- Finland

- /

- Construction

- /

- HLSE:KREATE

Kreate Group (HLSE:KREATE) Margin Recovery Challenges Bearish View After €1.6M One-Off Loss

Reviewed by Simply Wall St

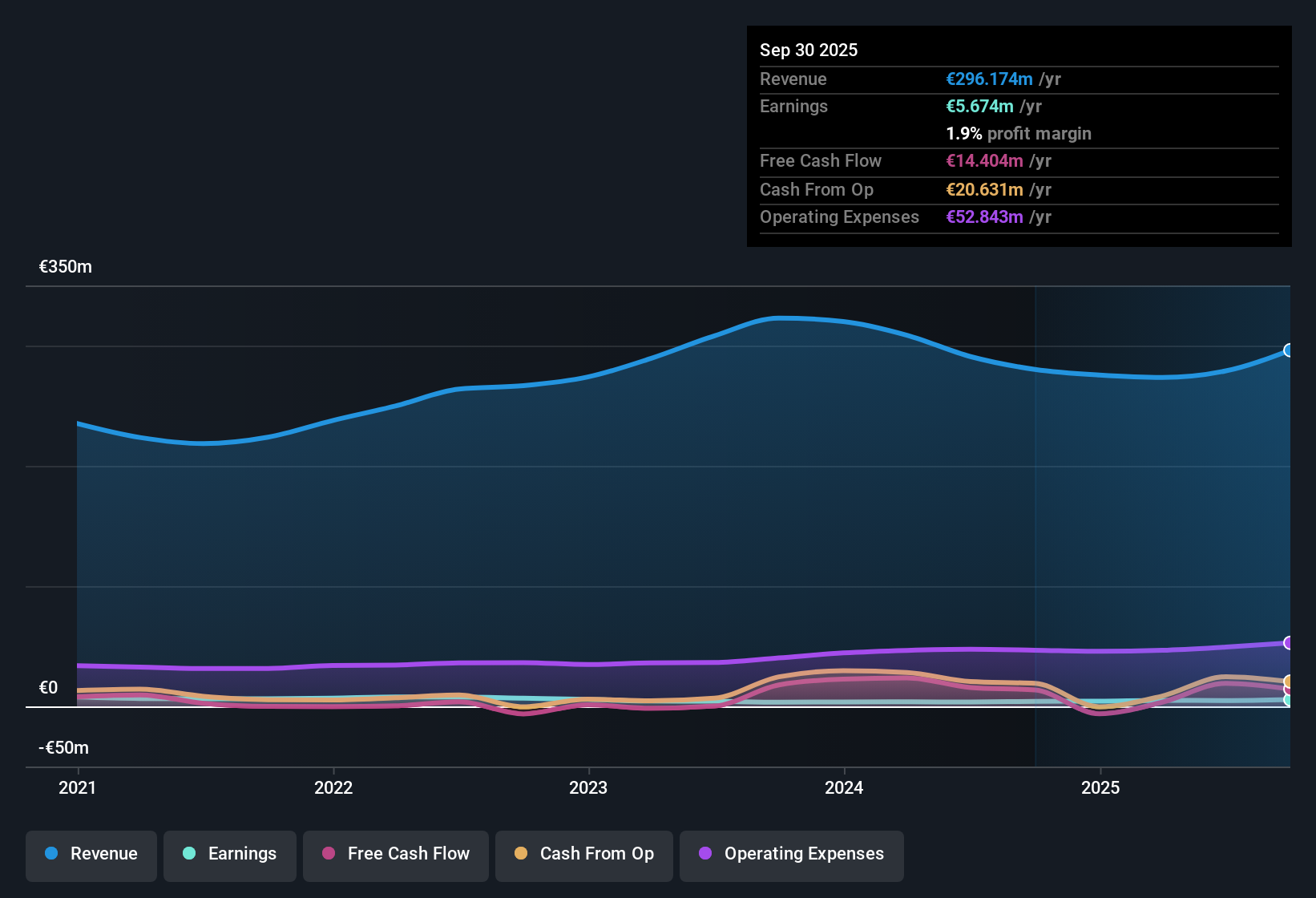

Kreate Group Oyj (HLSE:KREATE) delivered a 31.9% jump in earnings over the past year, bucking a multi-year trend of declining profits. Net profit margins rose to 1.7% from 1.3%, while future earnings growth is projected at 11.8% per year, lagging the Finnish market forecast of 16.1% per year. Despite a one-off €1.6 million loss impacting recent results, revenue is set to increase at 4.4% per year, just ahead of the broader market, and the stock trades at €10.65, below its estimated fair value of €19.35. For investors, the combination of recovering margins, expected growth, and a share price discount sets the stage for nuanced debate around value and risk.

See our full analysis for Kreate Group Oyj.Next up, we’ll see how these headline numbers compare to the wider narratives that investors and analysts are following. Some stories may get a boost, while others could be facing a challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Recover Despite €1.6 Million One-Off Loss

- Net profit margin improved to 1.7% from 1.3% in the latest period, even after accounting for a significant €1.6 million non-recurring loss that weighed on results.

- With profit margins rebounding, the prevailing market analysis highlights the company’s ability to move past recent hits, but notes that any new non-recurring costs could quickly pressure Kreate’s thin profitability.

- Current margin strength stems from operational improvements. However, single large costs remain impactful for future bottom-line resilience.

- Ongoing vigilance is crucial, as margins only recently returned to growth after five years of profit declines averaging 15% annually.

Growth Pace Trails Market Leaders

- Kreate’s forecasted annual earnings growth rate of 11.8% is positive, but it trails the Finnish market’s 16.1% average. This signals that while growth is back on track, it may not match the pace of sector peers.

- The prevailing market perspective views this as solid progress after years of contraction, but emphasizes that outperforming the broader industry will depend on sustained revenue momentum.

- Revenue is projected to rise 4.4% per year, just ahead of the market’s 4%. This modest edge could support further gains if matched by continued margin discipline.

- Slower-than-market earnings growth could cap upside potential if competitors continue to scale faster and widen the performance gap.

Share Price Undervalued Against DCF Fair Value

- Shares trade at €10.65, well below the DCF fair value estimate of €19.35. While the P/E ratio of 19.4x signals a premium to the European construction average (14.4x), it is still below direct peers’ 23.9x average.

- The prevailing market view interprets this valuation gap as a potential long-term opportunity, but underscores that investors are demanding a discount due to past earnings volatility.

- With the current share price undercutting both its DCF fair value and peer multiples, the market appears cautious, likely waiting for more evidence of sustained margin expansion and consistent growth.

- Any reduction in non-recurring losses could help close this gap and support re-rating, provided that forward growth meets or beats sector expectations.

Momentum is building around whether Kreate can convert these early signs of recovery into lasting upside. See how this stacks up to the full narrative for the company. See what the community is saying about Kreate Group Oyj

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kreate Group Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Kreate’s earnings growth and profitability are rebounding. However, inconsistent margins and years of underperformance still cloud its outlook compared to sector leaders.

If you want consistency and stronger earnings momentum, check out stable growth stocks screener (2093 results) for companies that deliver reliable growth without bumpy setbacks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kreate Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KREATE

Kreate Group Oyj

Engages in the construction of infrastructure projects for private and public sector customers in Finland.

Adequate balance sheet and fair value.

Market Insights

Community Narratives