As European markets navigate a complex landscape of monetary policy decisions and mixed economic indicators, the pan-European STOXX Europe 600 Index recently ended the week slightly lower. In this environment, identifying promising small-cap companies that can thrive despite broader market fluctuations is key to uncovering potential investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 394.25% | 3.36% | 6.34% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sidetrade SA is a SaaS company operating in France and internationally, with a market cap of €327.56 million.

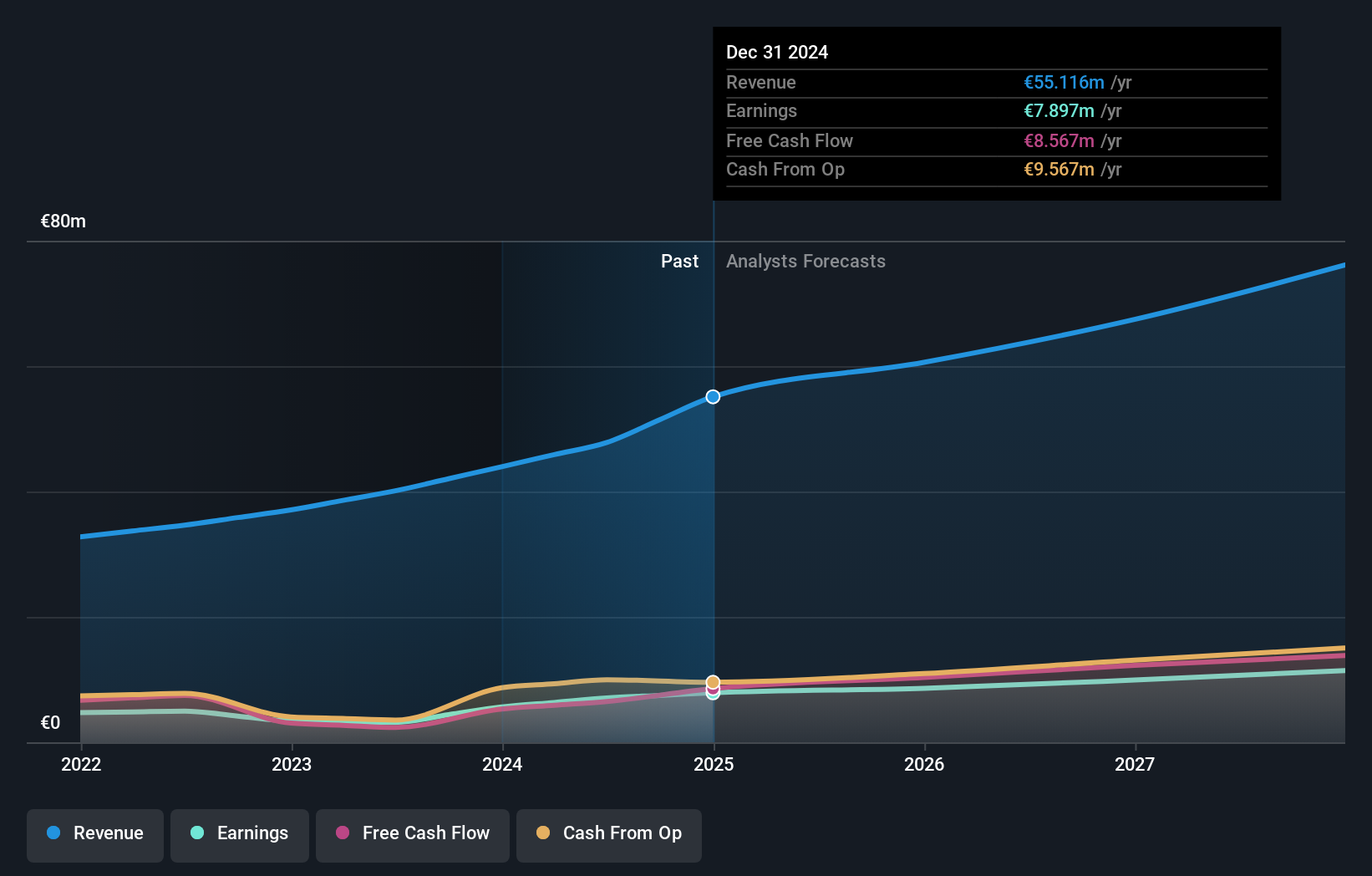

Operations: Sidetrade generates revenue primarily through its SaaS offerings, with a focus on international markets. The company has experienced fluctuations in its net profit margin, which is currently at 8.5%.

Sidetrade, a nimble player in the European tech scene, has shown robust performance with recent half-year sales of €29.42 million and revenue reaching €31.03 million, both up from last year's figures. Net income also climbed to €4.12 million from €3.59 million previously, highlighting its steady growth trajectory within the software industry where it outpaced peers with 19.3% earnings growth over the past year against an industry average of 15.4%. Recently added to the S&P Global BMI Index, Sidetrade's inclusion marks a significant milestone that could enhance its visibility and investor interest moving forward.

- Take a closer look at Sidetrade's potential here in our health report.

Understand Sidetrade's track record by examining our Past report.

GRK Infra Oyj (HLSE:GRK)

Simply Wall St Value Rating: ★★★★★★

Overview: GRK Infra Oyj is a company that offers infrastructure construction services across Finland, Sweden, and Estonia with a market capitalization of €538.75 million.

Operations: GRK Infra Oyj generates revenue primarily from its heavy construction segment, amounting to €844.38 million. The company's market capitalization stands at €538.75 million.

GRK Infra Oyj, a small player in the European construction industry, has shown impressive earnings growth of 80% over the past year, outpacing the industry's 3.9%. The company is trading at 35.2% below its estimated fair value, indicating potential undervaluation. Its debt to equity ratio improved from 30.2% to 16.2% over five years, reflecting better financial health. Despite these positives, earnings are expected to decline by an average of 7.3% annually for the next three years and capital expenditure remains significant at €15 million as of June 2025. Nonetheless, GRK maintains high-quality earnings and robust interest coverage.

Morrow Bank (OB:MOBA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Morrow Bank ASA is a financial institution offering unsecured loans to individuals across Norway, Finland, Sweden, the Netherlands, and Germany with a market capitalization of NOK3.40 billion.

Operations: Morrow Bank generates revenue primarily through its banking segment, amounting to NOK688.70 million.

Morrow Bank, a nimble player in the European financial landscape, showcases impressive growth with earnings surging by 66% over the past year, outpacing the industry average of 13.3%. The bank's total assets stand at NOK18.3 billion with deposits reaching NOK15.2 billion and loans at NOK14.3 billion, indicating a solid balance sheet foundation. However, challenges loom due to its high bad loan ratio of 18.2%, which could pose risks amid economic fluctuations. Despite these hurdles, Morrow Bank's digital expansion strategy and inclusion in the S&P Global BMI Index highlight its potential for future growth within the Nordic banking sector.

Key Takeaways

- Click this link to deep-dive into the 335 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALBFR

Excellent balance sheet with proven track record.

Market Insights

Community Narratives