- Spain

- /

- Gas Utilities

- /

- BME:ENG

Is Enagás (BME:ENG) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Enagás, S.A. (BME:ENG) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Enagás

What Is Enagás's Net Debt?

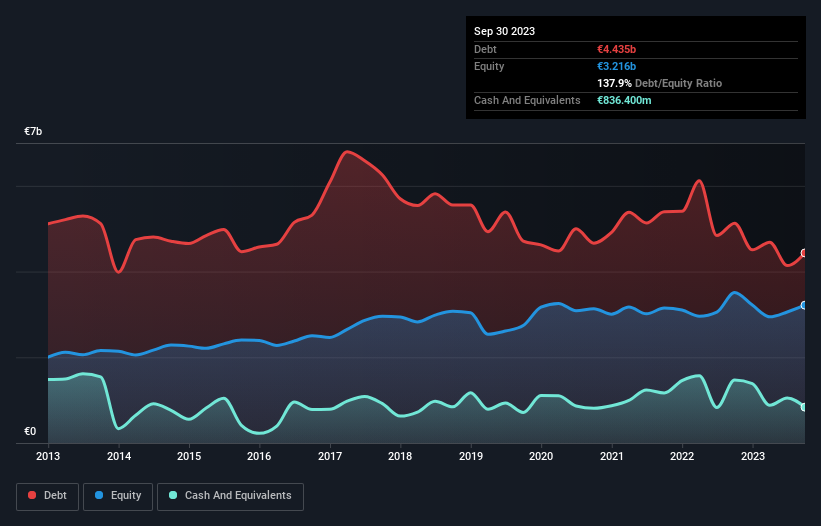

The image below, which you can click on for greater detail, shows that Enagás had debt of €4.44b at the end of September 2023, a reduction from €5.13b over a year. However, because it has a cash reserve of €836.4m, its net debt is less, at about €3.60b.

How Strong Is Enagás' Balance Sheet?

According to the last reported balance sheet, Enagás had liabilities of €1.01b due within 12 months, and liabilities of €4.39b due beyond 12 months. On the other hand, it had cash of €836.4m and €127.1m worth of receivables due within a year. So its liabilities total €4.44b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of €4.38b, we think shareholders really should watch Enagás's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 1.6 times and a disturbingly high net debt to EBITDA ratio of 6.8 hit our confidence in Enagás like a one-two punch to the gut. The debt burden here is substantial. Investors should also be troubled by the fact that Enagás saw its EBIT drop by 15% over the last twelve months. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Enagás's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Enagás actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

To be frank both Enagás's interest cover and its track record of managing its debt, based on its EBITDA, make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. We should also note that Gas Utilities industry companies like Enagás commonly do use debt without problems. Looking at the bigger picture, it seems clear to us that Enagás's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Enagás (of which 3 are potentially serious!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Enagás might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ENG

Enagás

Engages in the transmission, storage, and regasification of natural gas.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

A Case For NeXGold Mining Corp, a 20+ bagger by 2030 (C$40-70) or a 10 bagger by Christmas 2026 (C$16), or both?

A Company Preparing for the Future: Charles River Laboratories

The Birth of a High-Grade Canadian Gold Powerhouse

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks