- Finland

- /

- Professional Services

- /

- HLSE:ETTE

Etteplan (HLSE:ETTE) Margins Narrow Despite Fastest Projected Earnings Growth in Finnish Market

Reviewed by Simply Wall St

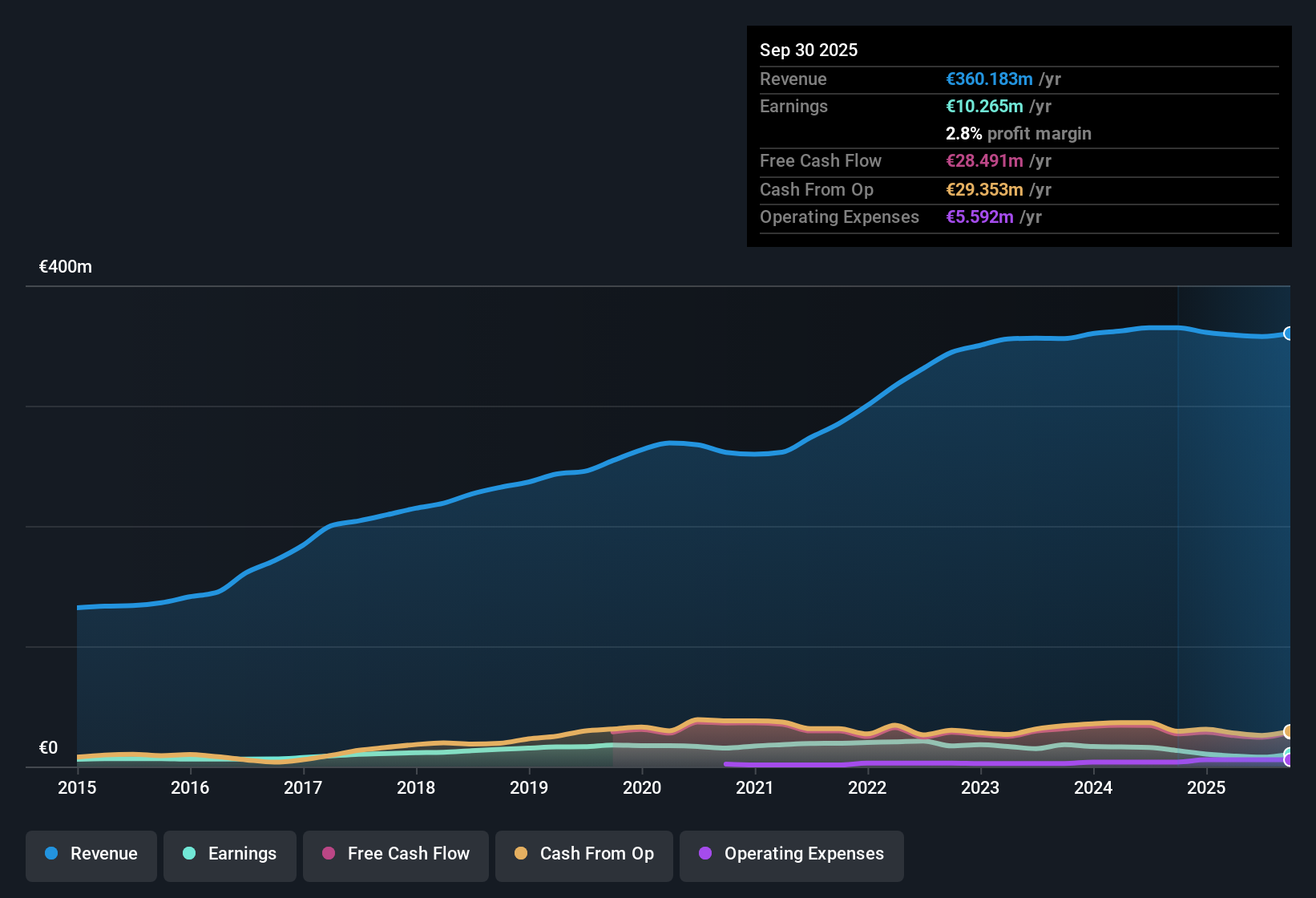

Etteplan Oyj (HLSE:ETTE) is projected to deliver robust earnings growth of 26.3% per year, outpacing the Finnish market’s anticipated 18.1% annual increase. Its revenue is forecast to rise at a more modest 3.6% per year compared to the market's 4%. Current net profit margins have narrowed to 2.8%, down from 3.6% last year. Over the past five years, the company’s earnings have declined by an average of 11.7% annually. Despite these margin pressures and historical contraction, the high-quality, fast-growing earnings profile gives investors a reason to keep a close eye on the stock.

See our full analysis for Etteplan Oyj.The next section puts Etteplan's headline numbers side by side with prevailing market narratives to reveal which stories hold up and which might come under pressure.

See what the community is saying about Etteplan Oyj

Margins Poised to Rebound with AI Expansion

- Analysts expect profit margins to rise from 2.2% today to 5.7% in three years, reflecting optimism that Etteplan’s efficiency initiatives and tech investments will deliver higher profitability even as sector headwinds persist.

- Consensus narrative notes margin improvement is not just about cost cuts, but hinges on

- AI-driven solutions, now doubling revenue quarter on quarter, providing a strategic edge as customers seek automation and cost efficiency. This supports the potential for stronger margins ahead

- the shift to managed service models, making up 66% of revenue, which could anchor stable earnings but still rely on successful scaling as AI contributes just 4% of sales so far

Valuation: Discounted to DCF, Premium vs Industry

- With shares trading at €9.62, Etteplan sits at a 55% discount to its DCF fair value of €21.19. However, its 23.7x PE is above the European Professional Services sector average of 20.8x and well below peers at 53.1x.

- Analysts’ consensus view weighs this mixed signal, pointing out that

- the current price is 7.3% below the analyst target of €10.50, implying limited near-term upside if consensus forecasts play out

- the company’s high-quality, rapidly growing earnings profile could justify a premium, but only if margin and diversification targets are hit as forecasted

Risks: Dividend and Financial Strength in Focus

- Two risks stand out in filings: Etteplan’s dividend may not be sustainable and its financial position could constrain future growth, making continued restructuring and efficiency crucial for long-term stability.

- Consensus narrative highlights how these risks underpin the cautious stance that

- sustained demand declines in legacy segments alongside continued margin pressure, driven by layoffs and restructuring costs, could threaten the company’s ability to deliver on growth promises

- failure to scale AI and higher-value services fast enough would leave the company exposed to intensifying competition and narrow its ability to reinvest in growth or support dividends

Analysts are watching Etteplan closely to see if earnings momentum, margin recovery and diversification play out as forecast in the consensus narrative. Get the full balanced narrative here. 📊 Read the full Etteplan Oyj Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Etteplan Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? In just a few minutes, you can turn your perspective into a full story. Do it your way.

A great starting point for your Etteplan Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Etteplan’s inconsistent profit margins, dividend concerns, and financial constraints mean its long-term stability is still in question.

If you want more reliable fundamentals and protection against balance sheet risk, check out solid balance sheet and fundamentals stocks screener (1988 results) that are built for lasting strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etteplan Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ETTE

Etteplan Oyj

Provides software and embedded, industrial equipment and plant engineering, and technical communication solutions in Finland, Scandinavia, China, and Central Europe.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives