- Spain

- /

- Electric Utilities

- /

- BME:RED

Redeia (BME:RED) Margin Slide Challenges Bullish Narratives Despite Forecasted Growth Outpacing Spanish Market

Reviewed by Simply Wall St

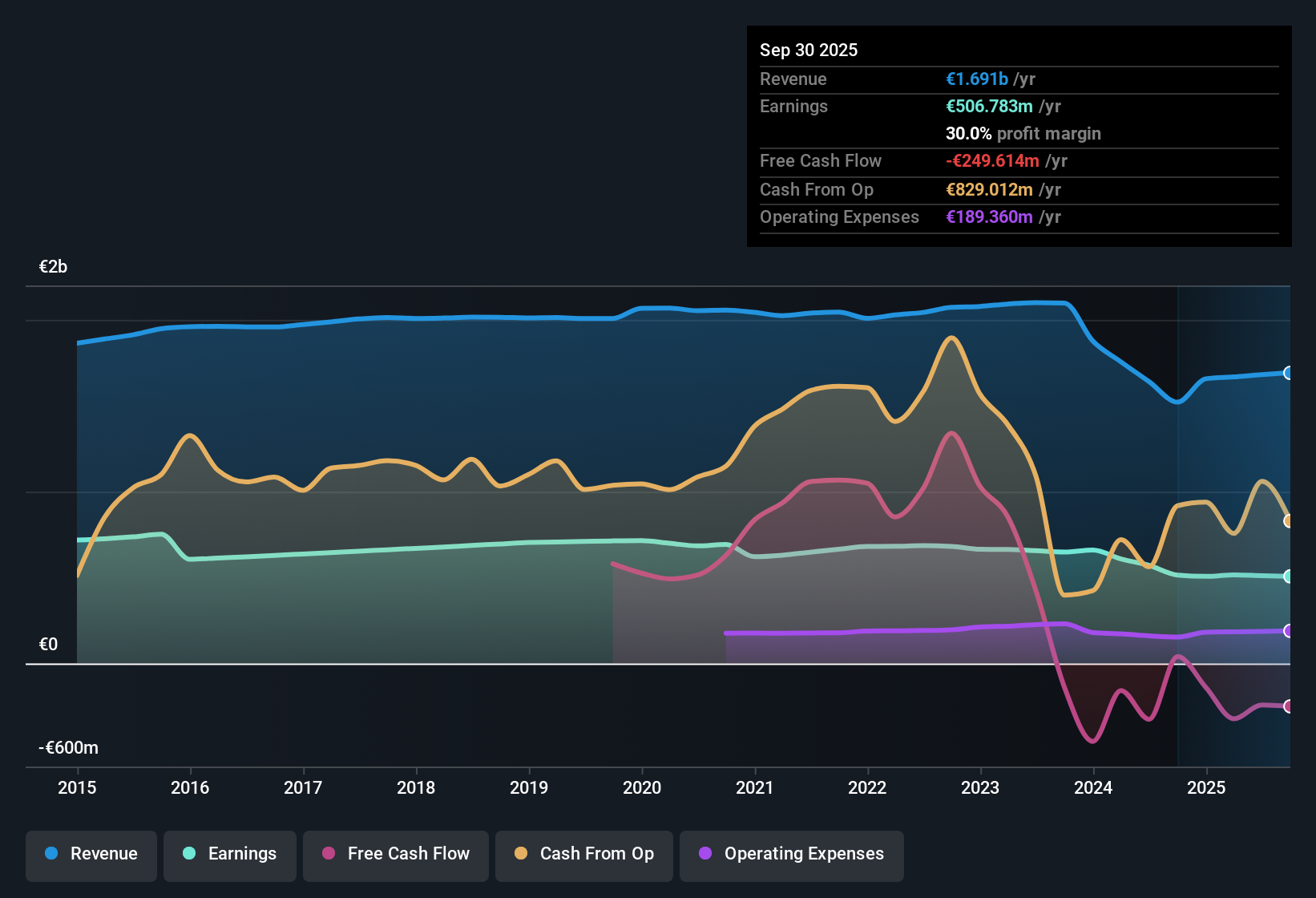

Redeia Corporación (BME:RED) is forecasting earnings growth of 5.23% per year and expects revenue to rise 4.8% annually, which is ahead of the broader Spanish market's 4.2% growth outlook. Despite these positive projections, the company's net profit margin has slipped from 33.6% to 30%, and reported earnings have decreased at a rate of 5.5% per year over the last five years. Although the stock is trading at a premium, with a Price-to-Earnings Ratio of 16.6x that surpasses both its peers (14.9x) and the industry average (13.3x), the current share price of €15.61 also remains above the estimated fair value of €13.75. Investors will note a compelling growth profile, but persistent margin pressure and a lofty valuation raise questions about the sustainability of future gains.

See our full analysis for Redeia Corporación.The next section puts these headline figures side by side with the most widely held stories about Redeia, spotlighting where expectations are met and where the numbers might prompt a rethink.

See what the community is saying about Redeia Corporación

Margin Resilience Amid Pressure

- Analysts expect Redeia's margins to rebound from 30.5% today to 32.1% over the next three years, reversing some of the recent margin compression that saw figures drop from 33.6% a year ago.

- According to the consensus narrative, the push towards grid digitalization and modernization is set to improve regulated revenues and operational efficiency.

- EU policy support and digital grid upgrades are highlighted as structural factors boosting future margin resilience. These factors help counter the recent drop in net profit margin.

- New regulatory incentives and higher projected EBITDA indicate that long-term investments could help stabilize or lift profitability, even as capital expenditure ramps up.

Rising Capital Investment, Rising Risks

- Redeia plans average annual capital expenditures of at least €1.5 billion through 2028, well above previous levels and industry norms, with major projects reinforcing the Spanish power network and interconnections.

- The consensus narrative notes that these heavy investments grow the regulated asset base and strengthen future revenue streams, yet bring notable risk:

- Operational and financial stress is cited as a risk. Ambitious spending could overload balance sheet leverage and pressure free cash flow if subsidies or disposals do not materialize as planned.

- S&P's placement of Redeia on negative CreditWatch underscores the concern that costly upgrades and regulatory uncertainty may elevate credit risk and funding costs over time.

Valuation Stays Stretched Versus Peers

- Redeia's current share price (€15.61) sits well above the DCF fair value estimate of €13.75 and implies a PE ratio of 16.6x, higher than both its peer group (14.9x) and the European Electric Utilities sector (13.3x).

- Analysts’ consensus view underscores the persistent premium. To match the long-term analyst price target of €17.86, investors must believe in sustained robust growth and margin recovery.

- The requirement for Redeia to trade at 19.5x PE on 2028 earnings shows the valuation is already baking in meaningful upside. This may leave little margin for error if growth or regulation disappoints.

- This premium reflects optimism about investment-led gains but creates valuation sensitivity if margin improvements or capital returns lag expectations.

Analyst forecasts and fundamental trends show Redeia's profile is defined by the balancing act between ambitious, capex-driven growth and the risks of cost overruns, margin pressure, and valuation stretch.

📊 Read the full Redeia Corporación Consensus Narrative.Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Redeia Corporación on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the data through your own lens? Take just a few minutes and turn your view into a unique narrative with Do it your way.

A great starting point for your Redeia Corporación research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Redeia’s lofty valuation, margin volatility, and heavy investment needs create vulnerability if earnings or regulatory outcomes fall short of expectations.

If you want stocks with clearer value upside and less sensitivity to setbacks, check out these 834 undervalued stocks based on cash flows that trade at more attractive prices relative to their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:RED

Redeia Corporación

Engages in the electricity transmission, and system operation and management of the transmission network for the electricity system in Spain and internationally.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion