- Finland

- /

- Electrical

- /

- HLSE:KEMPOWR

Kempower (HLSE:KEMPOWR): Exploring Valuation After Strong Year-to-Date Share Gains

Reviewed by Kshitija Bhandaru

Kempower Oyj (HLSE:KEMPOWR) shares have seen steady movement this week, catching the attention of investors curious about the company’s recent performance. Over the past month, the stock has dipped slightly, but it still shows strong gains for the year.

See our latest analysis for Kempower Oyj.

Kempower Oyj’s share price momentum has picked up in recent weeks, adding 5.9% over the past seven days, and its 51.95% year-to-date share price return highlights a remarkable run. While there has been a modest dip in the last month, the longer-term trend points to solid growth potential, with total shareholder return for the past year sitting at 45.03%. This is evidence that investor confidence is building as the company executes on its strategy.

If impressive gains like these inspire you to expand your watchlist, now is the perfect chance to discover fast growing stocks with high insider ownership.

But with shares not far below analyst targets and robust gains already logged, investors are left wondering if there is an undervalued opportunity here or if the market has already priced in Kempower's next chapter.

Most Popular Narrative: 6.7% Undervalued

With Kempower Oyj shares closing at €15.62 and the most-followed narrative assigning a fair value of €16.75, the market price sits slightly below consensus expectations. This sets the scene for a closer look at what is driving the optimism around Kempower's prospects and where analysts see its greatest upside.

Ongoing investment and leadership in modular scalable fast-charging technology and integrated software platforms (for example, Kempower MORE and Chargie SaaS) enable the company to command premium pricing, win large and high-value fleet and infrastructure contracts, and build high-margin recurring revenues, supporting future gross margin and earnings growth.

What’s the real story behind this premium valuation bump? One ambitious financial forecast is hidden at the heart of this popular narrative. It ties to long-term growth and rapidly expanding margins. Want to see how the analysts constructed their bold target? The full narrative unpacks the key leaps in numbers driving that fair value.

Result: Fair Value of €16.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as unpredictable policy changes or volatile demand. These factors could challenge Kempower’s long-term growth and alter its valuation outlook.

Find out about the key risks to this Kempower Oyj narrative.

Another View: What Do the Ratios Suggest?

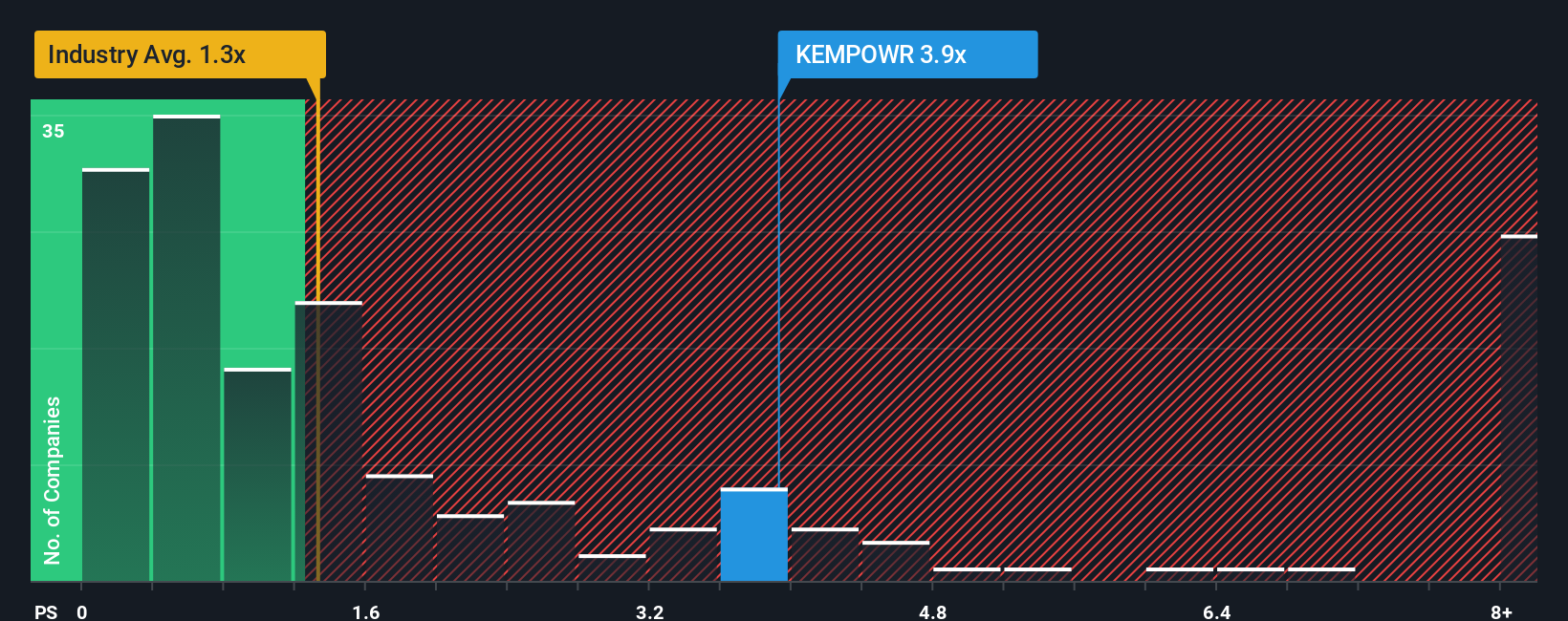

Looking at Kempower’s price-to-sales ratio, the story shifts. The company trades at 3.8x sales, significantly higher than the European Electrical industry average of 1.3x and its peer average of 0.8x. Even compared to its fair ratio of 2.7x, it appears pricey. This gap signals greater valuation risk if growth expectations disappoint. Should investors be concerned that the stock’s price has run too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kempower Oyj Narrative

If you prefer a different perspective or want to examine the data more closely, you can easily build your own forecast and investment thesis in just a few minutes. So why not Do it your way?

A great starting point for your Kempower Oyj research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for opportunities to pass you by. Get ahead of the curve and tap into market trends using these handpicked stock screens to uncover fresh strategies:

- Boost your portfolio’s growth potential by reviewing these 878 undervalued stocks based on cash flows companies trading below their intrinsic value, and positioned for strong upside.

- Secure reliable passive income by tapping into these 18 dividend stocks with yields > 3% with yields over 3% and a track record of delivering steady returns.

- Ride the wave of innovation and shape tomorrow by exploring these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and rapid sector expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kempower Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KEMPOWR

Kempower Oyj

Manufactures and sells electric vehicle (EV) charging equipment and solutions for cars, buses, trucks, boats, aviation, and machinery in Nordics, rest of Europe, North America, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives