- Finland

- /

- Commercial Services

- /

- HLSE:LAT1V

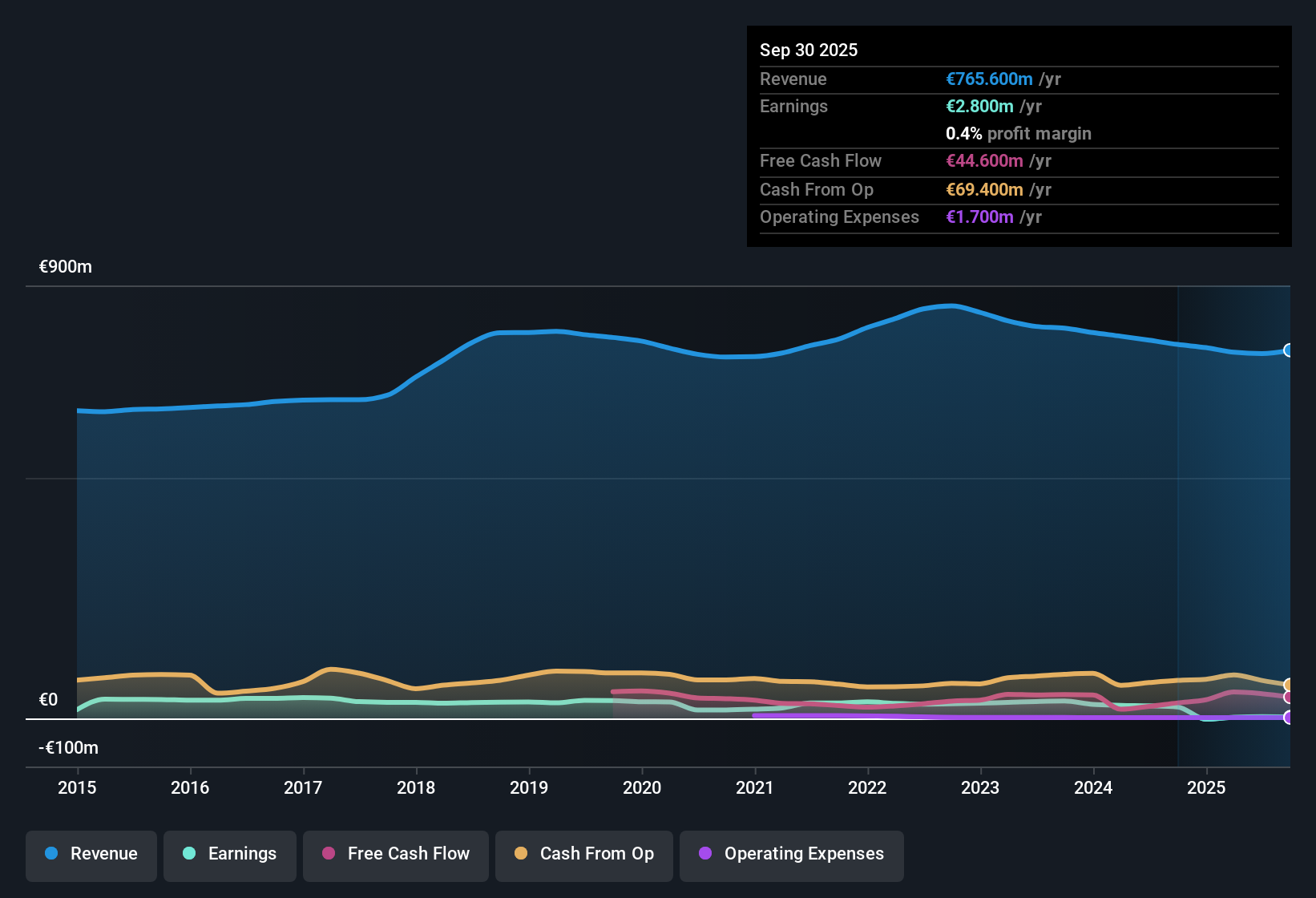

Lassila & Tikanoja (HLSE:LAT1V) Profit Margin Falls to 0.4%, Undermining Valuation Recovery Narrative

Reviewed by Simply Wall St

Lassila & Tikanoja Oyj (HLSE:LAT1V) reported a notable fall in profitability, with net profit margin slipping to 0.4% this period from last year’s 3.2%. The company’s earnings have contracted by an average of 16.6% annually over the past five years, with a €22.0 million one-off loss weighing heavily on the bottom line. Investors are watching keenly, as shares currently trade at a price-to-earnings ratio of 136.7x, a significant premium to the industry and peer averages. Despite these challenges, earnings are forecast to rebound sharply, with 44.2% annual growth expected, outpacing the broader Finnish market even as revenue growth lags.

See our full analysis for Lassila & Tikanoja Oyj.The next step is to see how these results measure up when set against the key narratives shaping investor sentiment for Lassila & Tikanoja. Some storylines may be confirmed, while others could be upended by the numbers.

See what the community is saying about Lassila & Tikanoja Oyj

Planned Demerger Leaves Circular Economy Arm With €174m Debt Load

- After the upcoming split, the new Circular Economy company will take on €174 million of the group’s net interest-bearing debt, nearly all of the €178 million total. This could significantly constrain investment flexibility and increase finance costs.

- According to the analysts' consensus view, the high leverage post-demerger stands out as a material risk, challenging the company’s outlook for margin expansion and profit growth.

- Analysts highlight that exposure to higher interest costs may cut into future net margins and earnings, directly offsetting benefits from segment focus and improved efficiencies.

- Persistently loss-making operations in Sweden add further drag, supporting the consensus caution that executing the turnaround plan remains an unresolved challenge.

To see how debt strategy, margin targets, and structural changes fit into the big picture, catch the full consensus narrative for Lassila & Tikanoja.

📊 Read the full Lassila & Tikanoja Oyj Consensus Narrative.Forecasted Margin Climb From 0.5% to 6.4% by 2028

- Analysts expect Lassila & Tikanoja’s profit margin will rise from today’s 0.5% to 6.4% within three years. This potentially reverses the long decline but requires substantial improvement from current weak levels.

- In line with the analysts' consensus view, this projected margin recovery is backed by the company’s shift toward digital platforms, expanding circular economy services, and recurring, long-term contracts.

- Full implementation of new ERP systems and digital tools is anticipated to drive efficiency, reduce costs, and support sustained margin expansion if execution stays on track.

- The growth in sustainability-driven and data-led business lines is expected to increase recurring revenues and stabilize cash flow, both crucial for achieving higher profitability.

Premium Valuation: 136.7x P/E Versus DCF Fair Value of €30.76

- Lassila & Tikanoja shares currently trade at a 136.7x price-to-earnings ratio, far above both the European industry average (14.4x) and its peer group (23.6x). The DCF fair value is estimated at €30.76, roughly triple the latest share price of €10.02.

- Analysts’ consensus narrative sees valuation tension. Although the stock is well below DCF fair value, analysts’ price target is just €10.50, only 4.8% above today’s price, reflecting skepticism around the pace of margin recovery and the risks to earnings quality.

- The consensus target implies analysts do not expect the stock to close the gap to DCF fair value soon, even if earnings growth outpaces the sector.

- For value-focused investors, the key debate is whether operational execution and margin expansion can deliver enough upside to justify the premium multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lassila & Tikanoja Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on what the results mean? Turn your unique angle into a fresh narrative in just a few minutes with Do it your way.

A great starting point for your Lassila & Tikanoja Oyj research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Lassila & Tikanoja faces uncertainty due to high debt after the planned demerger, margin pressure, and skepticism about its premium valuation.

If you want companies with stronger finances and less debt risk, check out solid balance sheet and fundamentals stocks screener (1988 results) to find those better positioned for financial resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:LAT1V

Lassila & Tikanoja Oyj

A service company, provides environmental management, and property and plant support services in Finland, Sweden, and internationally.

Slight risk with moderate growth potential.

Market Insights

Community Narratives