Hiab Oyj (HLSE:HIAB): Evaluating Valuation After Earnings Reveal Resilience and Upcoming MacGregor Sale

Reviewed by Kshitija Bhandaru

Hiab Oyj (HLSE:HIAB) just reported its latest earnings, showing a 7% decrease in revenue for the second quarter of 2025. The company still achieved a strong operating profit margin and maintained stable demand in key markets.

See our latest analysis for Hiab Oyj.

Despite some recent share price weakness and a 1-day decline of 2.32% following the earnings update, Hiab Oyj’s long-term total shareholder return tells a different story: up 205% over five years and 162% over just the last three. Investors may be weighing the short-term drop in revenue against management’s confidence in future profitability, as well as the sizable boost expected from the upcoming MacGregor sale.

If you’re looking to broaden your perspective, now’s a great time to discover fast growing stocks with high insider ownership

With Hiab Oyj trading nearly 28% below analyst price targets and showing robust returns over several years, the question for investors is whether the current price undervalues future growth or if the market has already factored it in.

Most Popular Narrative: 20% Undervalued

Hiab Oyj’s most widely followed narrative prices the stock at a fair value significantly higher than the last close, suggesting the market may be leaving long-term potential on the table. The context here is underpinned by structural shifts in business mix and efficiency gains that could shape profitability in coming years.

Continuous investments in automation (e.g., MULTILIFT's move to fully automated duty cycles) and digital platforms (HiConnect, predictive maintenance) position Hiab to capitalize on increased industry demand for smart, safe, and automated load handling solutions. This supports revenue growth and margin expansion.

What makes this narrative so compelling? It all rests on a growth forecast not just in revenues but in operating margins, underpinned by assumptions about major operational transformation. There is a specific set of forward-looking numbers that form the backbone of this valuation. Are you ready to discover what they are?

Result: Fair Value of $60.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and softening US demand could spark further volatility. These factors may challenge the bullish case for Hiab Oyj's rapid margin and profit growth.

Find out about the key risks to this Hiab Oyj narrative.

Another View: What Do Earnings Ratios Say?

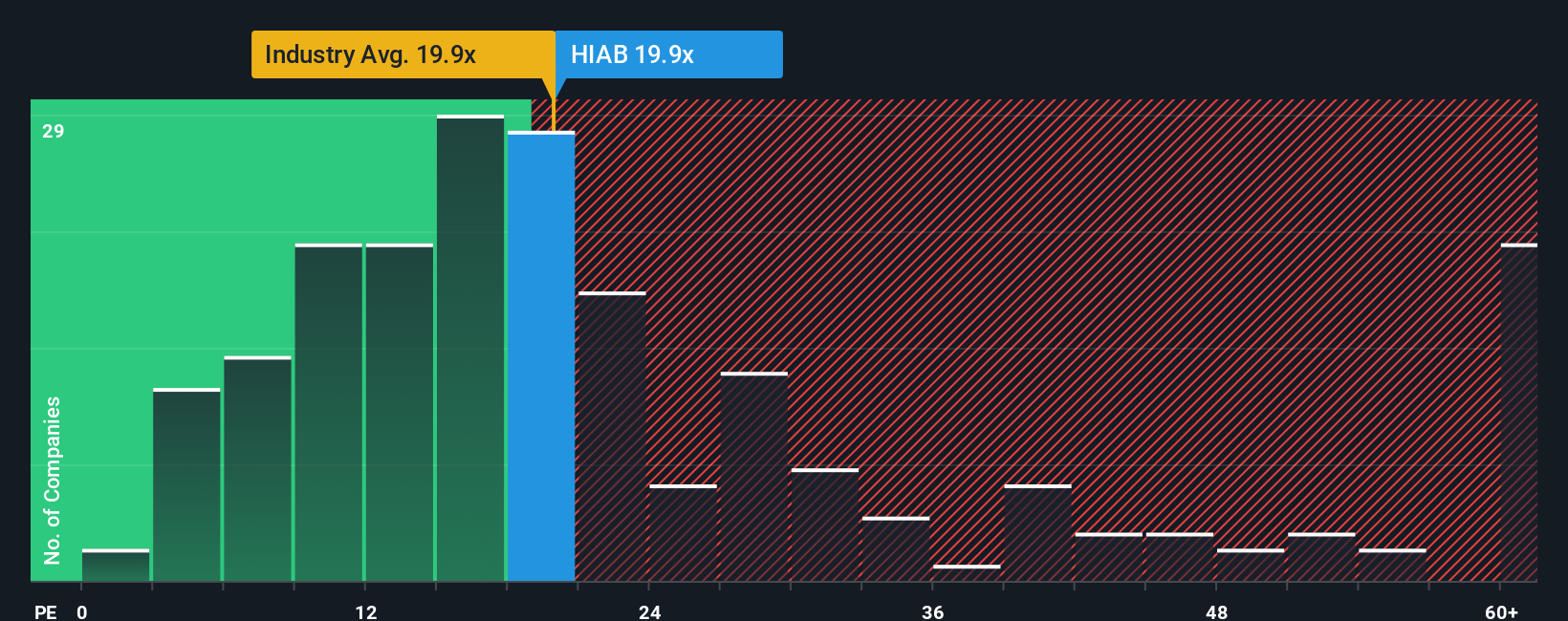

While the analyst narrative leans bullish, today's valuation by the earnings ratio puts Hiab Oyj in a different light. Its price-to-earnings ratio stands at 19.9x, which is almost identical to the wider European Machinery average, but higher than the average for its direct peers (19.1x) and just above the fair ratio of 19.8x.

This narrow gap signals that, according to market pricing of similar companies, there is little room for upside on multiples alone unless earnings surprise higher. Does this make Hiab Oyj a fair risk or could new developments tip the scale?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hiab Oyj Narrative

If you see the numbers differently or want to put your own research in the spotlight, crafting a personal narrative takes just a few minutes. Why not Do it your way?

A great starting point for your Hiab Oyj research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

You don’t want to miss your chance to act on the market’s best opportunities. Take a closer look at the strategies fueling tomorrow’s winners today.

- Find real value by targeting these 878 undervalued stocks based on cash flows that the market may have overlooked for true growth potential and future returns.

- Capture passive income potential with these 18 dividend stocks with yields > 3% offering strong yields above 3% and reliable payout histories.

- Ride the next tech wave by searching for these 24 AI penny stocks capitalizing on AI innovation in automation, data, and beyond.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hiab Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HIAB

Hiab Oyj

Provides smart and on road load-handling solutions and services in Finland.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives