Hiab Oyj (HLSE:HIAB): Exploring Valuation After Board Approves Special Dividend Payout

Reviewed by Kshitija Bhandaru

Hiab Oyj (HLSE:HIAB) is making headlines as its Board of Directors approved the payment of a special cash dividend of €1.57 per share. For investors, a special dividend like this often reflects management’s confidence in the company’s financial health.

See our latest analysis for Hiab Oyj.

Hiab Oyj’s recent special dividend comes on the heels of some notable leadership appointments and steady operational momentum. While short-term share price performance has been soft, down 2.5% over the past month, the 12-month total shareholder return of 6.8% and an impressive 213% total return over five years highlight the company’s ability to create lasting value.

If the combination of dividends and long-term gains appeals to you, now is the perfect moment to discover fast growing stocks with high insider ownership

The stock currently trades at a noticeable discount to analyst price targets. With a history of strong total returns, is this the beginning of a new opportunity for buyers, or are all the gains already priced in?

Most Popular Narrative: 14% Undervalued

Hiab Oyj’s most-followed narrative values the company at €60.09 per share, a notable premium to the recent close of €51.65. The setup behind this fair value is driven by bold assumptions on margin expansion and the expected growth of smart, sustainable product lines.

Continuous investments in automation (for example, MULTILIFT's move to fully automated duty cycles) and digital platforms (HiConnect, predictive maintenance) position Hiab to capitalize on increased industry demand for smart, safe, and automated load handling solutions, supporting revenue growth and margin expansion.

Curious how automation and digitalization could reshape future profits? The narrative’s calculations lean heavily on ambitious improvements to margins and sales mix. Think the story is straightforward? The financial assumptions might surprise even seasoned investors.

Result: Fair Value of €60.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and softening US demand could dampen Hiab Oyj’s growth outlook. These factors may potentially challenge even the most optimistic projections.

Find out about the key risks to this Hiab Oyj narrative.

Another View: Is Hiab Oyj Priced for Perfection?

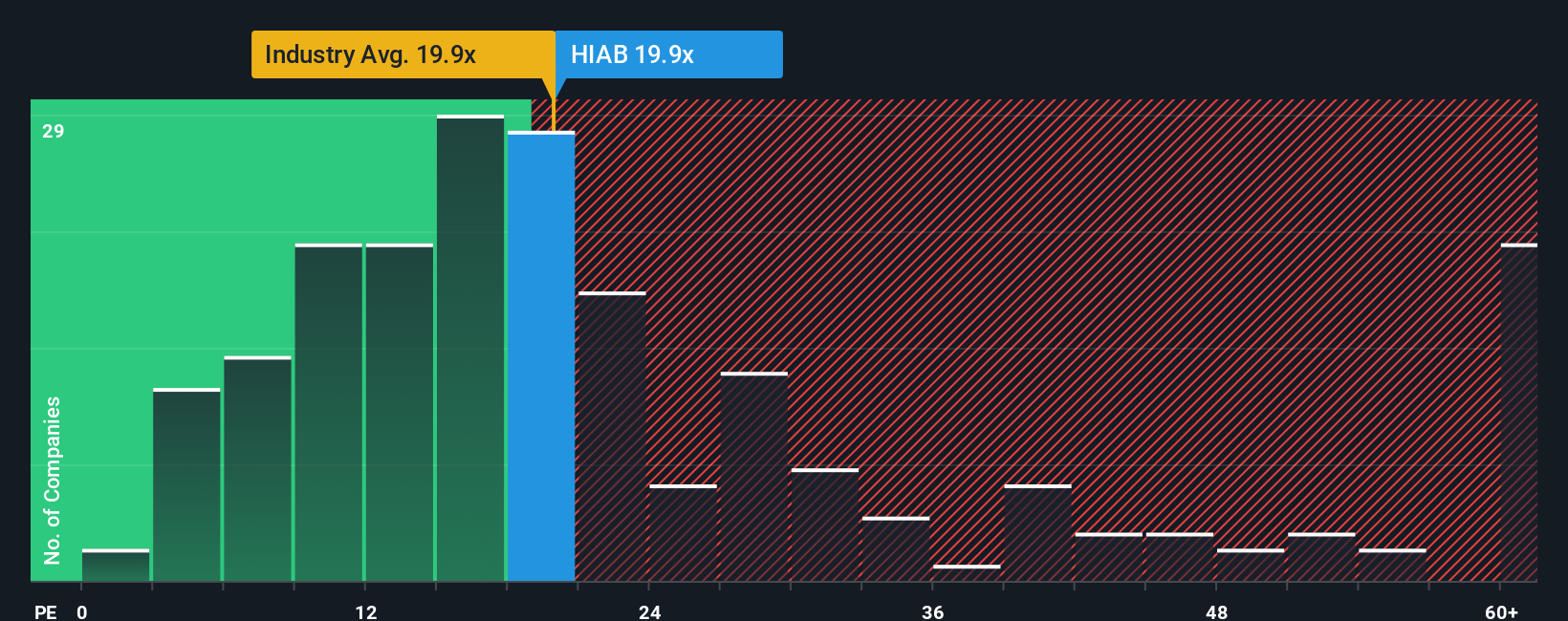

Looking at the market’s favored price-to-earnings ratio, Hiab Oyj trades at 21.4 times earnings, which is steeper than both its peer average of 19.4 and the European Machinery industry’s 20.3. Compared to a fair ratio of 20.1, this signals that investors might be paying a premium for expected growth. This premium could introduce risks if expectations fall short, or it could reflect the market's confidence in management’s strategy.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hiab Oyj Narrative

If you see the story differently or enjoy digging into the numbers yourself, you can craft your own take on Hiab Oyj in just a few minutes: Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Hiab Oyj.

Looking for More Smart Investment Ideas?

Don't settle for the obvious pick. If you want to get ahead, use the Simply Wall Street Screener to find stocks with breakout potential other investors might miss.

- Tap into tomorrow's tech breakthroughs by checking out these 25 AI penny stocks, which are powering innovation and reshaping entire industries with smarter automation and intelligence.

- Secure an income edge by scanning these 18 dividend stocks with yields > 3%, which consistently pay strong yields above 3% and reward patient shareholders year after year.

- Ride the next wave of financial transformation by uncovering these 78 cryptocurrency and blockchain stocks, which are reshaping global payment systems and reimagining digital value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hiab Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HIAB

Hiab Oyj

Provides smart and on road load-handling solutions and services in Finland.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives