- Finland

- /

- Professional Services

- /

- HLSE:DOV1V

These 4 Measures Indicate That Dovre Group (HEL:DOV1V) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Dovre Group Plc (HEL:DOV1V) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Dovre Group

What Is Dovre Group's Debt?

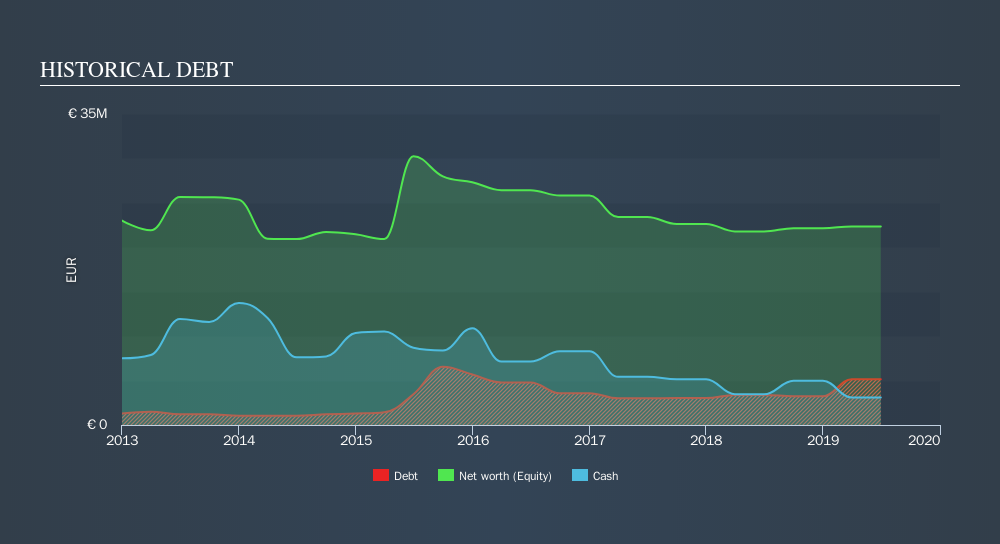

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Dovre Group had €5.16m of debt, an increase on €3.38m, over one year. However, because it has a cash reserve of €3.09m, its net debt is less, at about €2.06m.

How Healthy Is Dovre Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Dovre Group had liabilities of €20.6m due within 12 months and liabilities of €4.65m due beyond that. Offsetting this, it had €3.09m in cash and €17.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €4.37m.

Of course, Dovre Group has a market capitalization of €23.8m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Dovre Group's low debt to EBITDA ratio of 1.5 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 6.1 last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Even more impressive was the fact that Dovre Group grew its EBIT by 158% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Dovre Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last two years, Dovre Group saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Dovre Group's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better There's no doubt that its ability to grow its EBIT is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Dovre Group's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Dovre Group's dividend history, without delay!

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:DOV1V

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion