- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

European Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As European markets experience a mixed sentiment driven by relief from the U.S. government reopening and tempered enthusiasm around artificial intelligence, investors are increasingly focusing on companies with strong fundamentals and insider confidence. In this context, growth companies with high insider ownership can be particularly appealing as they often signal alignment between management and shareholder interests, potentially offering resilience amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 42.6% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 86.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

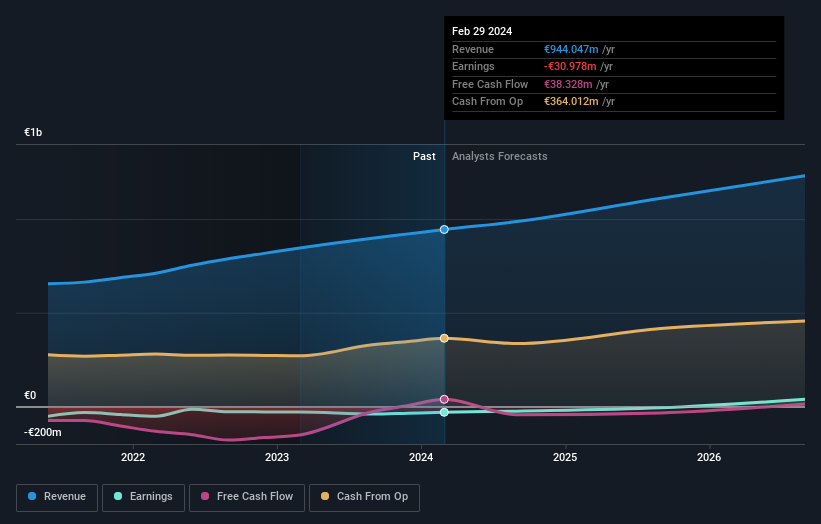

Overview: Basic-Fit N.V. operates fitness clubs through its subsidiaries and has a market cap of €1.52 billion.

Operations: The company's revenue primarily comes from its fitness club operations, with €541.70 million generated in the Benelux region and €766 million from France, Spain, and Germany.

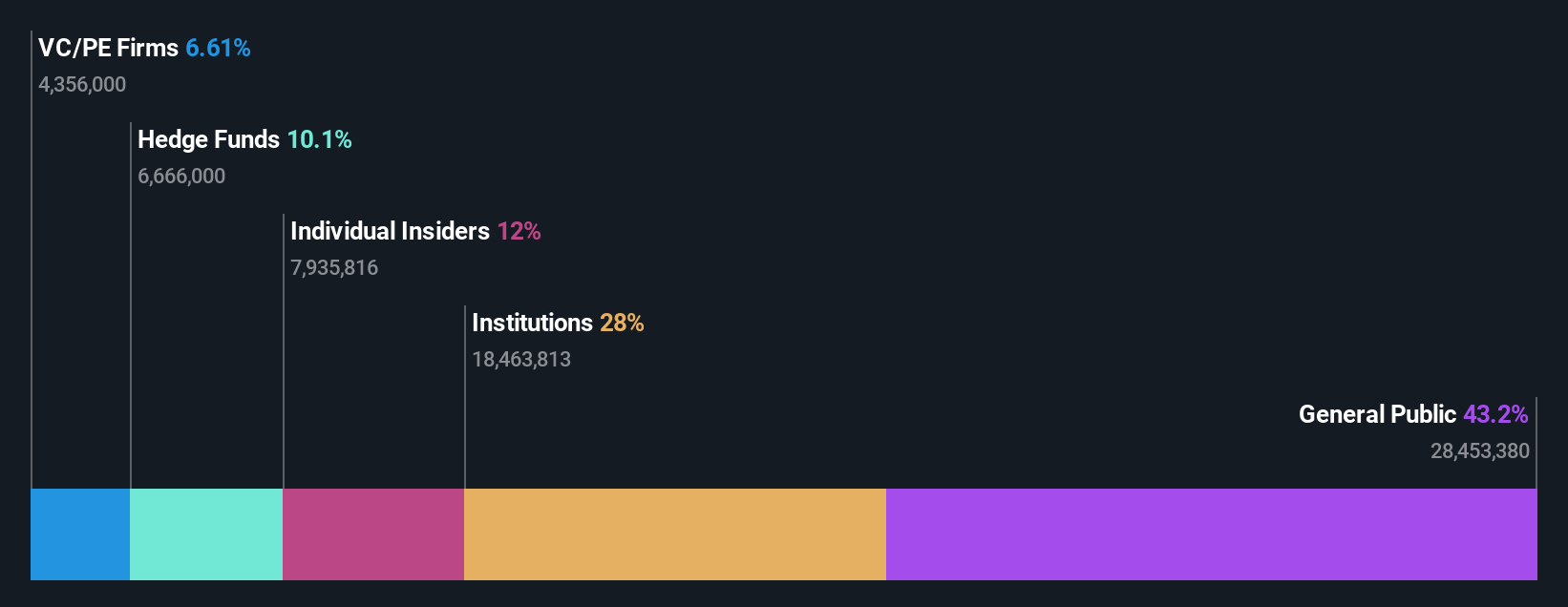

Insider Ownership: 12.1%

Basic-Fit demonstrates strong growth potential with its earnings forecast to grow 48.61% annually, and it is expected to become profitable in three years, outperforming the average market growth. Despite trading at 38.4% below its fair value estimate, revenue is projected to grow at 9.8% per year, surpassing the Dutch market's rate of 8.1%. Recent revenue results show a significant increase of EUR 1.034 billion for the first nine months of 2025, up by 60%.

- Dive into the specifics of Basic-Fit here with our thorough growth forecast report.

- The analysis detailed in our Basic-Fit valuation report hints at an deflated share price compared to its estimated value.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

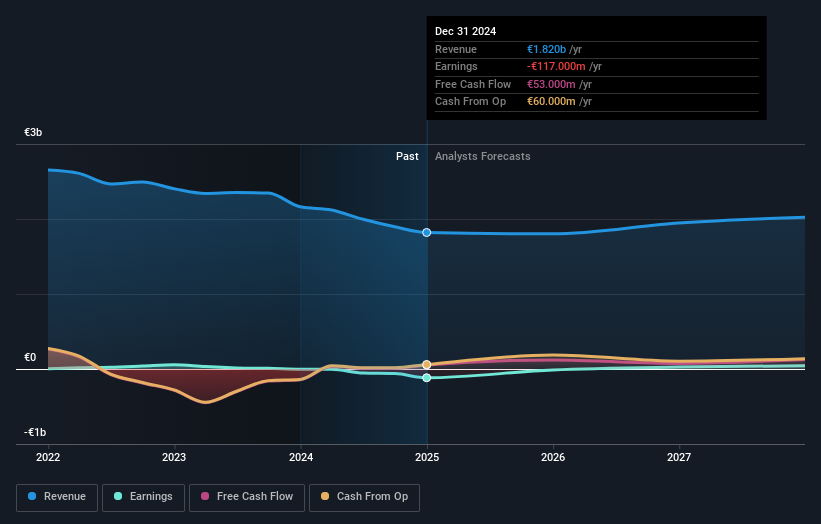

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market cap of approximately €1.15 billion.

Operations: OVH Groupe S.A.'s revenue is primarily derived from its Private Cloud segment at €671.60 million, followed by Web Cloud services generating €193.80 million, and Advertising, Publishing, and Public Relations contributing €219.20 million.

Insider Ownership: 12.7%

OVH Groupe's earnings are forecast to grow significantly at 66.9% annually, outpacing the French market's growth rate. The company recently became profitable, reporting sales of €1.08 billion for the year ending August 2025. Despite its volatile share price and removal from the Euronext 150 Index, OVHcloud is advancing with strategic initiatives like a partnership with Bitdefender and launching Managed Kubernetes Service Standard to enhance data security and operational efficiency in multicloud environments.

- Take a closer look at OVH Groupe's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, OVH Groupe's share price might be too optimistic.

YIT Oyj (HLSE:YIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YIT Oyj is a construction services company operating in Finland, the Czech Republic, Slovakia, Poland, and internationally with a market cap of €666.57 million.

Operations: The company's revenue is primarily derived from Building Construction (€657 million) and Infrastructure (€481 million) segments.

Insider Ownership: 10.4%

YIT Oyj is expected to achieve profitability within three years, with revenue growth projected at 8.1% annually, surpassing the Finnish market's rate. Despite trading 51% below its estimated fair value and having low forecasted return on equity, YIT's strategic focus on sustainable projects is evident in recent developments such as the Vantaa heat storage facility and various residential projects. These initiatives align with its vision for profitable growth and a sustainable society.

- Click here to discover the nuances of YIT Oyj with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, YIT Oyj's share price might be too pessimistic.

Seize The Opportunity

- Gain an insight into the universe of 200 Fast Growing European Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Basic-Fit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives