- Spain

- /

- Electric Utilities

- /

- BME:ELE

Assessing Endesa (BME:ELE) Valuation as Share Performance Trends Quietly Evolve

Reviewed by Simply Wall St

If you have been tracking Endesa (BME:ELE) lately, you might have noticed some interesting developments that warrant a closer look. There is no single headline-grabbing event at play, but steady shifts in share performance could prompt investors to re-examine their stance. Sometimes, it is the quieter moves that set the stage for smart decisions, especially when long-term trends start to diverge from the recent noise.

Putting the latest performance into context, Endesa’s stock has delivered a total return of 38% over the past year and 69% over the past three years. After a strong rally since January, the year-to-date return is still impressive at 22%, though short-term momentum has faded with a mild drop in the past three months. Recent weeks have been relatively stable, and while no major announcements have moved the needle, the market’s view on Endesa’s prospects is quietly evolving. Margins for revenue growth have held up, though net income has dipped modestly, underscoring the push-pull balance of expectations versus delivery.

With these dynamics in play, the key question is whether Endesa is now undervalued and primed for the next phase of growth, or if the market has already factored in everything it knows. What do you think? Is there an opportunity here, or are investors chasing returns that have already happened?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Endesa is trading very close to fair value based on current expectations for future growth, returns, and risks. The average analyst price target is only about one percent above the current share price, suggesting limited near-term upside or downside from here.

The market appears to be discounting the impact of accelerating distributed energy resource (DER) adoption such as rooftop solar and batteries, along with prosumer growth. This trend could structurally erode centralized utility revenues and undermine future top-line growth, especially as higher grid costs incentivize self-generation and reduce reliance on incumbent networks.

Looking for the real story behind Endesa’s so-called fair price? The expert narrative is built on bold assumptions for future earnings, profit margins, and a premium valuation multiple usually reserved for growth stars. Want to see the surprising financial formulas and hidden growth drivers that justify this price? The numbers behind the narrative may surprise even the most seasoned investor.

Result: Fair Value of €25.96 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, stronger-than-expected electricity demand or resilient financial results could challenge the consensus view and prompt a re-rating for Endesa’s shares.

Find out about the key risks to this Endesa narrative.Another View: Challenging the Narrative

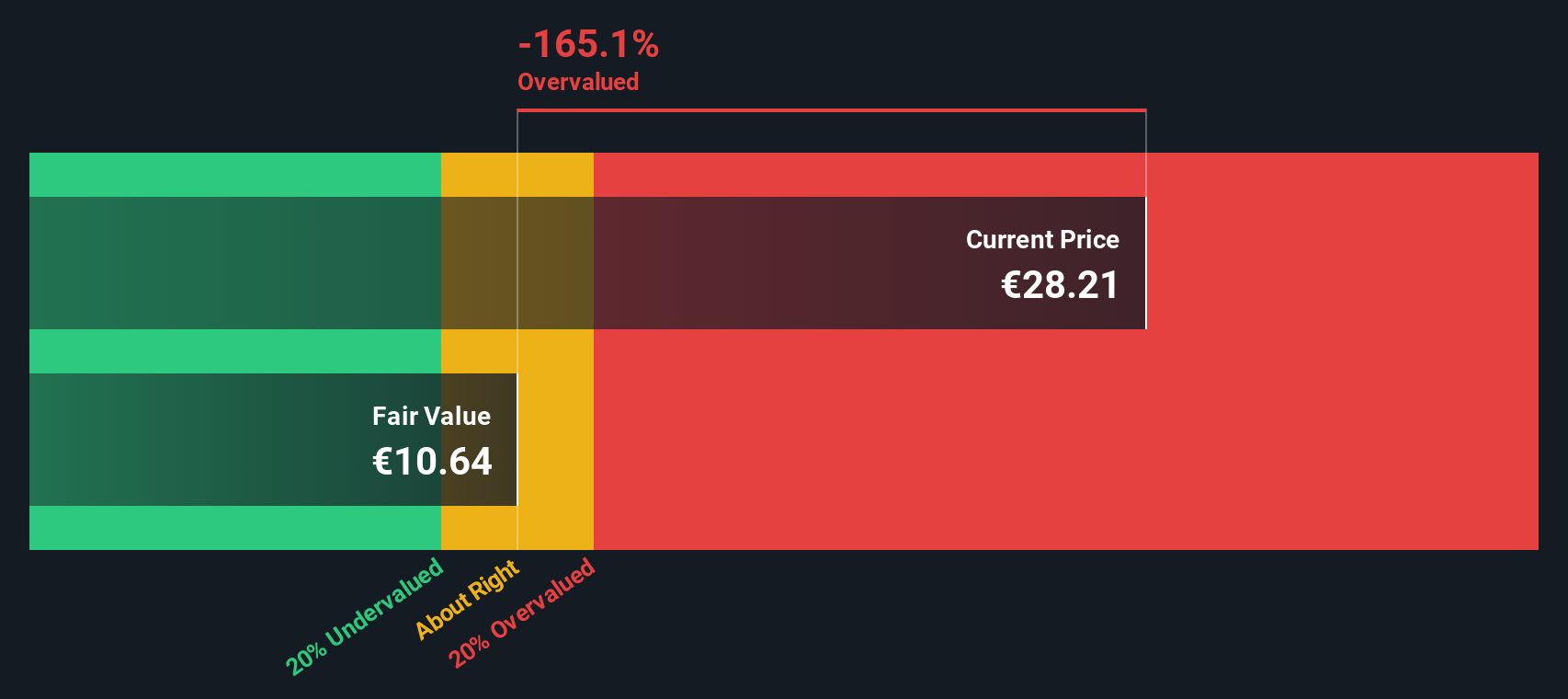

While the consensus suggests Endesa is fairly valued, our DCF model paints a very different picture and indicates the shares may be overvalued based on cash flow fundamentals. Could the market be overlooking something big?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Endesa to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Endesa Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own take in just a few minutes. Do it your way.

A great starting point for your Endesa research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Inspiring Investment Ideas?

Don’t let fresh investing opportunities slip past you. Use these handpicked tools to spot market trends early and get ahead of your competition now.

- Uncover tomorrow’s growth engines by checking out AI penny stocks. These innovative AI-powered solutions are transforming how businesses operate.

- Boost your portfolio’s income potential by tracking dividend stocks with yields > 3%. Find options with reliable yields and consistent returns in any market climate.

- Capitalize on overlooked values with the latest in undervalued stocks based on cash flows. Discover stocks screened to reveal those trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endesa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BME:ELE

Endesa

Engages in the generation, distribution, and sale of electricity in Spain, Portugal, France, Germany, the United Kingdom, Switzerland, Luxembourg, the Netherlands, Singapore, Italy, Morocco, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026