- Finland

- /

- Consumer Durables

- /

- HLSE:HONBS

Honkarakenne Oyj Leads The Charge In European Penny Stocks

Reviewed by Simply Wall St

The European market has shown mixed results recently, with the pan-European STOXX Europe 600 Index inching higher, buoyed by dovish signals from the U.S. Federal Reserve and easing trade tensions. Amid these broader market movements, investors may find opportunities in penny stocks—an often-overlooked segment that includes smaller or newer companies. While the term 'penny stock' might seem outdated, these investments can still offer significant potential when backed by solid financials and strategic positioning.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| DigiTouch (BIT:DGT) | €1.96 | €27.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €230.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.59 | DKK116.05M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.82 | €39.08M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.972 | €78.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Faes Farma (BME:FAE) | €4.52 | €1.41B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.03 | €280.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0792 | €8.37M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.918 | €30.74M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 275 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Honkarakenne Oyj (HLSE:HONBS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Honkarakenne Oyj designs, manufactures, and sells log and solid-wood house packages in Finland with a market cap of €14.25 million.

Operations: The company generates revenue of €38.91 million from its home builders segment, which includes both residential and commercial projects.

Market Cap: €14.25M

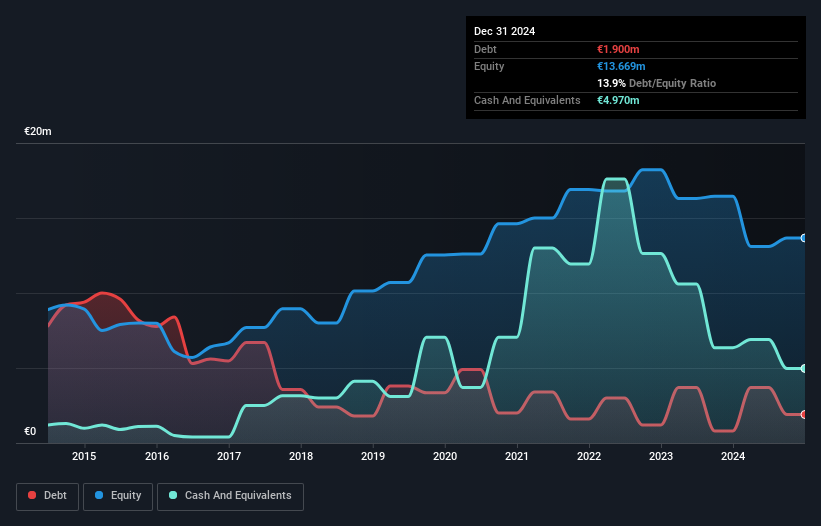

Honkarakenne Oyj, with a market cap of €14.25 million, operates in the log and solid-wood house package sector, generating €38.91 million in revenue from its home builders segment. Despite trading at 31% below its estimated fair value and having more cash than debt, the company remains unprofitable with increasing losses over the past five years. Recent earnings show a reduced net loss of €2.3 million for the half year ended June 30, 2025. The management team is experienced but faces challenges as operating cash flow is negative and dividend payouts are not well covered by earnings or free cash flows.

- Click to explore a detailed breakdown of our findings in Honkarakenne Oyj's financial health report.

- Gain insights into Honkarakenne Oyj's outlook and expected performance with our report on the company's earnings estimates.

Garin (WSE:GAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Garin S.A., with a market cap of PLN46.44 million, currently does not have significant operations.

Operations: Currently, there are no revenue segments reported for this company.

Market Cap: PLN46.44M

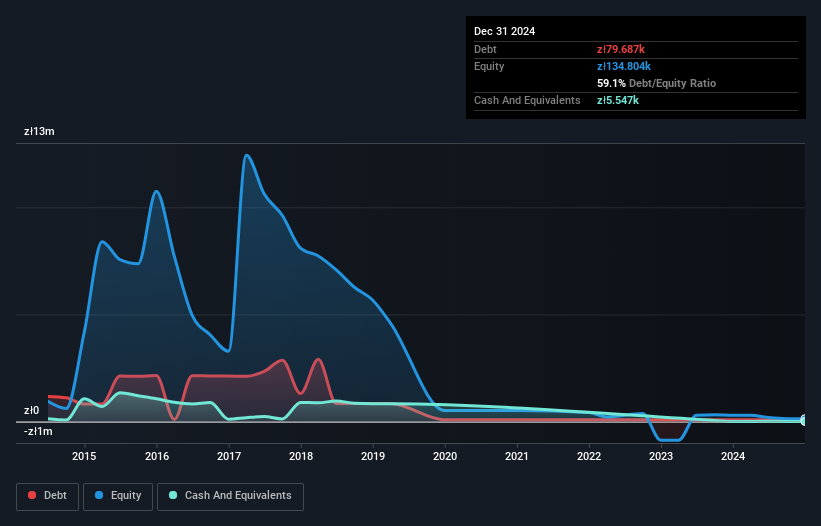

Garin S.A., with a market cap of PLN46.44 million, is currently pre-revenue and unprofitable, though it has managed to reduce losses over the past five years. Despite its high debt-to-equity ratio of 1230.8%, Garin's cash reserves exceed its total debt, providing a stable financial footing with more than three years' cash runway if current free cash flow levels are maintained. The company's share price has been highly volatile recently, yet shareholders have not faced significant dilution over the past year. Recent earnings reported a net loss for Q2 2025 but showed improvement compared to the previous year’s performance.

- Click here to discover the nuances of Garin with our detailed analytical financial health report.

- Gain insights into Garin's past trends and performance with our report on the company's historical track record.

PCC Exol (WSE:PCX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PCC Exol S.A. manufactures and distributes surfactants both in Poland and internationally, with a market cap of PLN438.82 million.

Operations: The company generates revenue of PLN1.04 billion from its Specialty Chemicals segment.

Market Cap: PLN438.82M

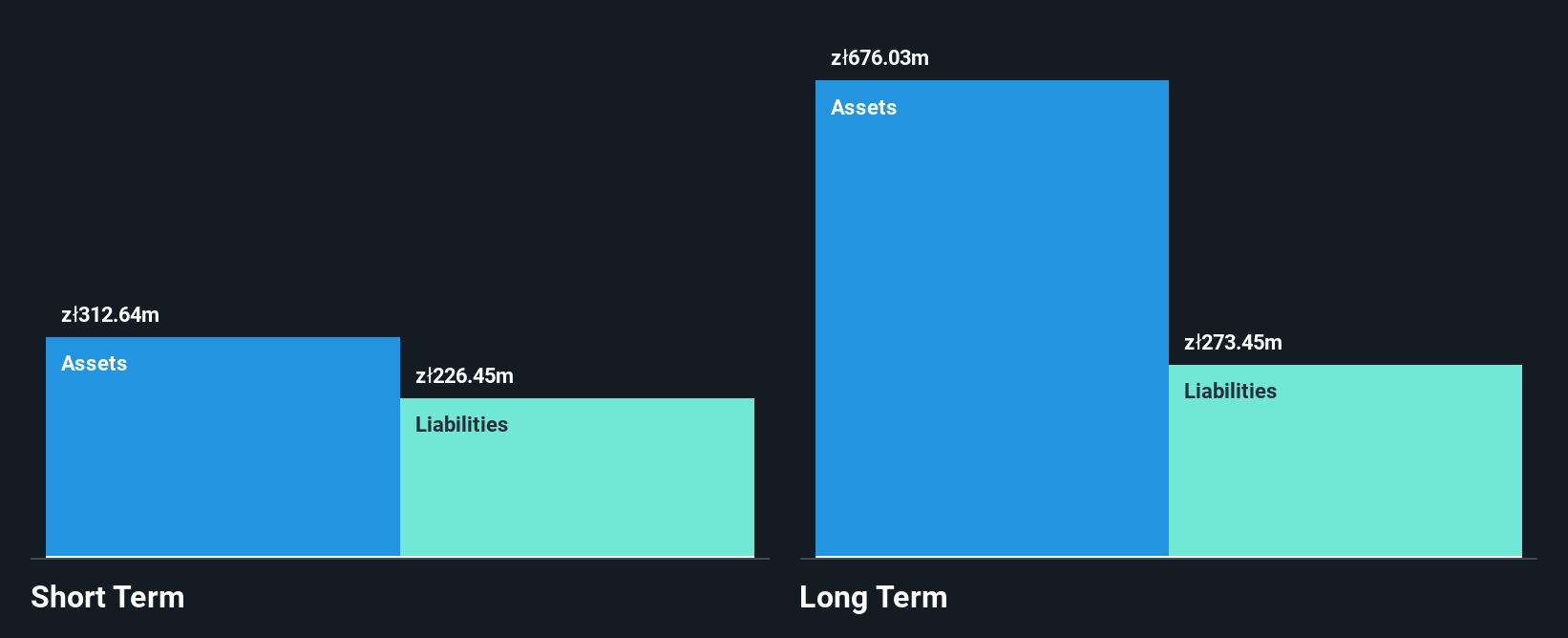

PCC Exol S.A. has shown a steady increase in sales, reporting PLN 269.92 million for Q2 2025, up from PLN 230.12 million the previous year, with net income rising to PLN 9.38 million from PLN 8.69 million. Despite this growth and high-quality earnings, the company's financial position is challenged by a high net debt-to-equity ratio of 58.6% and low return on equity at 7.9%. While short-term liabilities are well-covered by assets, operating cash flow struggles to adequately cover debt obligations, indicating potential cash flow management issues that investors should monitor closely.

- Jump into the full analysis health report here for a deeper understanding of PCC Exol.

- Review our historical performance report to gain insights into PCC Exol's track record.

Seize The Opportunity

- Explore the 275 names from our European Penny Stocks screener here.

- Ready For A Different Approach? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honkarakenne Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HONBS

Honkarakenne Oyj

Designs, manufactures, and sells log and solid-wood house packages in Finland.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives