30% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 21% is also fairly reasonable.

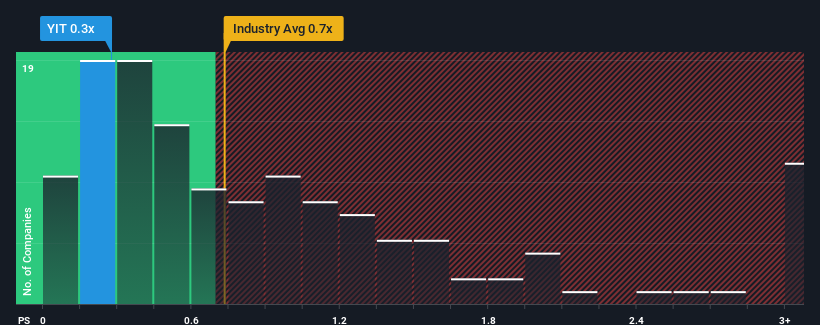

In spite of the firm bounce in price, it's still not a stretch to say that YIT Oyj's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in Finland, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for YIT Oyj

What Does YIT Oyj's P/S Mean For Shareholders?

There hasn't been much to differentiate YIT Oyj's and the industry's retreating revenue lately. It seems that few are expecting the company's revenue performance to deviate much from most other companies, which has held the P/S back. You'd much rather the company improve its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on YIT Oyj.Is There Some Revenue Growth Forecasted For YIT Oyj?

The only time you'd be comfortable seeing a P/S like YIT Oyj's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 9.4% decrease to the company's top line. As a result, revenue from three years ago have also fallen 27% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 2.9% each year during the coming three years according to the five analysts following the company. That's shaping up to be similar to the 4.7% each year growth forecast for the broader industry.

With this information, we can see why YIT Oyj is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

YIT Oyj appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A YIT Oyj's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Consumer Durables industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for YIT Oyj (1 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of YIT Oyj's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:YIT

YIT Oyj

Provides construction services in Finland, the Czech Republic, Slovakia, Poland, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives