- Finland

- /

- Electrical

- /

- HLSE:KEMPOWR

Kempower (HLSE:KEMPOWR): Revenue Forecast to Grow 23% Annually Ahead of Earnings Season

Reviewed by Simply Wall St

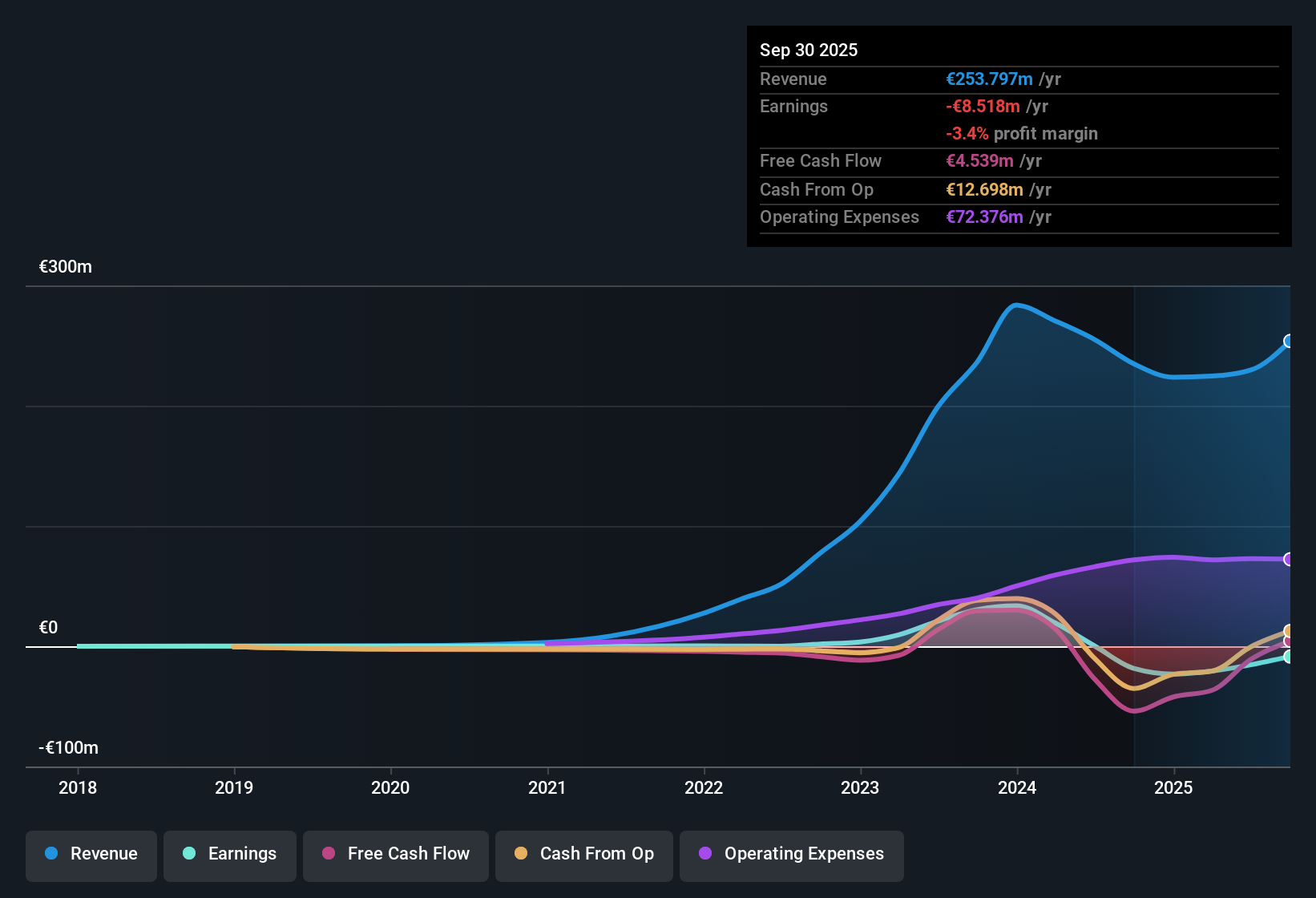

Kempower Oyj (HLSE:KEMPOWR) remains in the red, with losses compounding at an annual rate of 33.6% over the past five years. However, revenue is forecast to grow at 23% per year, far ahead of the broader Finnish market’s expected 4% pace. Earnings are projected to surge 58.42% annually and tip into profitability within three years. Right now, the stock trades below its estimated fair value of €17.97, but its 3.3x Price-to-Sales ratio looks pricey versus European industry and peer averages. This may lead investors to focus squarely on its trajectory toward profitability as earnings season unfolds.

See our full analysis for Kempower Oyj.Next, we’ll see how the latest financial performance stacks up against the main market narratives, putting the numbers in direct dialogue with the prevailing investor expectations.

See what the community is saying about Kempower Oyj

Order Intake Soars 37% Boosted by North American Momentum

- Kempower's total order intake climbed 37% year over year, with North America alone showing 150% order growth, fueled by accelerating demand for EV fast-charging infrastructure.

- Analysts' consensus view highlights how the combination of strong North American expansion and customer diversification (over 90 new customers in 1.5 years, with 30% of orders from new clients) is lowering risk of overdependence on mature markets and providing a foundation for multi-year revenue expansion.

- The revenue forecast of 32.3% annual growth over three years directly aligns with record order momentum.

- Bulls emphasize advanced tech and scalable solutions as key factors enabling Kempower to command premium pricing and recurring revenues from large contracts.

- What’s notable is that the company’s technology leadership, especially its modular systems and integrated software, is cited as a driver for both sticky, high-value contracts and future margin expansion according to the consensus narrative.

- Operational excellence and cost control initiatives are credited with beginning to improve cash flow even as scaling costs persist.

- Even as US regulatory support fluctuates, the structural release of NEVI funding is expected to provide a significant order backlog tailwind.

- While the scale of new customer wins indicates opportunity, order intake remains partly reliant on sizable, non-recurring deals which may not equate to steady, long-term financial commitments. Critics cite this as a potential source of near-term revenue volatility, putting the burden on Kempower to deepen recurring business faster than the broader sector.

Margins Projected to Turn Positive from -6.7% to 8.0%

- Analysts estimate that profit margins will swing from a current -6.7% to 8.0% in three years, supported by cost productivity measures and automation despite ongoing industry price pressures.

- Consensus narrative suggests bulls see operational improvements helping drive earnings growth, while bears point to intense industry rivalry and the risk that sector-wide pricing challenges could compress future margins.

- Robust pipeline and efficiency gains are expected to improve cash flow and EBIT margins as scale increases, backing the bullish view.

- Bears remain cautious about the unpredictability of demand, noting that volatility in non-recurring orders could hamper margin gains despite rising scale.

Valuation Tension: Premium to Peers, Discount to Fair Value

- The stock trades at a Price-to-Sales ratio of 3.3x, more than double the European industry average of 1.3x and far higher than its peer group’s 0.8x. Yet it is priced below its DCF fair value of €17.97, with the current share price at €15.33.

- Analysts' consensus view frames this as a mixed signal: valuation appears reasonable if you believe in the company’s forecast 58.42% annual earnings growth and move to profitability within three years, but expensive versus industry benchmarks if near-term growth falters or market expectations change.

- The analyst consensus price target is €16.83, just 4.7% above the current share price, reflecting the market's view that upside is modest and execution risk still looms large.

- Investors are challenged to weigh the premium multiple and growth potential against the current lack of profitability and future margin uncertainty.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kempower Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticed something the numbers might be missing? Share your interpretation and craft your unique narrative. Your perspective could take shape in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kempower Oyj.

See What Else Is Out There

Kempower Oyj’s valuation remains elevated compared to industry peers, with profitability still years away and near-term earnings growth susceptible to order volatility.

If you want to steer clear of this uncertainty, use stable growth stocks screener (2113 results) and focus on companies with proven records of steady top- and bottom-line growth regardless of market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kempower Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KEMPOWR

Kempower Oyj

Manufactures and sells electric vehicle (EV) charging equipment and solutions for cars, buses, trucks, boats, aviation, and machinery in Nordics, rest of Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives