- Spain

- /

- Electric Utilities

- /

- BME:RED

How Investors Are Reacting To Redeia (BME:RED) Reporting Higher Sales but Lower Net Income

Reviewed by Sasha Jovanovic

- Redeia Corporación recently announced its earnings results for the nine months ended September 30, 2025, reporting sales of €1,267.7 million, up from €1,233.5 million a year earlier, while net income decreased to €389.8 million from €408.8 million.

- Although revenue grew modestly, the decline in net income highlights cost pressures or margin challenges that affected profitability in the period.

- We will consider how this combination of higher sales but lower net income may influence the outlook for Redeia's long-term earnings resilience.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Redeia Corporación Investment Narrative Recap

To be a shareholder of Redeia Corporación, you need to believe in the long-term stability and modest growth of Spain’s electricity transmission sector, driven by regulated returns and grid modernization. The company’s latest earnings, showing higher revenue but lower net profit, do not materially shift the most important short-term catalyst, which is the ongoing regulatory review of returns on capital. However, the main risk remains that any regulatory changes could impact Redeia’s future margins and earnings resilience. Among recent developments, Redeia’s half-year results in July stood out as relevant, with stable net income despite revenue growth. This echoed through the recent nine-month revenue uptick, reinforcing the impact that incremental topline improvements can have when paired with careful cost management, yet it also suggests future performance may depend on external regulatory or operational factors, rather than organic profit growth. But while revenue trends are encouraging, investors should especially be mindful if regulatory changes push margins lower...

Read the full narrative on Redeia Corporación (it's free!)

Redeia Corporación's narrative projects €2.0 billion revenue and €645.2 million earnings by 2028. This requires 6.2% yearly revenue growth and a €134.3 million earnings increase from €510.9 million currently.

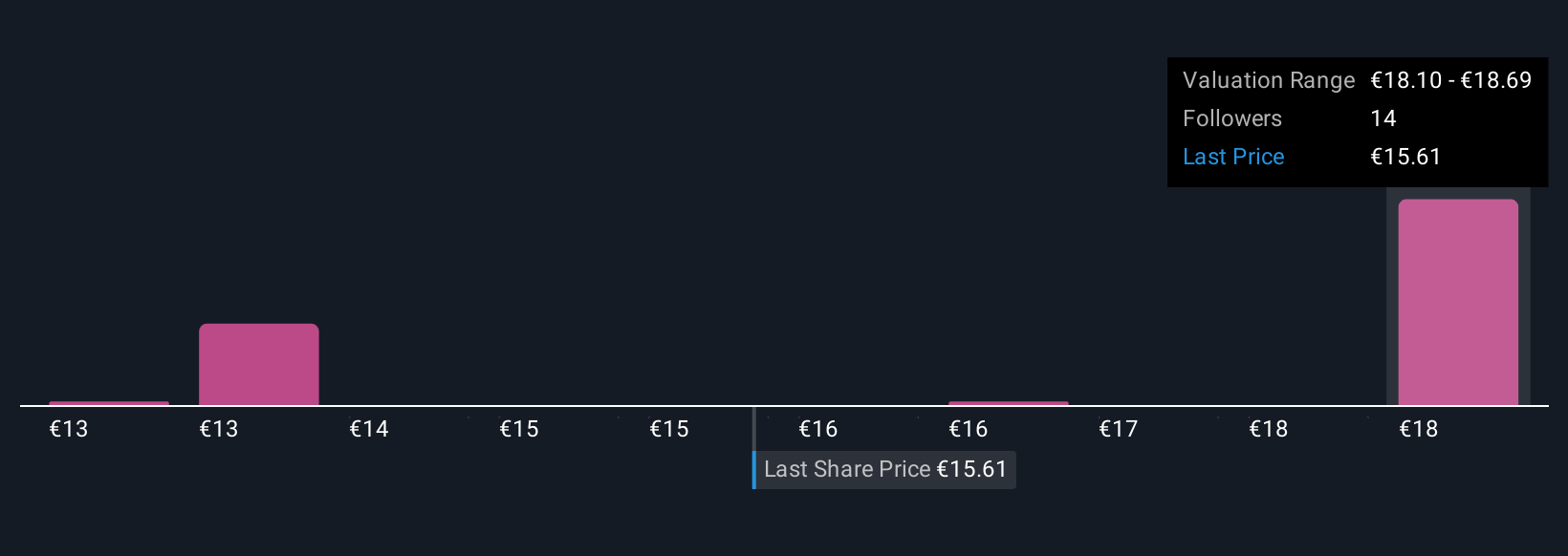

Uncover how Redeia Corporación's forecasts yield a €18.69 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate Redeia’s fair value between €12.77 and €18.69, illustrating a wide range of expectations. With regulatory headwinds front of mind, you can discover diverse viewpoints on how this contrast could shape Redeia’s future performance.

Explore 4 other fair value estimates on Redeia Corporación - why the stock might be worth 22% less than the current price!

Build Your Own Redeia Corporación Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Redeia Corporación research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Redeia Corporación research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Redeia Corporación's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:RED

Redeia Corporación

Engages in the electricity transmission, and system operation and management of the transmission network for the electricity system in Spain and internationally.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion