European Dividend Stocks Offering Up To 5.5% Yield For Income Growth

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index recently experienced a slight decline, expectations for further interest rate cuts from the European Central Bank have diminished, while economic growth in the eurozone shows signs of picking up. In this context of mixed market signals and steady inflation near target levels, dividend stocks offering yields up to 5.5% can be appealing for investors seeking income growth amidst fluctuating conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.46% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.03% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.90% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.35% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.85% | ★★★★★★ |

| Evolution (OM:EVO) | 4.83% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.20% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.25% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.65% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

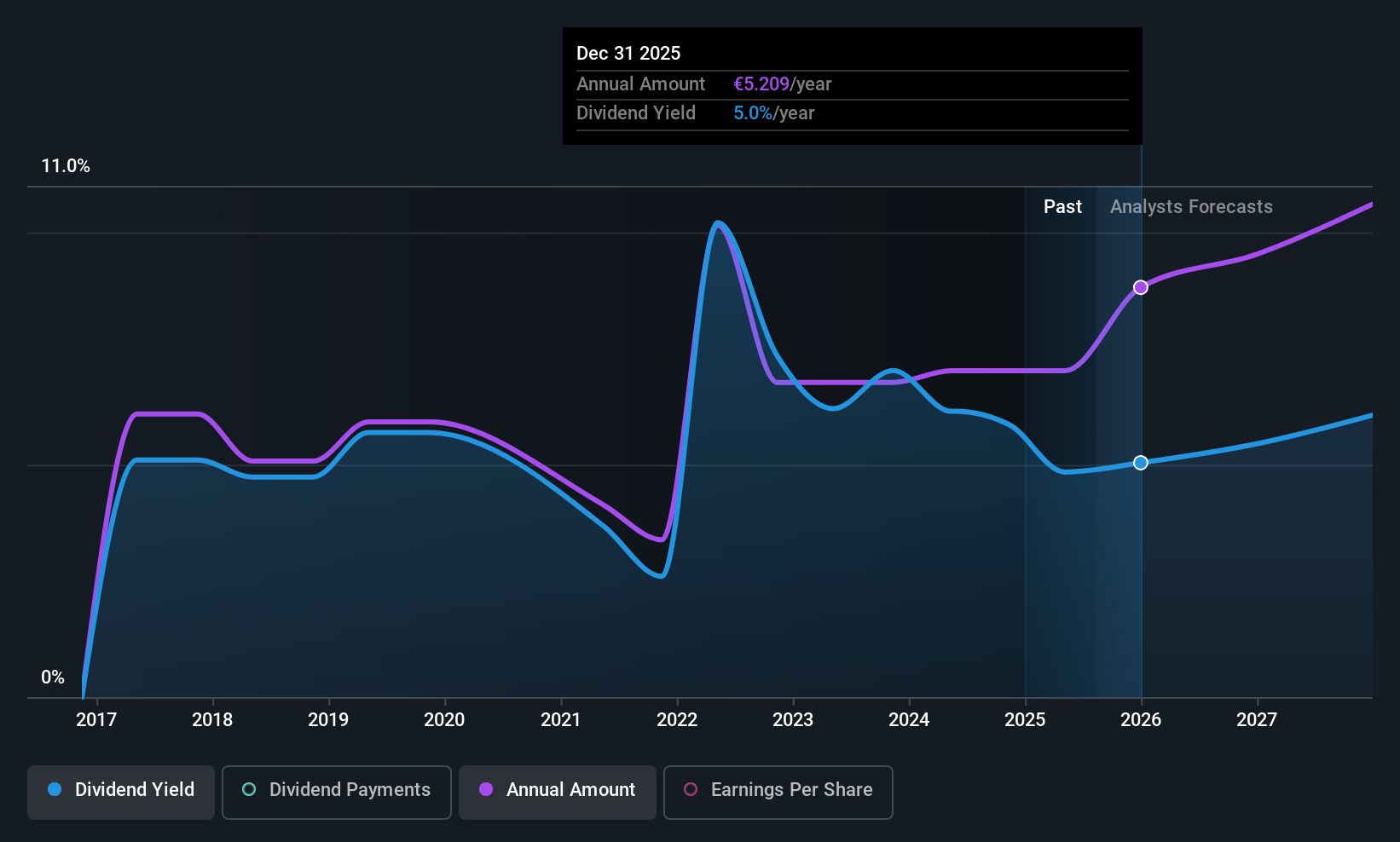

KBC Group (ENXTBR:KBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KBC Group NV operates as a provider of banking, insurance, and asset management services targeting retail, private banking, small and medium-sized enterprises, and mid-cap clients in Belgium, Bulgaria, the Czech Republic, Hungary, and Slovakia with a market cap of €41.34 billion.

Operations: KBC Group's revenue is primarily derived from its Belgium Business segment with €6.77 billion, followed by the Czech Republic Business at €2.39 billion, and its International Markets which include Hungary with €1.13 billion, Bulgaria with €840 million, and Slovakia with €493 million.

Dividend Yield: 4%

KBC Group's dividends are currently well-covered by earnings with a payout ratio of 47.6%, though past payments have been volatile. The dividend yield is lower than the top 25% in Belgium, but earnings growth and strategic moves, such as exploring acquisitions like Ethias NV, indicate potential for future stability. Recent financials show a rise in net interest income to €1.54 billion and net income to €1.02 billion for Q2 2025, supporting dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of KBC Group.

- The valuation report we've compiled suggests that KBC Group's current price could be quite moderate.

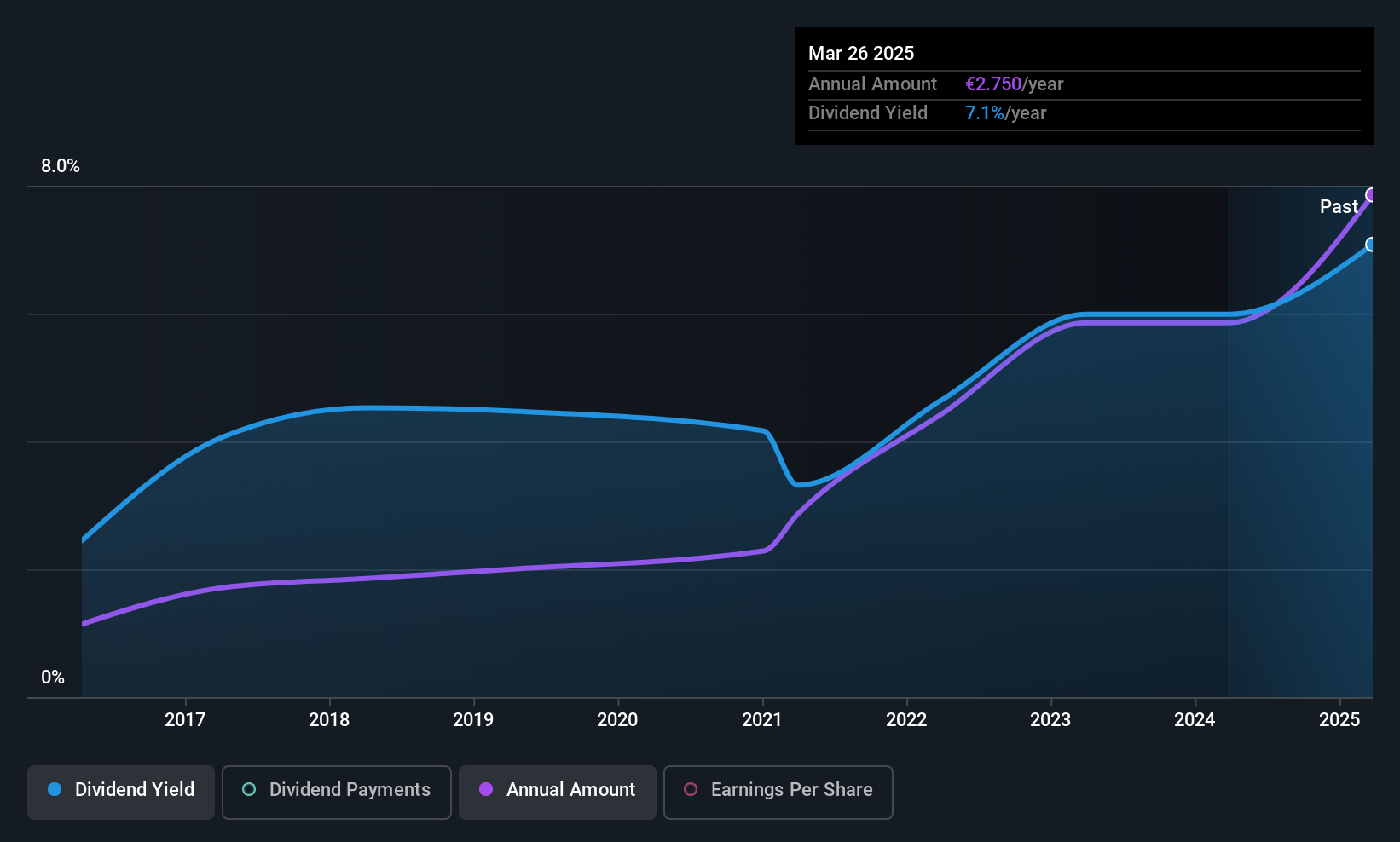

Ålandsbanken Abp (HLSE:ALBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ålandsbanken Abp operates as a commercial bank serving private individuals and companies in Finland and Sweden, with a market cap of €723.80 million.

Operations: Ålandsbanken Abp generates revenue from several segments, including IT (€54.43 million), Premium Banking (€66.20 million), Corporate and Other (€21.76 million), and Private Banking (Including Asset Management) (€96.10 million).

Dividend Yield: 5.6%

Ålandsbanken Abp offers a reliable dividend yield of 5.56%, with stable and growing dividends over the past decade, supported by a reasonable payout ratio of 68.4%. However, its yield is below the top tier in Finland. Recent earnings show slight declines in net interest income and net income for Q3 2025 compared to last year, but overall nine-month figures indicate growth. Leadership changes may impact strategic direction but are unlikely to affect dividend reliability immediately.

- Unlock comprehensive insights into our analysis of Ålandsbanken Abp stock in this dividend report.

- In light of our recent valuation report, it seems possible that Ålandsbanken Abp is trading beyond its estimated value.

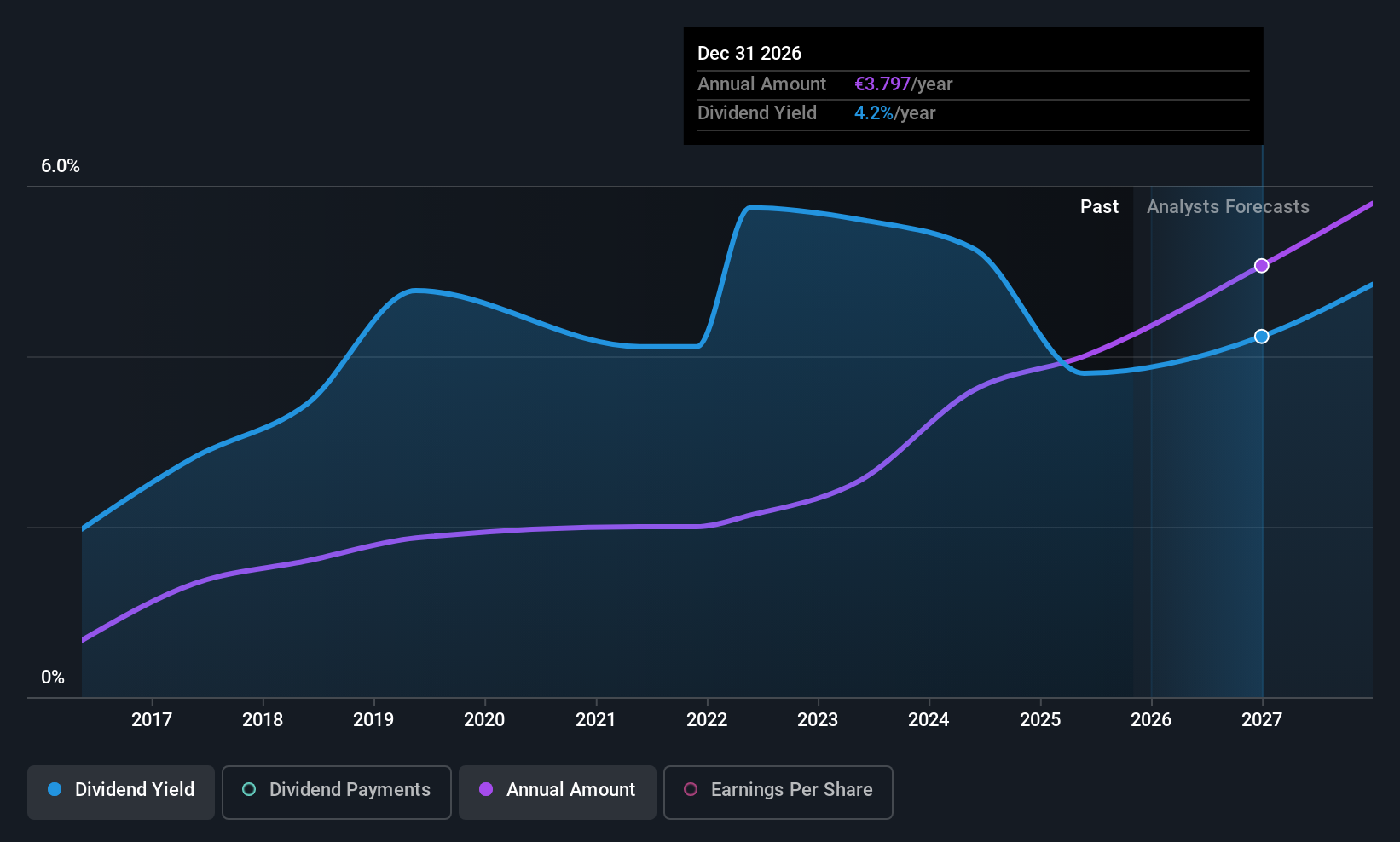

Erste Group Bank (WBAG:EBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Erste Group Bank AG offers a variety of banking and financial services to retail, corporate, and public sector clients, with a market cap of approximately €34.85 billion.

Operations: Erste Group Bank AG's revenue is derived from several segments, including Retail (€4.91 billion), Corporates (€2.34 billion), Group Markets (€836 million), and Savings Banks (€2.36 billion).

Dividend Yield: 3.3%

Erste Group Bank provides a stable dividend yield of 3.34%, which, while reliable and supported by a low payout ratio of 40.3%, is below the top tier in Austria. Dividends have been consistent and growing over the past decade. Recent earnings reveal slight declines in net interest income for Q3 2025 compared to last year, though net income has increased slightly. The bank's strategic alliances may enhance research capabilities but do not directly influence its dividend policy at present.

- Click here to discover the nuances of Erste Group Bank with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Erste Group Bank is priced lower than what may be justified by its financials.

Taking Advantage

- Gain an insight into the universe of 228 Top European Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ALBAV

Ålandsbanken Abp

Operates as a commercial bank for private individuals and companies in Finland and Sweden.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives