- Finland

- /

- Professional Services

- /

- HLSE:TNOM

Talenom (HLSE:TNOM) Earnings Growth of 61.8% Reinforces Turnaround Narrative

Reviewed by Simply Wall St

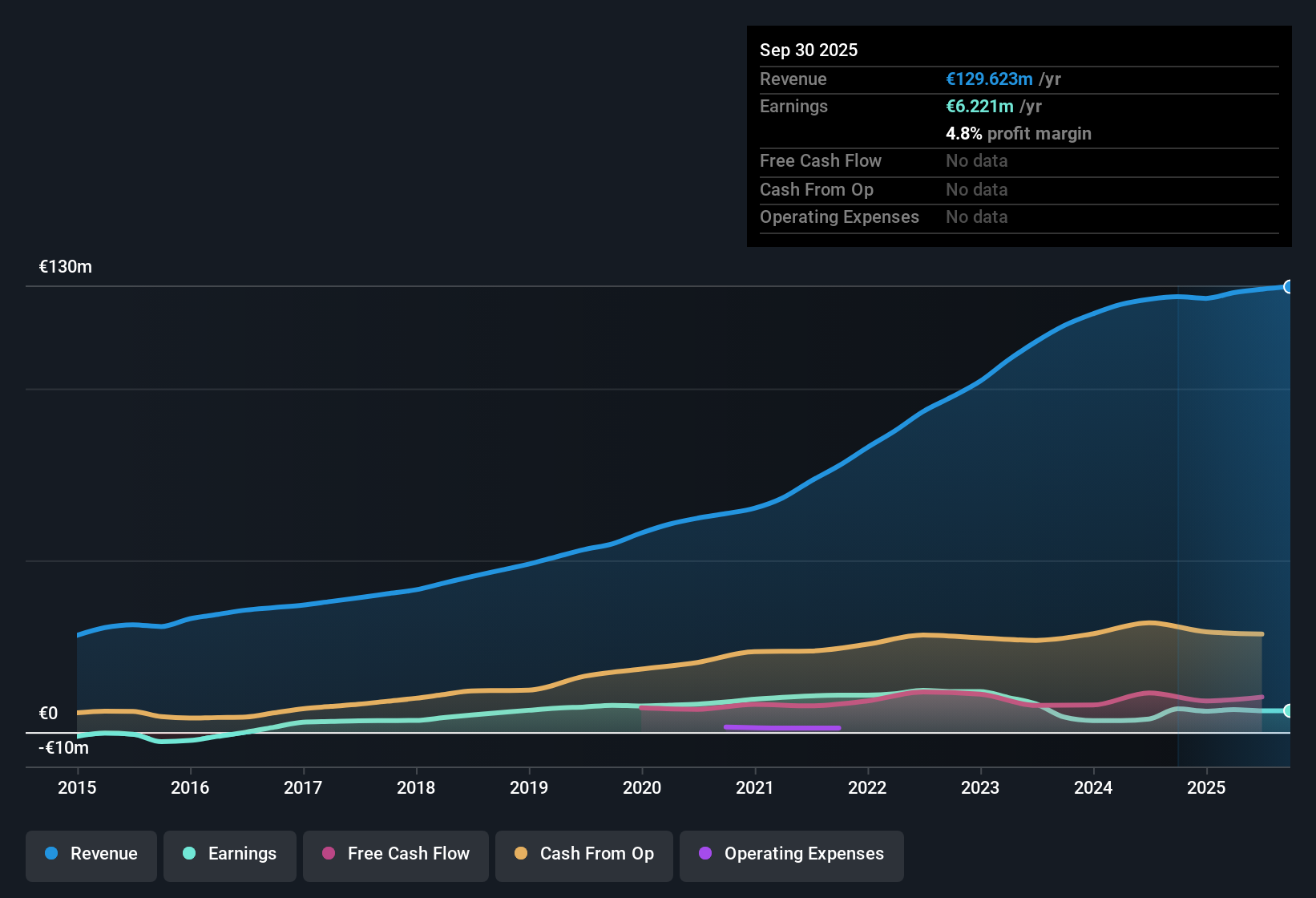

Talenom Oyj (HLSE:TNOM) delivered headline numbers that point to a turnaround story, with revenue forecast to grow 7.7% per year, well above the Finnish market's 4% annual pace. EPS momentum is clear, as the company posted a striking 61.8% earnings growth rate over the past year, compared to a five-year average of negative 14.2% per year. Net profit margins now stand at 4.8% versus last year's 3%, underscoring an improvement in underlying profitability and the quality of earnings.

See our full analysis for Talenom Oyj.Now, let’s see how these results compare with the current narratives circulating among investors and analysts. Where do the numbers confirm expectations, and where might they shake things up?

See what the community is saying about Talenom Oyj

Recurring Revenue Drives Momentum

- The company stands out for its forecast annual revenue growth rate of 7.7%, comfortably above the Finnish market average of 4%. This momentum is largely due to regulatory forces accelerating digital adoption in markets like Spain.

- Analysts' consensus view highlights that Spain’s mandatory e-invoicing law is bringing a wave of new SME clients, while Talenom’s proprietary software is improving scalability and cross-selling:

- Expansion into Spain is expected to speed recurring revenue growth, thanks to the e-invoicing mandate.

- The long-term switch from manual to cloud-based solutions, especially in Spain and Italy, is widening Talenom's total addressable market and underpins multi-year growth expectations.

Bulls and bears both watch Talenom's shift to recurring revenues. See what analysts say next. 📊 Read the full Talenom Oyj Consensus Narrative.

Margin Expansion Ups Potential

- Net profit margin has improved to 4.8%, supported by decreasing software investment and strong international growth. This is driving expected margin expansion to a projected 10.1% within three years.

- According to the analysts' consensus narrative, lowering capital expenditure from an earlier high point means more cash for operations and margin gains:

- Declining software spend should translate into lower depreciation and a stronger bottom line.

- Talenom's international playbook is diversifying income and lowering reliance on its home market, which consensus sees as crucial for sustainable profit growth.

Valuation Above Peers, Priced Below DCF

- Shares currently trade at a price-to-earnings multiple of 26.4x, above the professional services peer average of 25.3x and the European industry average of 20.9x. However, they are priced below a DCF fair value of €7.24 and 15% under the consensus analyst target of €4.10 (current share price €3.60).

- The consensus narrative points out that while valuation is elevated on a PE basis, the market may be discounting risks such as acquisition integration and ongoing revenue concentration in Finland:

- The market's discount to both DCF and analyst targets shows investors remain cautious about execution and diversification risks.

- For consensus to play out, investors need confidence that profit will grow from €6.2m to €16.3m by 2028 and margins will reach 10.1%.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Talenom Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something the market missed? Share your viewpoint and shape your own story in just a few minutes. Do it your way.

A great starting point for your Talenom Oyj research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While Talenom’s valuation is high and investors remain cautious about integration and diversification risks, profits and margins still rely heavily on successful expansion.

If you want to cut through the uncertainty and focus on opportunities that may offer more value for your money, check out these 878 undervalued stocks based on cash flows to spot stocks currently trading at attractive prices with room for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talenom Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TNOM

Talenom Oyj

Provides accounting and other services for small and medium-sized enterprises in Finland, Sweden, Spain, and Italy.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives