As October 2025 unfolds, the European market is experiencing a notable upswing, with the pan-European STOXX Europe 600 Index reaching record levels due to a rally in technology stocks and favorable sentiment from anticipated lower U.S. borrowing costs. Amidst this positive backdrop, discerning investors are increasingly drawn to small-cap stocks that exhibit strong fundamentals and growth potential, offering unique opportunities in an environment where broader market trends favor innovation and economic resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Moury Construct | 2.06% | 11.11% | 23.28% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Harvia Oyj (HLSE:HARVIA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Harvia Oyj is a company specializing in the sauna industry, with a market capitalization of €662.58 million.

Operations: Harvia Oyj generates revenue primarily from its Building Materials - HVAC Equipment segment, amounting to €188.89 million.

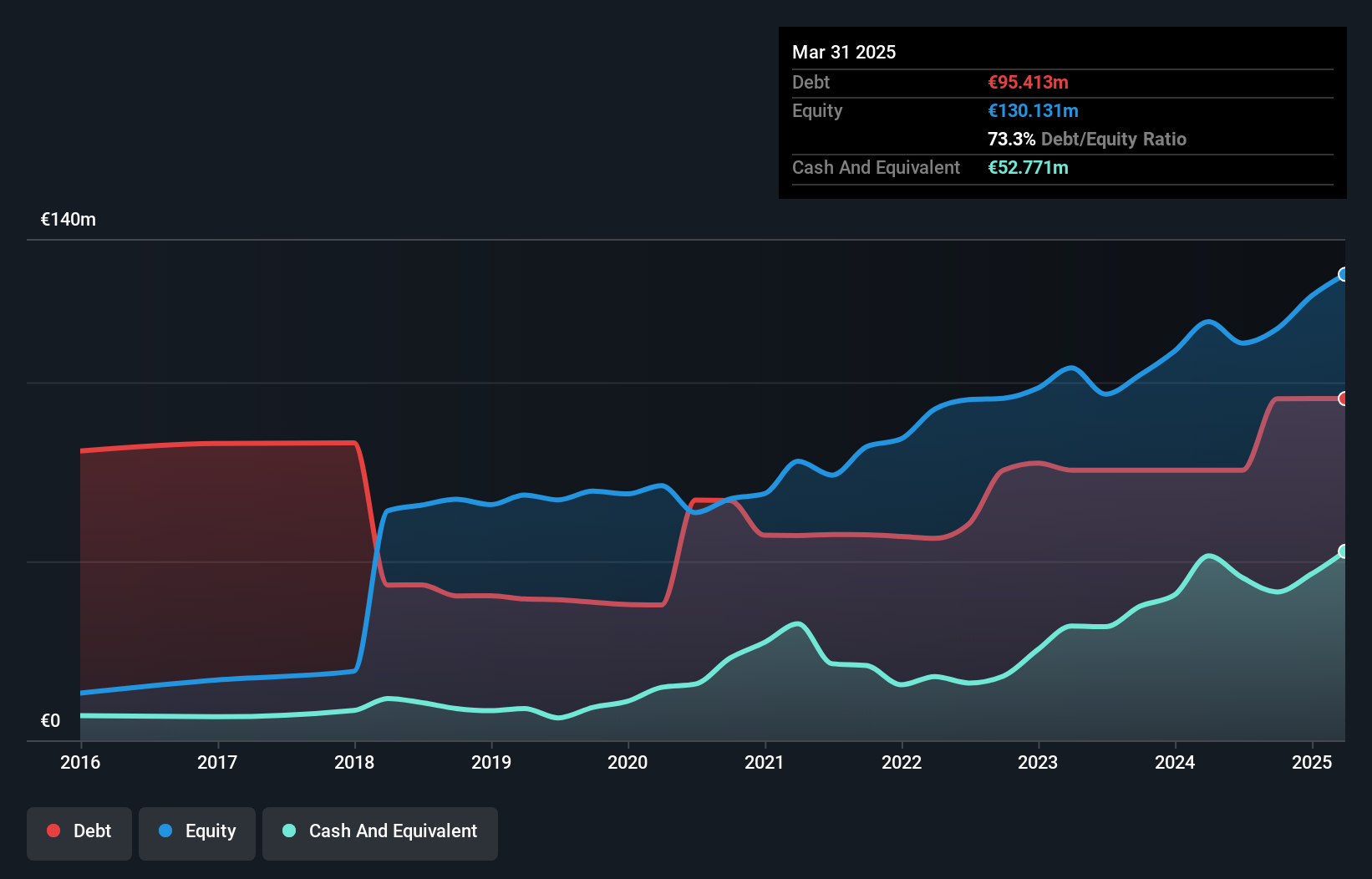

Harvia Oyj, a notable player in the wellness industry, is leveraging its strategic expansion into emerging markets and partnerships to capture global demand. The company recently introduced innovative products like the Fenix control panel and MyHarvia app, enhancing user experience with smart technology. Despite facing challenges such as heavy reliance on core markets and rising competition, Harvia's net debt to equity ratio has improved from 105.5% to 82.3% over five years. With earnings forecasted to grow by 18.79% annually and trading at 41.7% below estimated fair value, Harvia presents an intriguing opportunity for investors seeking growth potential in niche markets.

Boozt (OM:BOOZT)

Simply Wall St Value Rating: ★★★★★★

Overview: Boozt AB (publ) operates as an online retailer offering a wide range of fashion, apparel, shoes, accessories, kids' products, home goods, sports items, and beauty products with a market capitalization of approximately SEK6.18 billion.

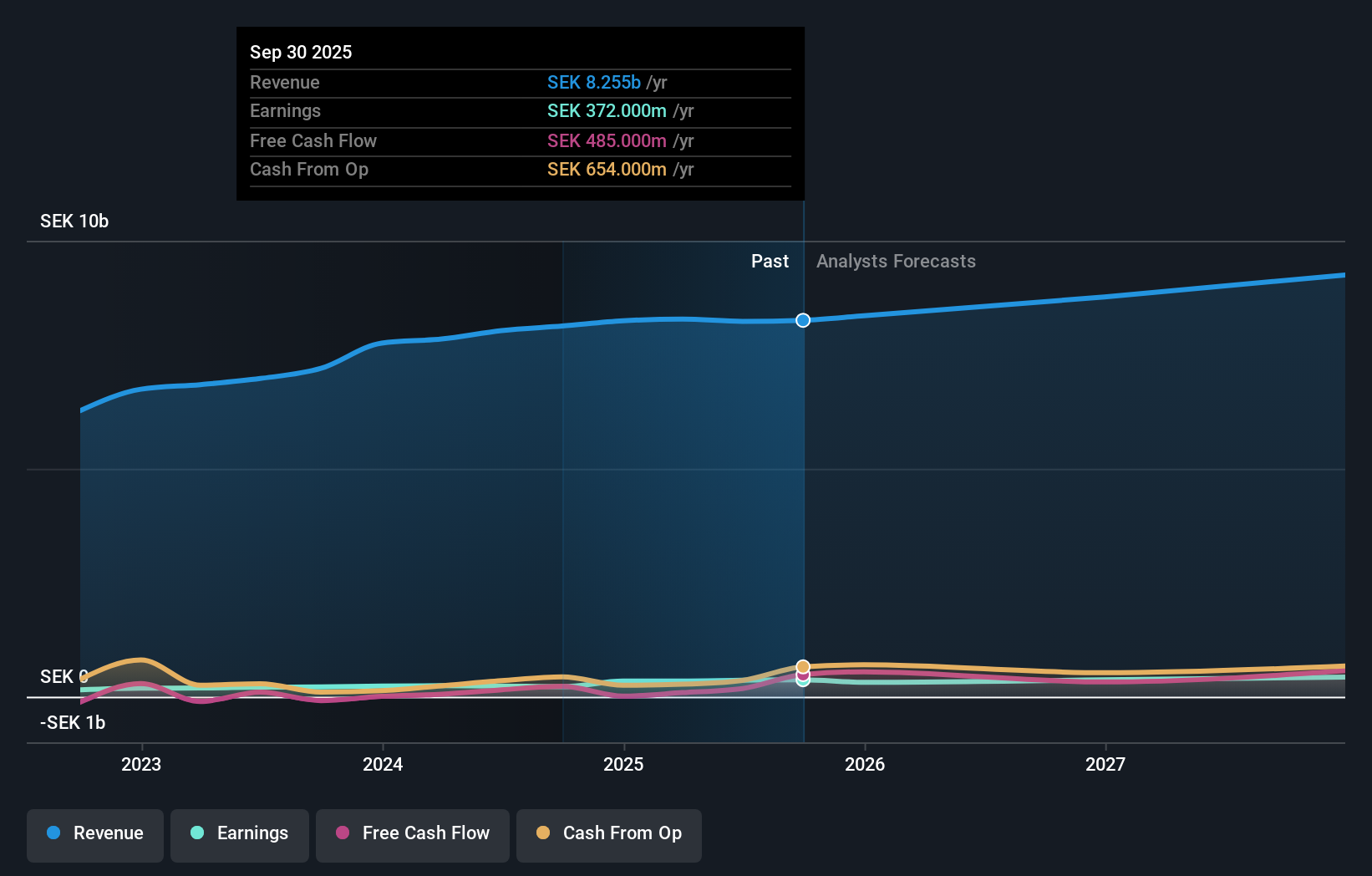

Operations: Boozt generates revenue primarily from its online platforms, Boozt.com and Booztlet.com, with sales of SEK6.55 billion and SEK1.68 billion respectively.

Boozt stands out in the Nordic online retail scene with a strong growth trajectory, evidenced by a 54.9% earnings increase over the past year, outpacing industry averages. Its debt to equity ratio has impressively decreased from 35.9% to 10.7% in five years, and it trades at a notable 40.3% below fair value estimates. Recent share repurchases totaling SEK 94 million for over a million shares reflect confidence in its valuation. Despite sales dipping slightly to SEK 1,823 million this quarter compared to last year, net income rose significantly from SEK 59 million to SEK 76 million, showcasing resilience amidst market challenges.

Mikron Holding (SWX:MIKN)

Simply Wall St Value Rating: ★★★★★★

Overview: Mikron Holding AG is a company that specializes in developing, producing, and marketing automation solutions, machining systems, and cutting tools globally with a market capitalization of CHF316.60 million.

Operations: Mikron Holding generates revenue primarily from its Automation and Machining Solutions segments, with CHF226.27 million and CHF149.10 million respectively. The company's operations span various regions, including Switzerland, Europe, North America, and the Asia Pacific.

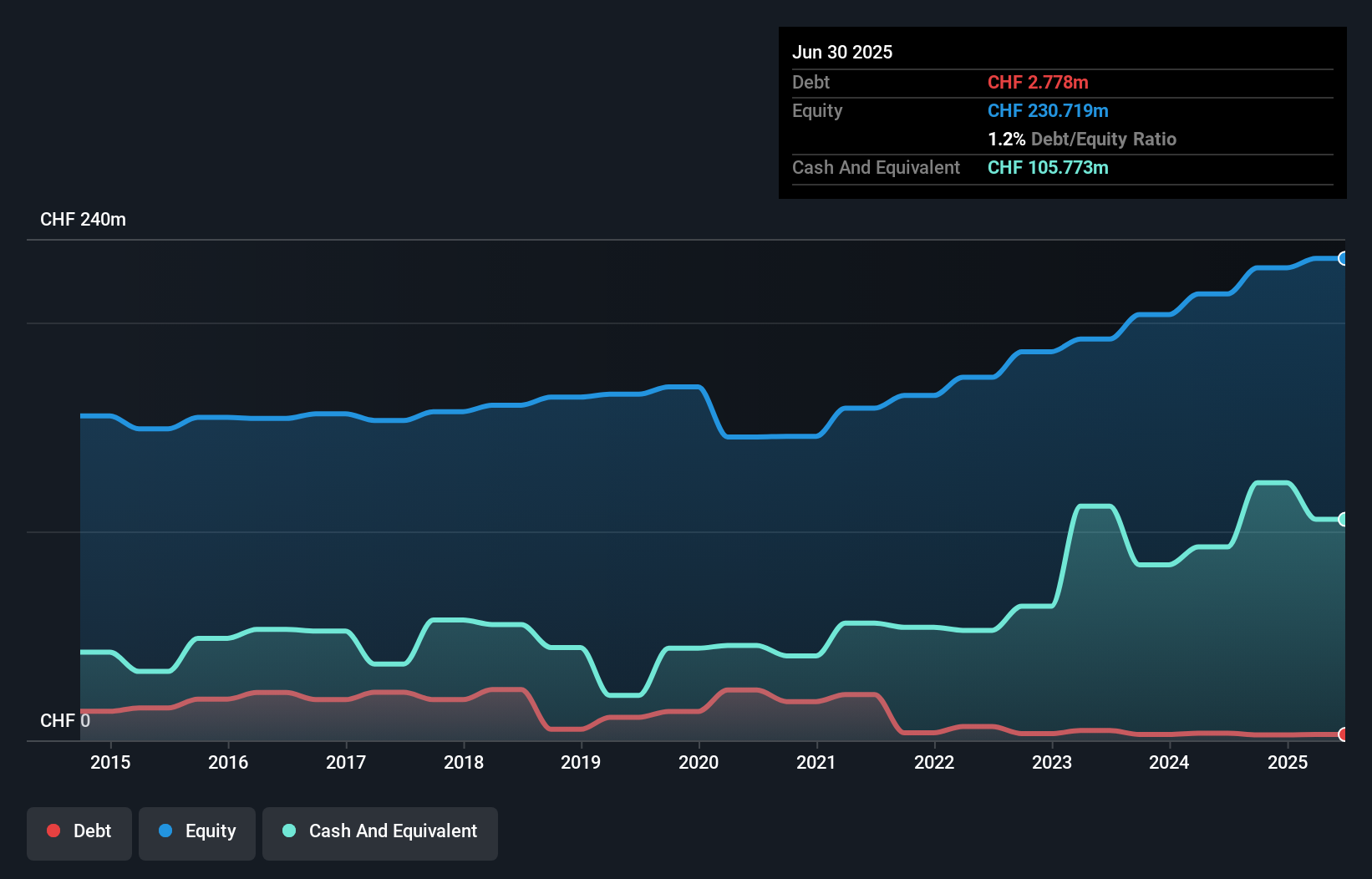

Mikron Holding, a nimble player in the European market, has been trading at 62.3% below its estimated fair value, suggesting potential undervaluation. With earnings growth of 7% over the past year, Mikron outpaced the broader machinery industry's -6.2%. The company's financial health appears robust with a debt-to-equity ratio reduced to 1.2% from 16.6% over five years and interest payments covered 37 times by EBIT. Recent developments include an agreement with United Machining Solutions for trademark licensing and leadership changes as Philip Kraus is set to head Mikron Automation Division in January 2026, following Rolf Rihs's transition to Senior Advisor role.

- Navigate through the intricacies of Mikron Holding with our comprehensive health report here.

Evaluate Mikron Holding's historical performance by accessing our past performance report.

Taking Advantage

- Delve into our full catalog of 328 European Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harvia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HARVIA

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives