- Italy

- /

- Tech Hardware

- /

- BIT:CELL

Cellularline And 2 Other European Penny Stocks To Consider

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed returns, with the pan-European STOXX Europe 600 Index remaining relatively flat and major indexes showing varied performance, investors are exploring diverse opportunities. Penny stocks, though a term rooted in earlier market days, continue to represent smaller or less-established companies that can offer significant value. By focusing on those with robust financials and clear growth trajectories, investors may uncover potential gems within this segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.44 | €45.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.51 | RON17.25M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.83 | €59.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.72 | €17.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.455 | SEK2.35B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.64 | SEK221.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.115 | €292.01M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.978 | €32.98M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 326 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cellularline (BIT:CELL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cellularline S.p.A. is a company that manufactures and sells smartphone and tablet accessories across various regions including Europe, the Middle East, North America, and internationally, with a market cap of €59.69 million.

Operations: The company generates its revenue of €164.26 million from the Electronic Components & Parts segment.

Market Cap: €59.69M

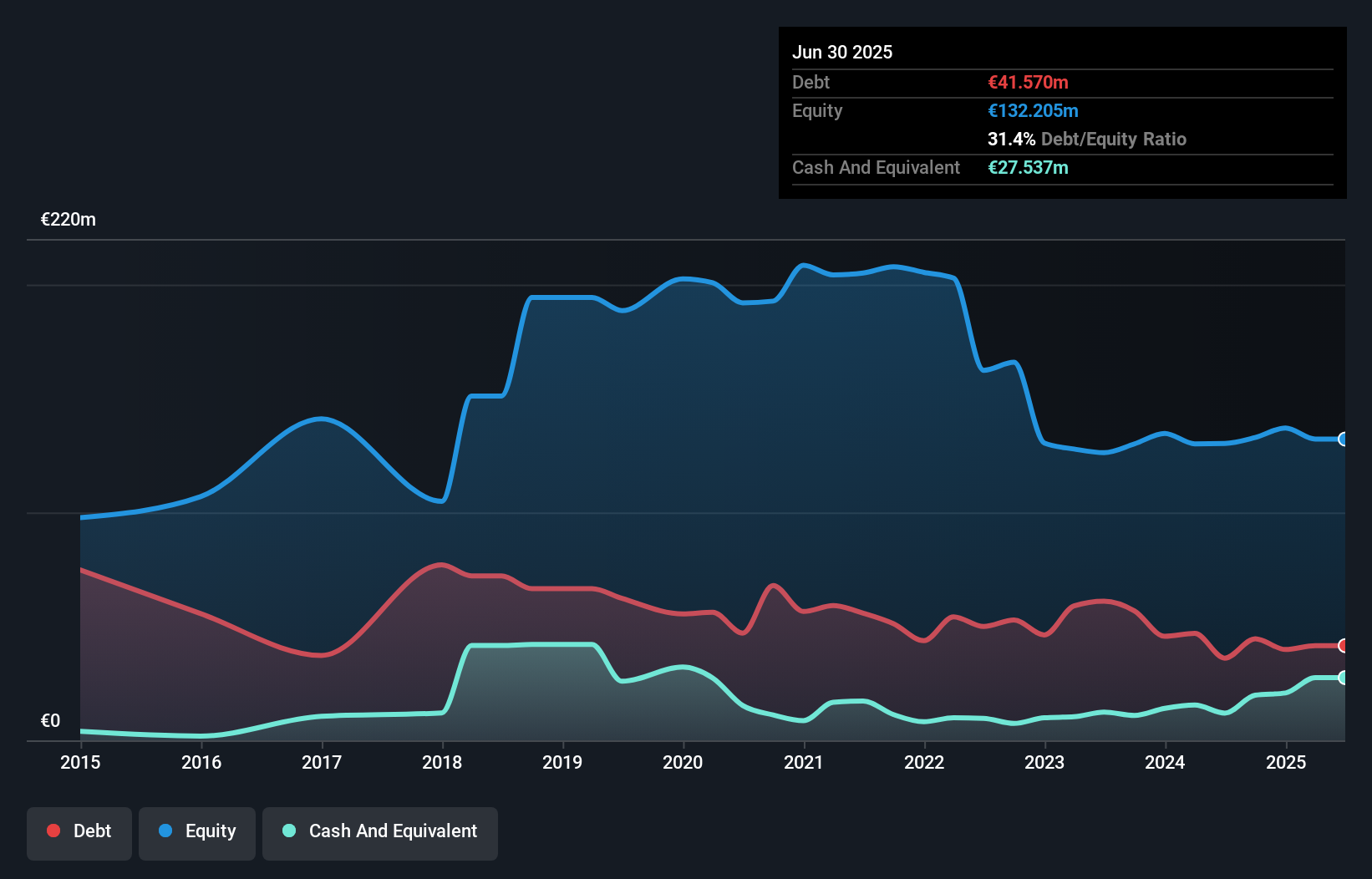

Cellularline S.p.A., with a market cap of €59.69 million, has shown promising growth in earnings, surging by 57.1% over the past year, outpacing the broader tech industry. Despite an increased debt-to-equity ratio from 27.4% to 29.1% over five years, its debt is well-covered by operating cash flow at 54%. The company trades at a significant discount to its estimated fair value and recently initiated a share buyback program worth up to €3.8 million to enhance liquidity and support stock prices, signaling confidence in its financial stability and future prospects amidst volatile penny stock markets.

- Unlock comprehensive insights into our analysis of Cellularline stock in this financial health report.

- Evaluate Cellularline's prospects by accessing our earnings growth report.

Munic (ENXTPA:ALMUN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Munic S.A. is a company that focuses on vehicle data collection, processing, and monetization in Europe and North America, with a market cap of €6.40 million.

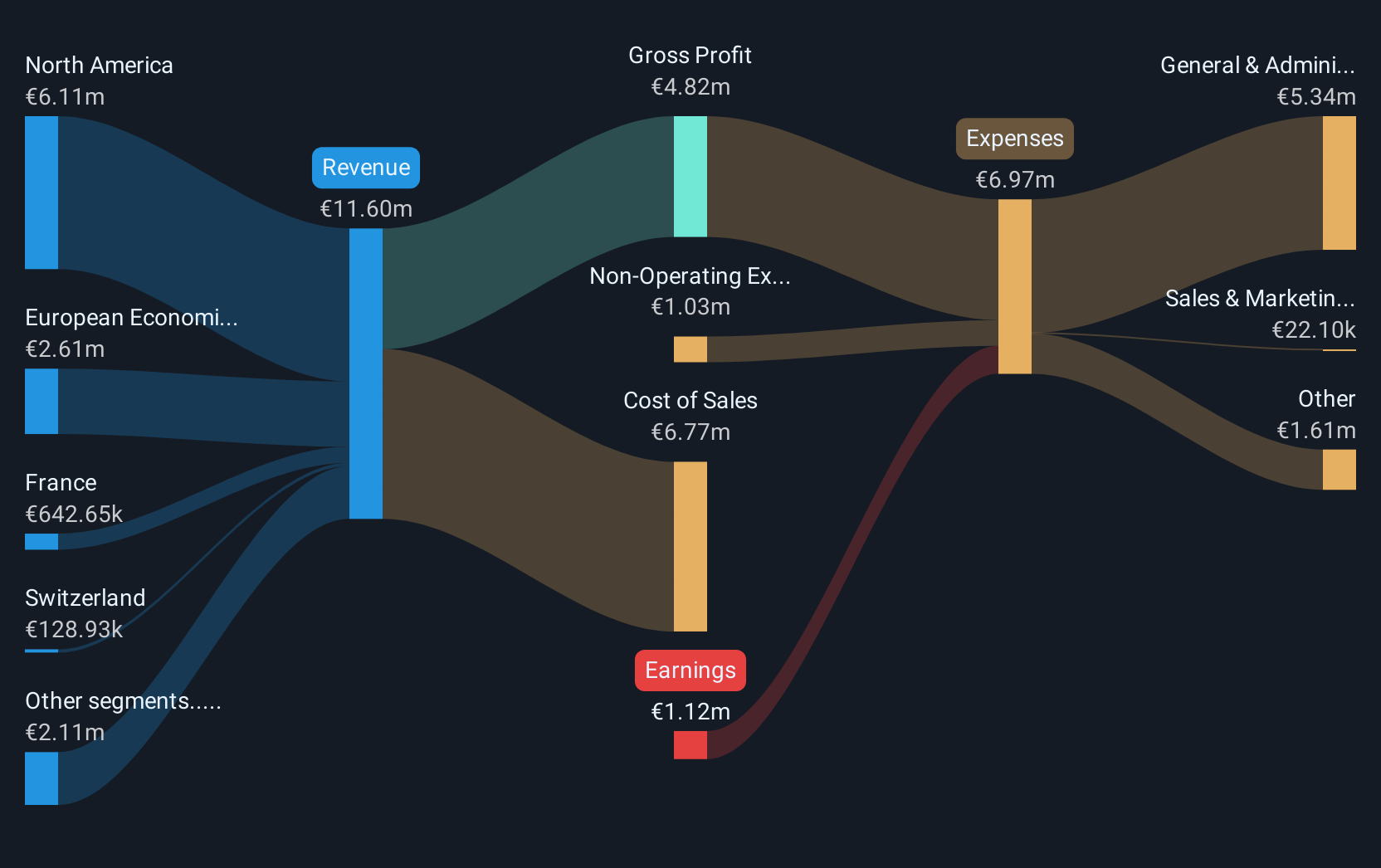

Operations: The company generates revenue of €11.60 million from its Auto Parts & Accessories segment.

Market Cap: €6.4M

Munic S.A., with a market cap of €6.40 million, is navigating the challenges of being unprofitable yet has managed to reduce its losses by 20.4% annually over five years. The company maintains a satisfactory net debt to equity ratio of 27% and possesses sufficient cash runway for more than three years, even if free cash flow shrinks slightly. Despite high volatility in its share price, Munic's short-term assets exceed both short and long-term liabilities, indicating financial stability amidst the volatile penny stock environment. Upcoming shareholder meetings on June 30 may provide further strategic insights.

- Jump into the full analysis health report here for a deeper understanding of Munic.

- Explore historical data to track Munic's performance over time in our past results report.

Honkarakenne Oyj (HLSE:HONBS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Honkarakenne Oyj designs, manufactures, and sells log and solid-wood house packages in Finland with a market cap of €16.73 million.

Operations: The company's revenue is derived from its Home Builders segment, which focuses on residential and commercial projects, generating €36.71 million.

Market Cap: €16.73M

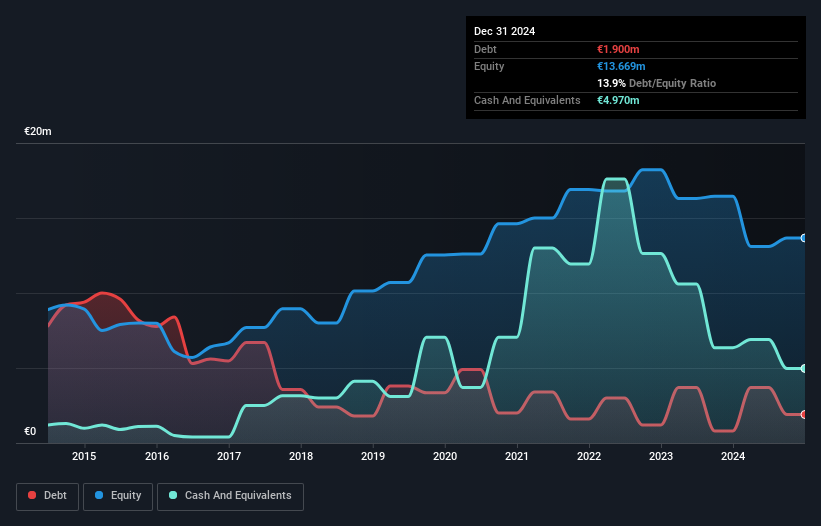

Honkarakenne Oyj, with a market cap of €16.73 million, is currently unprofitable and has seen its losses increase by 44.5% annually over five years. Despite this, the company trades at a significant discount to its estimated fair value and maintains financial stability with short-term assets exceeding both short and long-term liabilities (€12M vs €9M and €3.9M). The board of directors is experienced, averaging 4.3 years in tenure, while management averages 3.9 years. Recent decisions include not paying dividends for the financial year ended December 2024 due to ongoing profitability challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Honkarakenne Oyj.

- Assess Honkarakenne Oyj's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 326 European Penny Stocks by clicking here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Terbium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CELL

Cellularline

Manufactures and sells accessories for smartphones and tablets in Italy, Spain, Portugal, Germany, Eastern Europe, Switzerland, Benelux, Northern Europe, France, Great Britain, the Middle East, North America, and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives