Wärtsilä (HLSE:WRT1V) Margin Improvement Challenges Market’s High-Growth Narrative

Reviewed by Simply Wall St

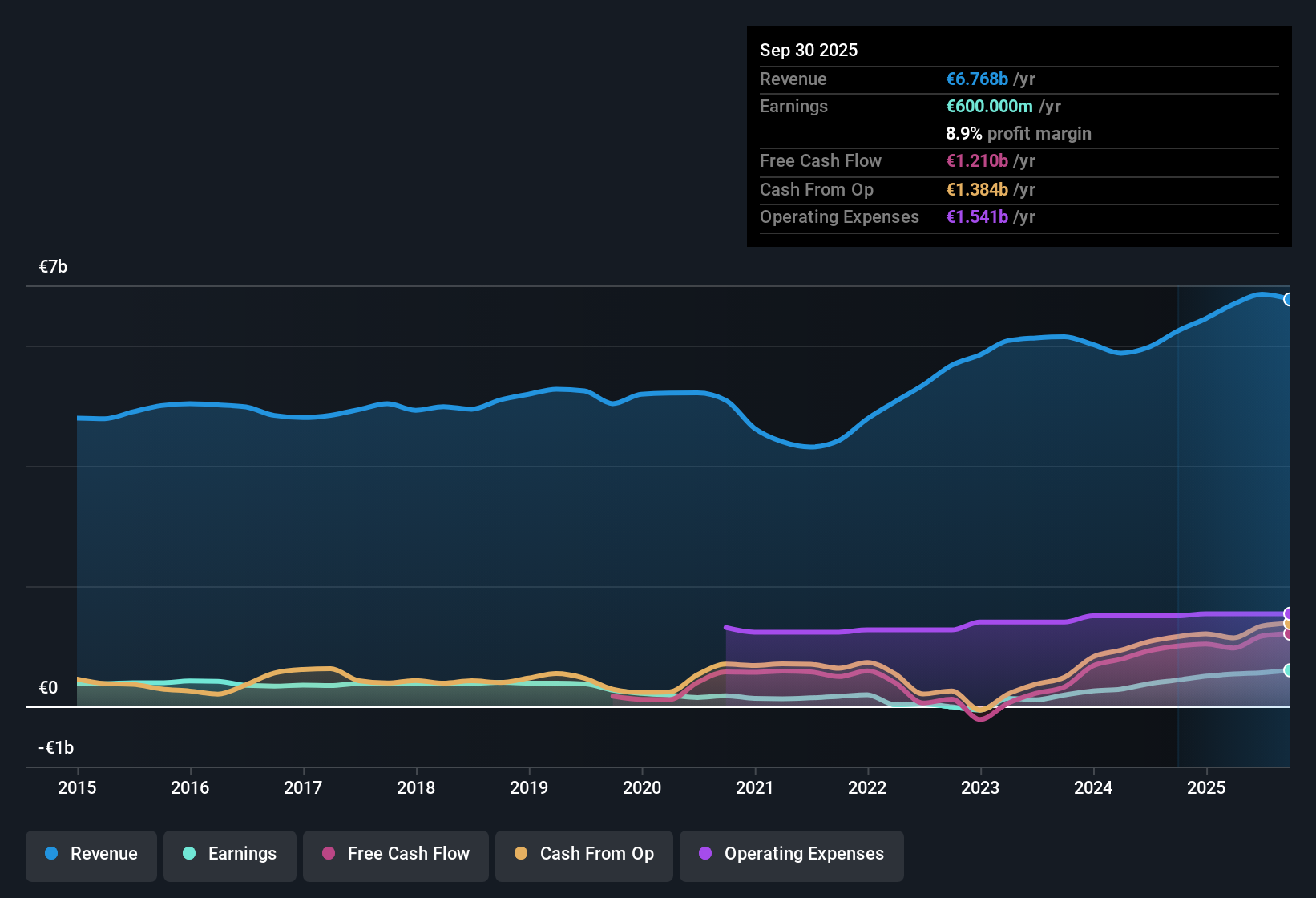

Wärtsilä Oyj Abp (HLSE:WRT1V) reported a net profit margin of 8.9%, up from 7% the previous year. Earnings have grown 40.1% per year on average over the past five years, with the most recent annual growth rate at 37%. Investors might be encouraged by this consistent profitability and the upward trajectory in margins, but are also mindful that future earnings growth, forecast at 6.9% per year, is set to trail the broader Finnish market’s pace. Meanwhile, revenue is still expected to grow slightly ahead of the local industry benchmark.

See our full analysis for Wärtsilä Oyj Abp.Now, let’s see how these numbers compare with the dominant narratives circulating in the market, and where surprises might come into play.

See what the community is saying about Wärtsilä Oyj Abp

Margin Expansion Guided by Order Growth

- Analysts project profit margins edging up from 8.2% today to 8.8% over the next three years, a positive sign given strong recurring service agreements and a record-high energy order intake highlighted in the consensus narrative.

- Analysts' consensus view points to this margin progress being underpinned by a 48% year-on-year increase in service agreement order intake, which now covers more than 30% of the installed base and enjoys high renewal rates.

- This high-margin, recurring revenue stream helps counter pressures from shifting regulations and customer preferences.

- Continued demand for decarbonization and digitalized solutions is expected to sustain robust order growth and margin stability, supporting the case for higher long-term profitability.

- To see how analysts weigh these drivers in the bigger picture for Wärtsilä’s future, review the full consensus narrative.📊 Read the full Wärtsilä Oyj Abp Consensus Narrative.

Valuation Premium Versus Peers

- Wärtsilä currently trades at a Price-to-Earnings ratio of 27.8x, meaning the stock is valued at a 36% premium to the European Machinery industry average of 20.4x and a 30% premium to its direct peer average of 21.4x.

- Analysts' consensus view frames this premium as a reflection of past earnings growth and recurring revenue momentum, but emphasizes the challenge the company faces in justifying its higher valuation as profit growth is forecast to slow to 6.9% annually, trailing the Finnish market’s 18.1%.

- Consensus price target sits at €23.25, roughly 18% below the current market price of €28.31, suggesting analysts believe expectations embedded in today’s price may be lofty.

- Despite gradual margin expansion and revenue outperformance versus industry averages, skepticism remains about whether these fundamentals warrant such a substantial valuation gap.

DCF Fair Value Signals Downside Risk

- The discounted cash flow (DCF) fair value for Wärtsilä stands at €11.68, considerably below the current price of €28.31, flagging a substantial downside risk if market optimism does not play out.

- From the analysts' consensus perspective, this gap spotlights how the market’s willingness to pay a significant premium hinges on the company sustaining high growth and order momentum in the face of rising regulation and technology shifts.

- Market optimism could prove fragile should progress in new technologies or service-led growth falter, making valuation risk an important consideration for investors deciding whether to back continued outperformance.

- The DCF valuation reminds investors to rigorously sense-check their expectations against mechanical valuation benchmarks, not just rosy narratives, even when recurring revenues are strong.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Wärtsilä Oyj Abp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Shape your perspective into a unique narrative in just a few minutes by using Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Wärtsilä Oyj Abp.

See What Else Is Out There

Profit growth at Wärtsilä is forecast to slow sharply compared to the broader market, which raises doubts about whether its steep valuation can be justified.

If you’re seeking stronger value and lower downside risk, use these 853 undervalued stocks based on cash flows to uncover stocks where the price better aligns with robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wärtsilä Oyj Abp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:WRT1V

Wärtsilä Oyj Abp

Offers technologies and lifecycle solutions for the marine and energy markets worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives