- Spain

- /

- Renewable Energy

- /

- BME:ENRS

Revenues Not Telling The Story For Enerside Energy, S.A. (BME:ENRS) After Shares Rise 38%

Enerside Energy, S.A. (BME:ENRS) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

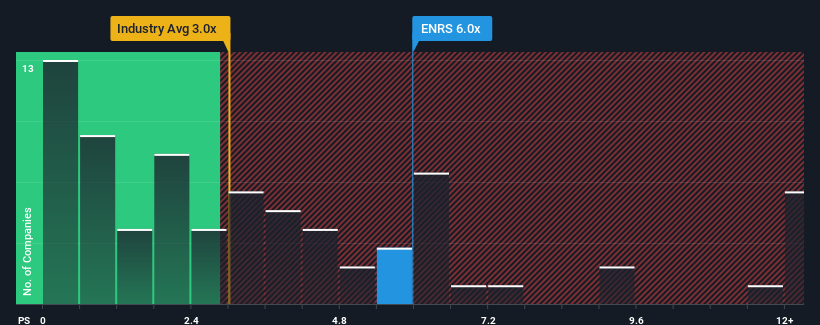

Since its price has surged higher, given around half the companies in Spain's Renewable Energy industry have price-to-sales ratios (or "P/S") below 2.6x, you may consider Enerside Energy as a stock to avoid entirely with its 6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Enerside Energy

How Has Enerside Energy Performed Recently?

Recent times haven't been great for Enerside Energy as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Enerside Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Enerside Energy would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 15% per annum over the next three years. Meanwhile, the broader industry is forecast to expand by 2.7% per annum, which paints a poor picture.

With this in mind, we find it intriguing that Enerside Energy's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Enerside Energy's P/S

Shares in Enerside Energy have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Enerside Energy currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

It is also worth noting that we have found 2 warning signs for Enerside Energy (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Enerside Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Enerside Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ENRS

Enerside Energy

Engages in the development, construction, and maintenance of renewable energy projects.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives