- Finland

- /

- Consumer Durables

- /

- HLSE:FSKRS

Fiskars (HLSE:FSKRS): Assessing Valuation After Narrowed 2025 Guidance and Q3 Profit Turnaround

Reviewed by Simply Wall St

Fiskars Oyj Abp (HLSE:FSKRS) recently narrowed its full-year 2025 EBIT outlook, indicating expectations toward the lower end of the prior range because of current trends. Still, management anticipates net sales growth for the fourth quarter.

See our latest analysis for Fiskars Oyj Abp.

Fiskars Oyj Abp’s share price recently gained 5.8% over the past week, a move that followed an improved Q3 profit and news of a permanent CEO appointment. However, the one-year total shareholder return remains down nearly 10% as the market balances cautious forward earnings guidance with signs of operational progress. Despite some near-term headwinds, long-term shareholders have still seen a 19% total return over five years, which indicates that underlying growth potential is still in play for patient investors.

If you’re looking to expand your investment radar beyond the headlines, now’s an interesting time to discover fast growing stocks with high insider ownership.

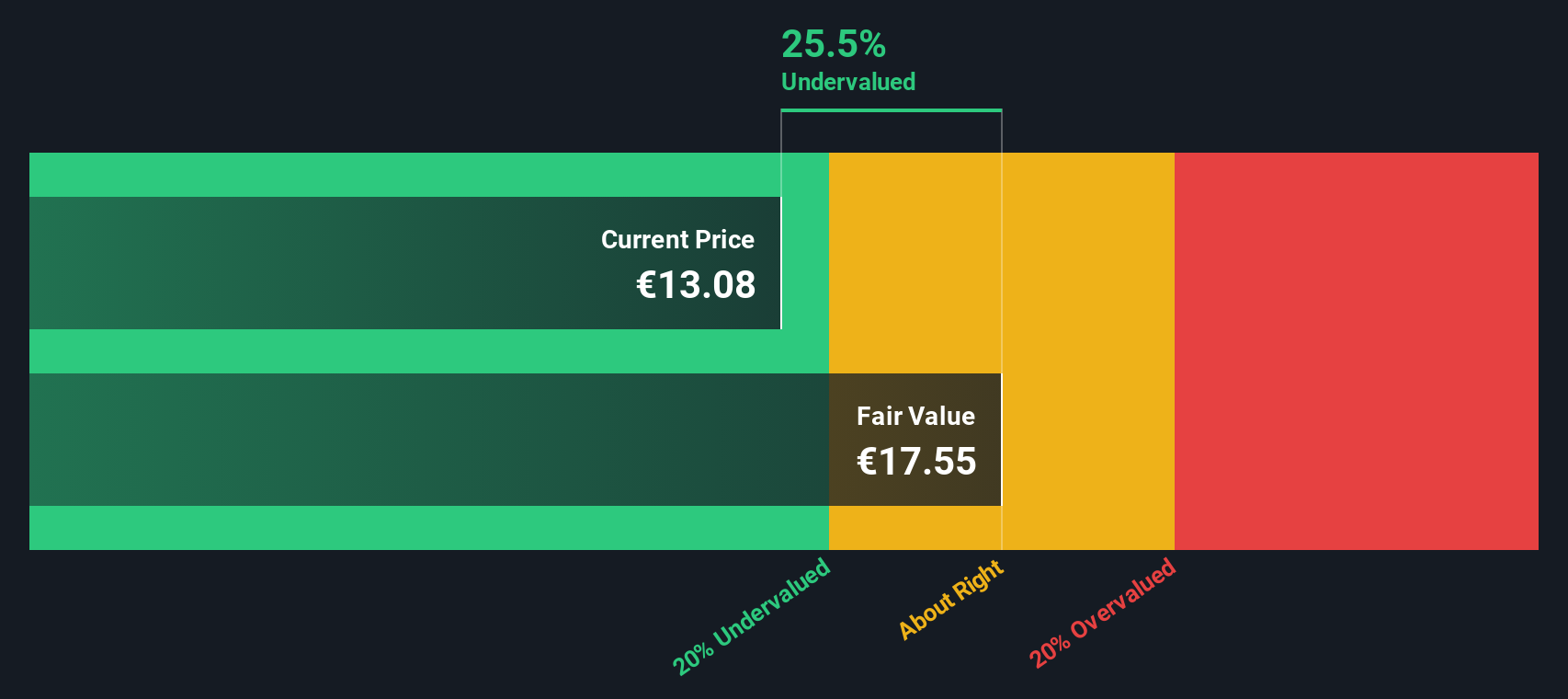

With earnings guidance pointing lower even as profitability improves, investors are now left to weigh whether Fiskars shares have fallen enough to warrant interest, or if the market is accurately reflecting the company’s growth prospects.

Most Popular Narrative: 4.3% Overvalued

At a last close of €13.04, the most widely followed narrative pegs Fiskars Oyj Abp's fair value slightly below the market price, suggesting that current optimism may be a stretch. The numbers behind this view reflect not just headline trends but also significant shifts in channel strategy and regional momentum.

Strong double-digit sales growth in China, supported by expansion into new categories (such as branded water bottles) and geographic broadening of core Nordic and Danish brands, positions Fiskars to capitalize on the rising affluence and expanding middle class in Asia. This will likely support future top-line growth and margin expansion as the emerging market sales mix improves.

Curious what could justify a premium above today's price? The key factors in this narrative are aggressive international growth, margin expansion, and a direct-to-consumer push that promises to reset profit benchmarks. Want the exact levers and projected trajectory? Get the full story in the narrative—numbers you will not want to miss.

Result: Fair Value of €12.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in U.S. retail channels or prolonged inventory challenges could quickly undermine these optimistic growth assumptions and shift sentiment toward a more bearish outlook.

Find out about the key risks to this Fiskars Oyj Abp narrative.

Another View: Discounted Cash Flow Points to Opportunity

While the prevailing narrative suggests Fiskars Oyj Abp is slightly overvalued, our DCF model offers a different take. It calculates a fair value of €15.65, which means shares trade about 16.7% below this estimate. Could the market be overlooking upside, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fiskars Oyj Abp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fiskars Oyj Abp Narrative

If you want to dig deeper or trust your own analysis over popular wisdom, you can craft your own narrative using our tools in just a few minutes: Do it your way.

A great starting point for your Fiskars Oyj Abp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for the ordinary when you can uncover tomorrow's standouts today? Give yourself the edge with these hand-picked opportunities that could be the spark your portfolio needs.

- Amplify your returns by targeting strong cash flow potential using these 854 undervalued stocks based on cash flows, which helps you identify undervalued gems before they hit the spotlight.

- Boost your passive income stream by spotting reliable yield plays with these 21 dividend stocks with yields > 3%, where high dividend stocks with solid fundamentals await.

- Capture the momentum of a digital revolution by exploring these 81 cryptocurrency and blockchain stocks, putting the latest cryptocurrency and blockchain leaders on your radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:FSKRS

Fiskars Oyj Abp

Manufactures and markets consumer products for indoor and outdoor living in Europe, the Americas, and the Asia Pacific.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives