- Switzerland

- /

- Banks

- /

- SWX:BEKN

3 European Dividend Stocks Offering Up To 7.0% Yield

Reviewed by Simply Wall St

As European markets face pressures from concerns over artificial intelligence stock valuations and major indices like the STOXX Europe 600 experience declines, investors are increasingly looking for stability in dividend stocks. In uncertain times, a good dividend stock is often characterized by its ability to provide consistent yields and financial resilience, making them attractive options for those seeking reliable income amidst fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.67% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.94% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.41% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.01% | ★★★★★★ |

| Evolution (OM:EVO) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.26% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.69% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.33% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.72% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

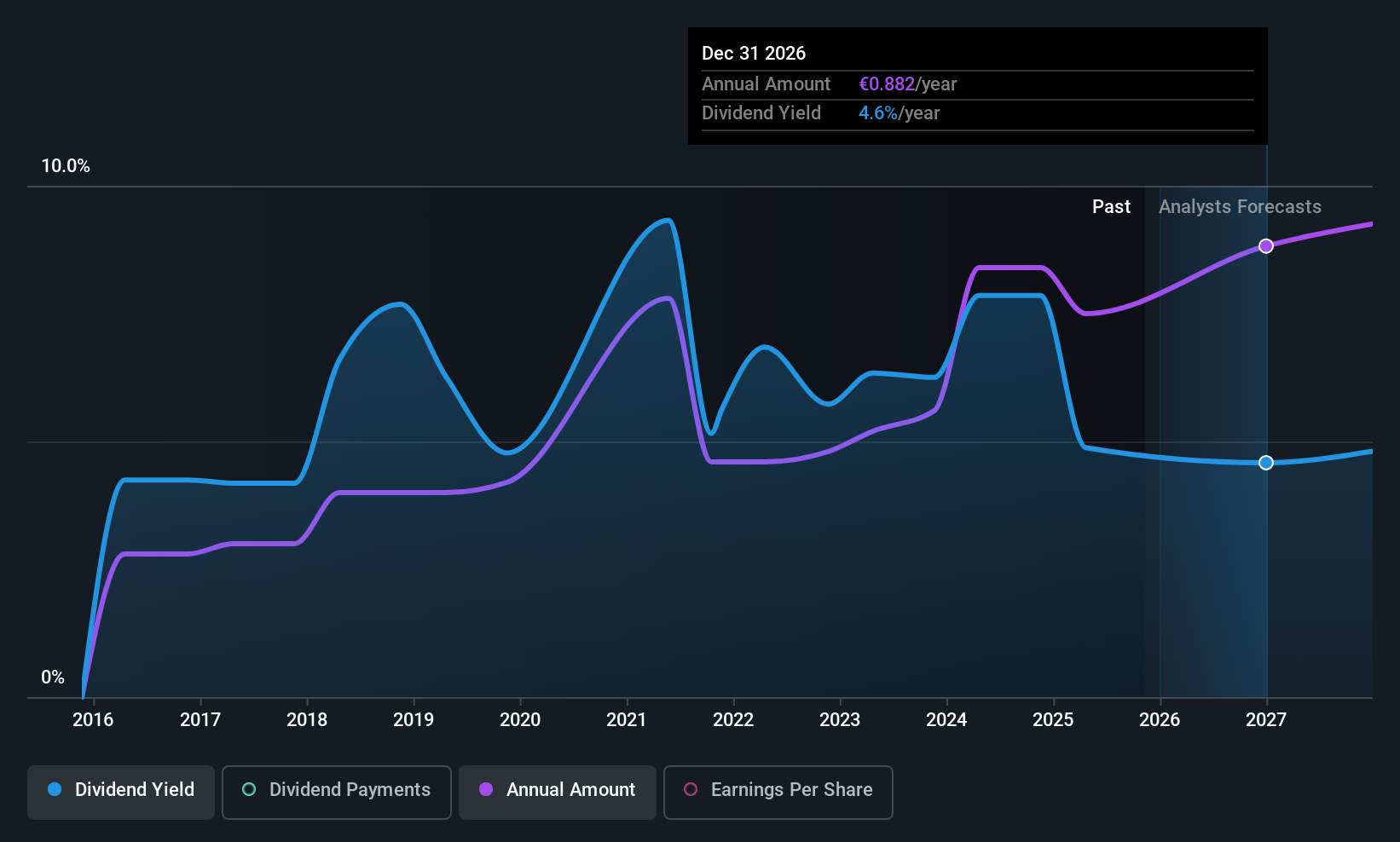

Banca Mediolanum (BIT:BMED)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banca Mediolanum S.p.A. provides a range of banking products and services in Italy and has a market cap of €13.33 billion.

Operations: Banca Mediolanum S.p.A. generates revenue through several segments, including €672.30 million from Italy - Banking, €468.52 million from Italy - Insurance, €357.34 million from Italy - Asset Management, €129.84 million from Foreign - Spain, and €2.89 million from Foreign - Germany.

Dividend Yield: 4.2%

Banca Mediolanum's dividend yield of 4.16% is below the top tier in Italy, yet its dividends are covered by earnings with a payout ratio of 61.8%, forecasted to remain sustainable at 67.5%. Despite past volatility, dividends have grown over the last decade. The company offers good relative value with a P/E ratio of 11.4x against the Italian market's 16.6x, supported by recent earnings growth and increased net income in Q3 and nine months ending September 2025.

- Unlock comprehensive insights into our analysis of Banca Mediolanum stock in this dividend report.

- According our valuation report, there's an indication that Banca Mediolanum's share price might be on the cheaper side.

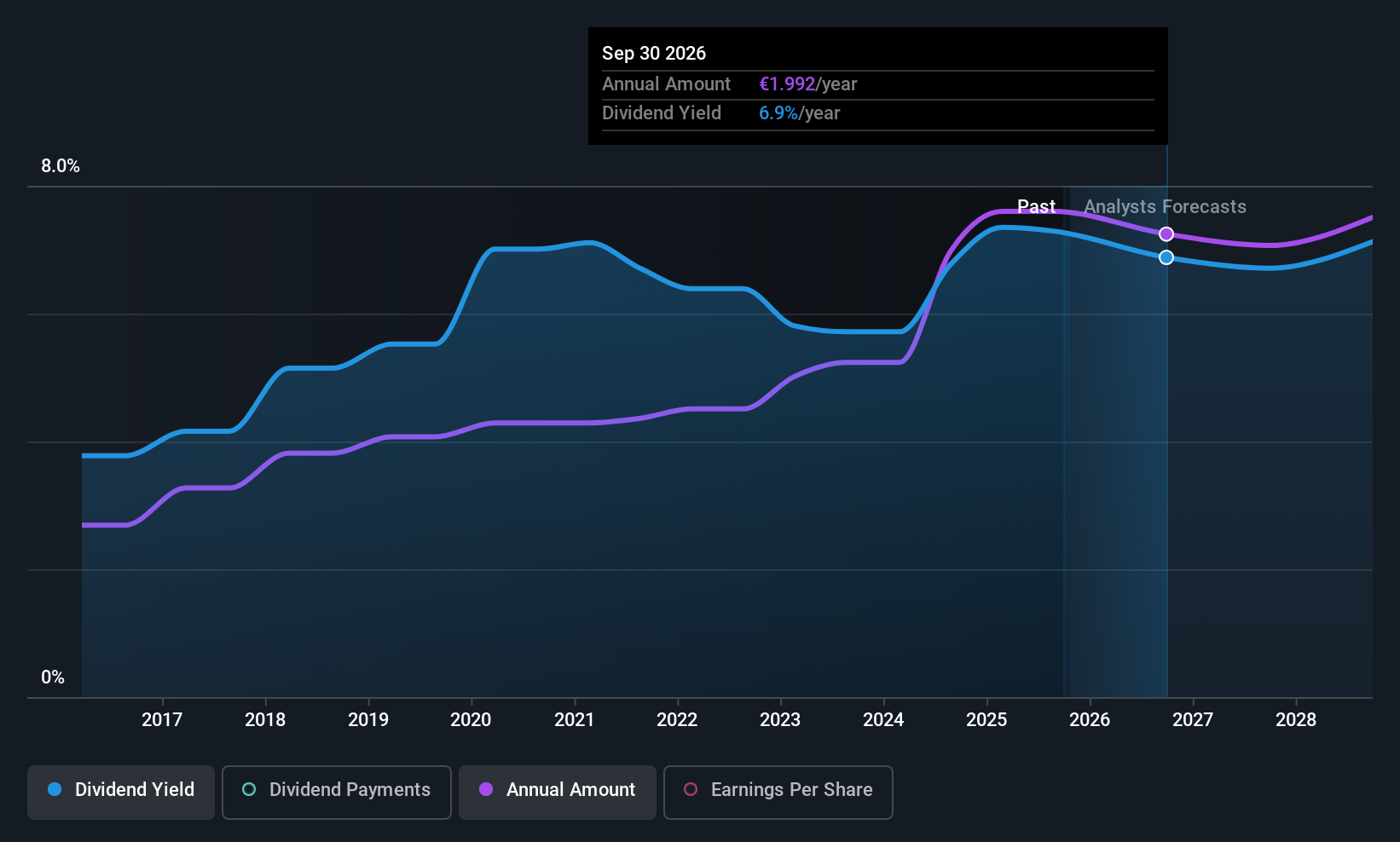

Logista Integral (BME:LOG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Logista Integral, S.A. operates as a distributor and logistics operator in Spain, France, Italy, Portugal, and Poland with a market cap of €3.89 billion.

Operations: Logista Integral, S.A. generates revenue through its operations as a distributor and logistics provider across Spain, France, Italy, Portugal, and Poland.

Dividend Yield: 7.1%

Logista Integral's dividend yield of 7.1% ranks in the top 25% of Spanish dividend payers, yet its sustainability is questionable with a high payout ratio of 96.9%. While dividends have been stable and growing over the past decade, they are not fully covered by earnings despite being supported by cash flows with an 85.5% cash payout ratio. The company's P/E ratio of 13.8x suggests good value compared to the broader Spanish market at 16.6x, although recent earnings show a decline in net income from €308 million to €281 million year-over-year.

- Get an in-depth perspective on Logista Integral's performance by reading our dividend report here.

- According our valuation report, there's an indication that Logista Integral's share price might be on the expensive side.

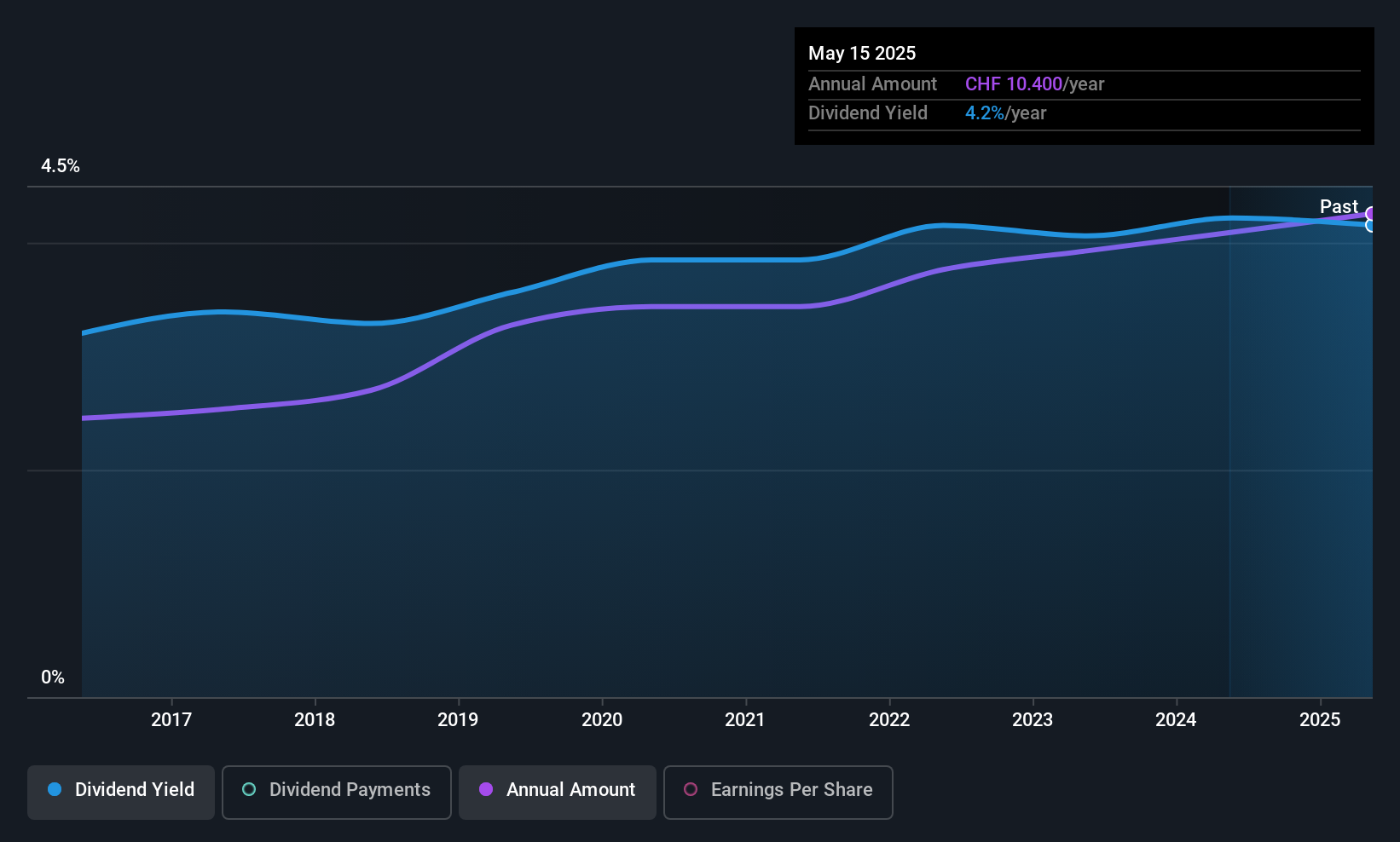

Berner Kantonalbank (SWX:BEKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Berner Kantonalbank AG provides banking products and services to private individuals and corporate customers in Switzerland, with a market cap of CHF2.48 billion.

Operations: Berner Kantonalbank AG generates revenue from its banking segment, amounting to CHF555.79 million.

Dividend Yield: 3.9%

Berner Kantonalbank offers a stable dividend yield of 3.88%, supported by a reasonable payout ratio of 53.3%. Over the past decade, its dividends have been both reliable and growing, with minimal volatility. Despite trading at 30.4% below estimated fair value, its yield is slightly lower than the Swiss market's top quartile. Recent earnings show slight growth in net income to CHF 76.33 million for H1 2025, indicating ongoing financial stability conducive to sustaining dividends.

- Navigate through the intricacies of Berner Kantonalbank with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Berner Kantonalbank's share price might be too pessimistic.

Summing It All Up

- Explore the 228 names from our Top European Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berner Kantonalbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BEKN

Berner Kantonalbank

Offers banking products and services to private individuals and corporate customers in Switzerland.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives