- Spain

- /

- Renewable Energy

- /

- BME:SLR

With EPS Growth And More, Solaria Energía y Medio Ambiente (BME:SLR) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Solaria Energía y Medio Ambiente (BME:SLR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Solaria Energía y Medio Ambiente

How Fast Is Solaria Energía y Medio Ambiente Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Solaria Energía y Medio Ambiente has managed to grow EPS by 20% per year over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Solaria Energía y Medio Ambiente's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Solaria Energía y Medio Ambiente shareholders can take confidence from the fact that EBIT margins are up from 35% to 52%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

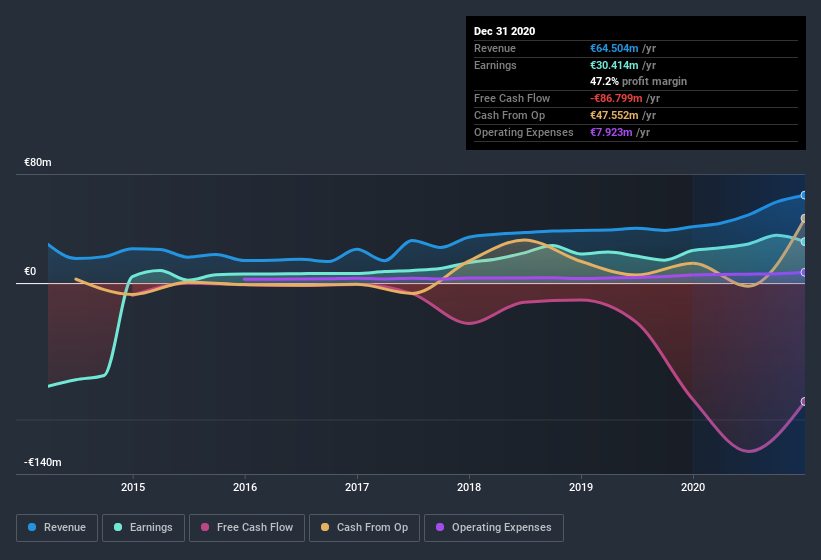

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Solaria Energía y Medio Ambiente?

Are Solaria Energía y Medio Ambiente Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Solaria Energía y Medio Ambiente insiders have a significant amount of capital invested in the stock. To be specific, they have €17m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Solaria Energía y Medio Ambiente Worth Keeping An Eye On?

You can't deny that Solaria Energía y Medio Ambiente has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. You still need to take note of risks, for example - Solaria Energía y Medio Ambiente has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Although Solaria Energía y Medio Ambiente certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Solaria Energía y Medio Ambiente, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:SLR

Proven track record and fair value.

Market Insights

Community Narratives