The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Endesa, S.A. (BME:ELE) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Endesa

What Is Endesa's Net Debt?

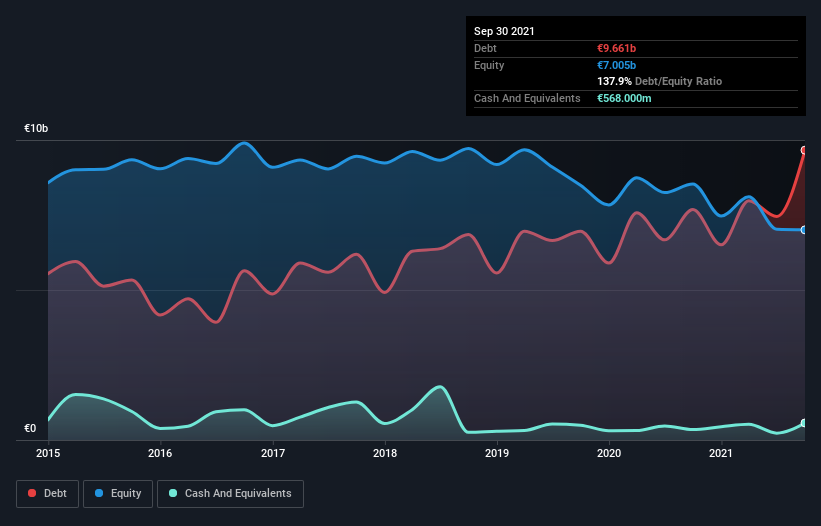

The image below, which you can click on for greater detail, shows that at September 2021 Endesa had debt of €9.66b, up from €7.68b in one year. On the flip side, it has €568.0m in cash leading to net debt of about €9.09b.

How Healthy Is Endesa's Balance Sheet?

We can see from the most recent balance sheet that Endesa had liabilities of €17.4b falling due within a year, and liabilities of €17.2b due beyond that. On the other hand, it had cash of €568.0m and €11.1b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €23.0b.

When you consider that this deficiency exceeds the company's huge €21.3b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Endesa's net debt to EBITDA ratio of about 2.3 suggests only moderate use of debt. And its strong interest cover of 55.6 times, makes us even more comfortable. Also relevant is that Endesa has grown its EBIT by a very respectable 28% in the last year, thus enhancing its ability to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Endesa's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Endesa's free cash flow amounted to 45% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Both Endesa's ability to to cover its interest expense with its EBIT and its EBIT growth rate gave us comfort that it can handle its debt. In contrast, our confidence was undermined by its apparent struggle to handle its total liabilities. We would also note that Electric Utilities industry companies like Endesa commonly do use debt without problems. When we consider all the factors mentioned above, we do feel a bit cautious about Endesa's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Endesa (1 is a bit concerning) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Endesa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:ELE

Endesa

Engages in the generation, distribution, and sale of electricity in Spain, Portugal, France, Germany, the United Kingdom, Switzerland, Luxembourg, the Netherlands, Singapore, Italy, Morocco, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives