- Finland

- /

- Commercial Services

- /

- HLSE:VIAFIN

Does Viafin Service Oyj (HEL:VIAFIN) Create Value For Shareholders?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. To keep the lesson grounded in practicality, we'll use ROE to better understand Viafin Service Oyj (HEL:VIAFIN).

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Viafin Service Oyj

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Viafin Service Oyj is:

10% = €2.0m ÷ €20m (Based on the trailing twelve months to June 2020).

The 'return' is the yearly profit. That means that for every €1 worth of shareholders' equity, the company generated €0.10 in profit.

Does Viafin Service Oyj Have A Good ROE?

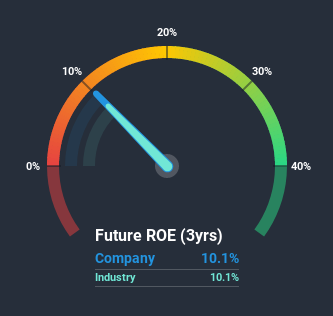

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. If you look at the image below, you can see Viafin Service Oyj has a similar ROE to the average in the Commercial Services industry classification (10%).

That isn't amazing, but it is respectable. Even if the ROE is respectable when compared to the industry, its worth checking if the firm's ROE is being aided by high debt levels. If a company takes on too much debt, it is at higher risk of defaulting on interest payments. You can see the 2 risks we have identified for Viafin Service Oyj by visiting our risks dashboard for free on our platform here.

Why You Should Consider Debt When Looking At ROE

Virtually all companies need money to invest in the business, to grow profits. That cash can come from issuing shares, retained earnings, or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. That will make the ROE look better than if no debt was used.

Combining Viafin Service Oyj's Debt And Its 10% Return On Equity

Viafin Service Oyj is free of net debt, which is a positive for shareholders. Its solid ROE indicates a good business, especially when you consider it is not using leverage. At the end of the day, when a company has zero debt, it is in a better position to take future growth opportunities.

Summary

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have the same ROE, then I would generally prefer the one with less debt.

But when a business is high quality, the market often bids it up to a price that reflects this. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So you might want to take a peek at this data-rich interactive graph of forecasts for the company.

But note: Viafin Service Oyj may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

When trading Viafin Service Oyj or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:VIAFIN

Flawless balance sheet with solid track record.

Market Insights

Community Narratives